Real eState

Metro Vancouver home sales hit all-time record in March: real estate board – Coast Reporter

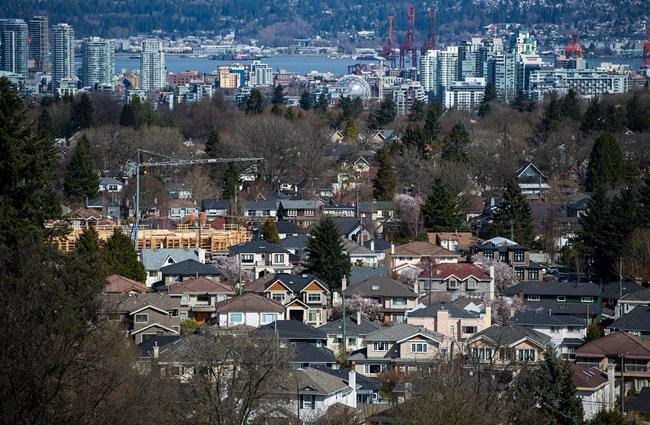

VANCOUVER — The Real Estate Board of Greater Vancouver says home sales and new listings set all-time records across the region last month.

The board reports that residential home sales totaled 5,708 in March, up by more than 53 per cent from February and 126 per cent from March 2020.

It says that’s the highest-ever monthly sales total recorded in the region that stretches from B.C.’s Lower Mainland to Whistler and the Sunshine Coast.

Sales were up more than 72 per cent above the 10-year March average.

Board Chair Taylor Biggar says the surge has pushed price gains into the double digits for single-family homes and townhomes over the last year.

Biggar says new listings also hit a record last month, but the overall inventory of homes for sale decreased compared with last year since demand is preventing that supply from accumulating in the market.

“Today’s activity can be attributed, in part, to an economy that’s showing signs of recovery, historically low interest rates, high demand for space, and increased household savings,” Biggar said in a statement on Friday.

The board says demand was most pronounced in rural and suburban areas, with the largest increase reported in Delta at 195.8 per cent.

Whistler and Squamish followed with 194.7 and 188.6 per cent increases, respectively, in home sales over last year.

The MLS home price index composite benchmark price for all residential properties in Metro Vancouver hit $1,123,300 in March, a 3.6 per cent increase from February and a 9.4 per cent increase from last March.

The benchmark price for a detached home was $1,700,200, up nearly 18 per cent from last year, while the benchmark price of an attached home was just over $872,000, up 10.4 per cent from March 2020.

The board says the benchmark price for an apartment was close to $716,000, a 3.7 per cent increase from last year.

This report by The Canadian Press was first published April 2, 2021.

The Canadian Press

Real eState

Waterdown home listed for $2M offers 'rural-style living' – Hamilton Spectator

/* OOVVUU Targeting */

const path = ‘/business/real-estate’;

const siteName = ‘thespec.com’;

let domain = ‘thestar.com’;

if (siteName === ‘thestar.com’)

domain = ‘thestar.com’;

else if (siteName === ‘niagarafallsreview.ca’)

domain = ‘niagara_falls_review’;

else if (siteName === ‘stcatharinesstandard.ca’)

domain = ‘st_catharines_standard’;

else if (siteName === ‘thepeterboroughexaminer.com’)

domain = ‘the_peterborough_examiner’;

else if (siteName === ‘therecord.com’)

domain = ‘the_record’;

else if (siteName === ‘thespec.com’)

domain = ‘the_spec’;

else if (siteName === ‘wellandtribune.ca’)

domain = ‘welland_tribune’;

else if (siteName === ‘bramptonguardian.com’)

domain = ‘brampton_guardian’;

else if (siteName === ‘caledonenterprise.com’)

domain = ‘caledon_enterprise’;

else if (siteName === ‘cambridgetimes.ca’)

domain = ‘cambridge_times’;

else if (siteName === ‘durhamregion.com’)

domain = ‘durham_region’;

else if (siteName === ‘guelphmercury.com’)

domain = ‘guelph_mercury’;

else if (siteName === ‘insidehalton.com’)

domain = ‘inside_halton’;

else if (siteName === ‘insideottawavalley.com’)

domain = ‘inside_ottawa_valley’;

else if (siteName === ‘mississauga.com’)

domain = ‘mississauga’;

else if (siteName === ‘muskokaregion.com’)

domain = ‘muskoka_region’;

else if (siteName === ‘newhamburgindependent.ca’)

domain = ‘new_hamburg_independent’;

else if (siteName === ‘niagarathisweek.com’)

domain = ‘niagara_this_week’;

else if (siteName === ‘northbaynipissing.com’)

domain = ‘north_bay_nipissing’;

else if (siteName === ‘northumberlandnews.com’)

domain = ‘northumberland_news’;

else if (siteName === ‘orangeville.com’)

domain = ‘orangeville’;

else if (siteName === ‘ourwindsor.ca’)

domain = ‘our_windsor’;

else if (siteName === ‘parrysound.com’)

domain = ‘parrysound’;

else if (siteName === ‘simcoe.com’)

domain = ‘simcoe’;

else if (siteName === ‘theifp.ca’)

domain = ‘the_ifp’;

else if (siteName === ‘waterloochronicle.ca’)

domain = ‘waterloo_chronicle’;

else if (siteName === ‘yorkregion.com’)

domain = ‘york_region’;

let sectionTag = ”;

try

if (domain === ‘thestar.com’ && path.indexOf(‘wires/’) = 0)

sectionTag = ‘/business’;

else if (path.indexOf(‘/autos’) >= 0)

sectionTag = ‘/autos’;

else if (path.indexOf(‘/entertainment’) >= 0)

sectionTag = ‘/entertainment’;

else if (path.indexOf(‘/life’) >= 0)

sectionTag = ‘/life’;

else if (path.indexOf(‘/news’) >= 0)

sectionTag = ‘/news’;

else if (path.indexOf(‘/politics’) >= 0)

sectionTag = ‘/politics’;

else if (path.indexOf(‘/sports’) >= 0)

sectionTag = ‘/sports’;

else if (path.indexOf(‘/opinion’) >= 0)

sectionTag = ‘/opinion’;

} catch (ex)

const descriptionUrl = ‘window.location.href’;

const vid = ‘mediainfo.reference_id’;

const cmsId = ‘2665777’;

let url = `https://pubads.g.doubleclick.net/gampad/ads?iu=/58580620/$domain/video/oovvuu$sectionTag&description_url=$descriptionUrl&vid=$vid&cmsid=$cmsId&tfcd=0&npa=0&sz=640×480&ad_rule=0&gdfp_req=1&output=vast&unviewed_position_start=1&env=vp&impl=s&correlator=`;

url = url.split(‘ ‘).join(”);

window.oovvuuReplacementAdServerURL = url;

#HamOntHouseHunt is a regular feature looking at houses for sale in the Hamilton area market. Have a tip? Email us at fhewitt@torstar.ca.

Price $1,999,900

The fully functional barn located on the property of 694 Centre Rd. in Waterdown.

The kitchen of 694 Centre Rd. in Waterdown.

The primary bedroom of 694 Centre Rd. in Waterdown.

The back deck of 694 Centre Rd. in Waterdown.

Real eState

Former HGTV star slapped with $10 million fine and jail time for real estate fraud – Fortune

Back when mortgage rates and home prices were more reasonable and manageable, homeowners invested in fixer-upper properties and made them their own. Now these types of projects aren’t as popular. But in the early-to-mid-2010s, HGTV shows including Fixer Upper, Love It or List It, and Flip It to Win It were all the rage as viewers binge-watched dilapidated homes transform into dream properties.

But as it turns out, one former HGTV star’s house-flipping show was masking major real estate fraud. On Tuesday, Charles “Todd” Hill, was sentenced to four years in jail and ordered to pay back nearly $10 million to his victims following his conviction. Los Gatos, Calif.–based Hill, 58, was the star of HGTV show Flip It to Win It, which aired in 2013 and featured Hill and his team purchasing dilapidated homes and fixing them up. Hill then sold them for a profit.

“Some see the huge amount of money in Silicon Valley real estate as a business opportunity,” Santa Clara County District Attorney Jeff Rosen said in a statement. “Others, unfortunately, see it as a criminal opportunity—and we will hold those people strictly accountable.”

What did Hill do?

According to the indictment shared with Fortune, the accusations against Hill happened between 2012 and 2014, around the time his show (which lasted just one season) began. The indictment shows 10 counts of grand theft of personal property exceeding $950,000; three counts of embezzlement; and one count of diversion of construction funds. Hill could not be reached by Fortune to comment on the indictment, conviction, or sentencing.

Hill was convicted last year of the multiple fraud schemes, including scams that happened before his show aired. This included a Ponzi scheme with evidence showing that Hill had spent laundered money on a rented apartment in San Francisco, hotels, vacations, and luxury cars, according to a press release from the Santa Clara County District Attorney’s Office. HGTV did not respond to requests for comment from Fortune ahead of publication.

“To hide the theft, he created false balance sheets and got loans using fraudulent information,” according to the district attorney’s office. In another case, Hill diverted construction money for personal use. But one of the strangest accounts came from an investor who had poured $250,000 into a property he wanted Hill to remodel.

Instead, during a tour of the home, the investor “found it to be a burnt-down shell with no work done on it.”

After the district attorney’s investigation, Hill was indicted in November 2019 and in September 2023 admitted his guilt and was convicted by plea of grand theft against all of his victims. He’ll have to pay restitution of more than $9.4 million and serve 10 years on probation.

Victims who spoke at Tuesday’s hearing said they’re still reeling from the financial and professional damages from the fraud, according to the district attorney’s office.

Real eState

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

A Winnipeg man’s registration as a real estate salesman has been cancelled after a family vacated their home on a tight deadline for a sale that never went through, then changed brokerages and, months later, got $60,000 less for their house than what they expected when they moved out.

A Manitoba Securities Commission panel found Reginald Wayne Kehler engaged in professional misconduct and conduct unbecoming a registrant when he signed a document on behalf of sellers without their knowledge, reduced the listing price of a home without their approval, and didn’t tell them for nearly a month that a potential buyer hadn’t paid a promised $100,000 deposit.

The sellers, identified as D.R. and P.R. in the panel decision released Wednesday, were awarded $10,394 from the real estate reimbursement fund. Kehler was ordered to pay $12,075 to cover costs of the investigation and hearing.

The sellers were a military family who had to move in 2020 after the husband was posted to Ottawa.

They chose Kehler as their listing agent, because he had helped them find the home when they moved to Winnipeg in 2018, and they had a good relationship with him, the panel’s decision says.

They listed their house in May and on June 15, 2020, accepted an offer of $570,000 with possession on July 15. A deposit of $100,000 was to be paid within 72 hours of acceptance of the offer.

Kehler was the salesperson for both the buyer and the sellers — but the sellers say he never told them that.

A form that indicated the sellers knew he was also representing the buyer, dated June 15, 2020, was filed.

While it appeared to be signed with the sellers’ names, they said they didn’t see it until March 2021. One of the two wasn’t even in Winnipeg on June 15.

“Kehler, in his interview with commission staff, acknowledges that the sellers never signed this document — we note that the purported signatures on the form look nothing like the actual signatures of the sellers on other documents,” the decision says.

Kehler told commission staff he’d been authorized to sign on the sellers’ behalf, which they denied. The panel found them more believable.

Once the deal was made, the sellers, believing they had just a month before the buyer would take possession of their home, quickly packed up and prepared to move with their two young children.

Buyer never made deposit

Meanwhile, the buyer hadn’t made the $100,000 deposit before the deadline — but Kehler didn’t tell the sellers.

Kehler told commission staff that was because he thought the deposit was still coming, and he didn’t want to cause more stress for the sellers.

On July 10, just five days before the buyer was to take possession and the day before the family was leaving Winnipeg, the sellers spoke to Kehler — but he still didn’t tell them the deposit hadn’t been paid.

Kehler “said everything was fine,” according to the decision.

It wasn’t until the evening of July 13, when the family arrived in Toronto on their way to Ottawa and just 36 hours before the scheduled closing, that Kehler told them he’d never received the deposit.

Eventually, they received $4,000 of the deposit, but the sale of the house never closed. The sellers scrambled to extend the insurance on their old home and make sure they continued to pay the utility bills, the decision says.

Home relisted

Kehler then recommended they relist the home, and it went back on the market at $574,900.

On Aug. 10, 2020, Kehler recommended the price be reduced to $569,900. Instead, the seller said he should reduce the price to $567,900.

But when the seller looked at the online listing on Aug. 22, it was listed at $564,900.

The sellers also asked Kehler about maintaining the property, since they were no longer in Winnipeg. He agreed he would, but friends ended up going and mowing the lawn, the decision says.

The sellers asked Kehler and his brokerage about what could be done to “make things right,” the decision says, but they never received any responses.

On Sept. 5, they hired a new brokerage to sell the home. Under the new real estate salesman, they accepted an offer on Dec. 13, and closed the deal Jan. 2, 2021, receiving $507,500 for the home.

Kehler’s actions were “contrary to the best interests of the public” and undermined “public confidence in the real estate industry,” the decision says.

-

Media23 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Investment23 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Real eState15 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

News21 hours ago

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

-

Business23 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Business15 hours ago

Dow Jones Rises But S&P, Nasdaq Fall; Nvidia, SMCI Flash Sell Signals As Bitcoin's Fourth Halving Arrives – Investor's Business Daily

-

Science20 hours ago

Science20 hours agoMarine plankton could act as alert in mass extinction event: UVic researcher – Langley Advance Times

-

Media24 hours ago

Three drones downed after explosions heard in Iran’s Isfahan: State media – Al Jazeera English