Economy

Mexico Economy Disappoints As Resurgent Covid Halts Recovery – BNN

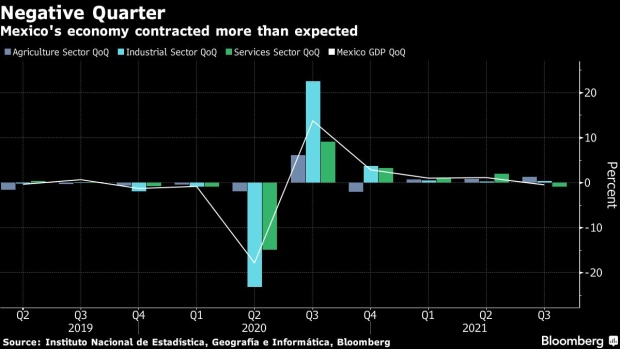

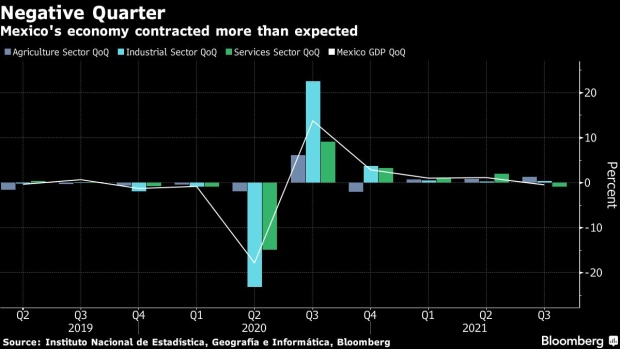

(Bloomberg) — Mexico’s economy shrank more than expected in the third quarter after new legislation banning labor outsourcing hit the services industry and coronavirus cases surged.

Gross domestic product fell 0.4% from the previous three-month period, more than its preliminary 0.2% drop and the median estimate of a 0.3% fall in a Bloomberg survey. It’s the first contraction since the second quarter of 2020, when Mexico imposed its harshest set of restrictions to tackle the Covid-19 pandemic. From a year ago, GDP grew by 4.5%, according to final data from the national statistics institute published Thursday.

The quarterly contraction halts the recovery of Latin America’s second-largest economy, which is far from returning to pre-pandemic levels after suffering last year its worst recession in almost a century. It also contradicts President Andres Manuel Lopez Obrador, who has repeatedly said the economy is doing well despite his decision to avoid additional public spending to support households and companies during the pandemic.

“Instead of demanding new loans, it seems firms and households are more focused on paying down their debt. That saps growth from the economy,” said Nikhil Sanghani, a Latin America economist at Capital Economics, who described the government’s austerity drive as part of the economic problem. “It could lead to longer-term scars from the crisis.”

Services Suffer

Mexico in April passed a law banning most subcontracting in an effort to fight tax evasion and ensure employers cover benefits. The measure helped to boost formal hiring, but hit service companies dedicated to labor outsourcing. The country also saw a jump in coronavirus cases in August, leading to an unexpected drop in economic activity that month.

The services sector shrank 0.9% in comparison to the previous three-month period, while the agriculture and the manufacturing sectors grew 1.3% and 0.3%, respectively.

A separate report showed Mexico’s economic activity unexpectedly declined 0.43% in September from the month prior, compared with economists’ forecasts for 0.3% growth.

“Economic activity is not only losing dynamism,” said Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa. “For the second consecutive month, it was negative. With that, the time that it will take to recoup the ground lost during the pandemic will extend for various months more.”

Inflation has hovered around 6% for the past few months and accelerated to more than 7% in early November, also hurting domestic demand. Market confidence in the central bank’s ability to tame price increases was dented this week when Lopez Obrador pulled his nomination of former Finance Minister Arturo Herrera to head the central bank. The new nominee is lesser-known Victoria Rodriguez, who is in charge of spending at the Finance Ministry.

The services sector was a major contributor to the downward revision to the preliminary third-quarter data, though economists says the negative effects of the outsourcing law are likely to be temporary. Slower-than-expected in industrial production, reflecting ongoing supply-chain issues, also contributed to the poor economic performance.

(Updates with surprise economic activity decline in September and economist comments starting in fourth paragraph.)

©2021 Bloomberg L.P.

Economy

Biden's Hot Economy Stokes Currency Fears for the Rest of World – Bloomberg

As Joe Biden this week hailed America’s booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: cool it.

The push-back from central bank governors and finance ministers gathering for the International Monetary Fund-World Bank spring meetings highlight how the sting from a surging US economy — manifested through high interest rates and a strong dollar — is ricocheting around the world by forcing other currencies lower and complicating plans to bring down borrowing costs.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

-

Media8 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media10 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment9 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Health23 hours ago

Health23 hours agoType 2 diabetes is not one-size-fits-all: Subtypes affect complications and treatment options – The Conversation

-

Media22 hours ago

DJT Stock Jumps. The Truth Social Owner Is Showing Stockholders How to Block Short Sellers. – Barron's

-

Business22 hours ago

Tofino, Pemberton among communities opting in to B.C.'s new short-term rental restrictions – Vancouver Sun

-

Business21 hours ago

A sunken boat dream has left a bad taste in this Tim Hortons customer's mouth – CBC.ca

-

Sports23 hours ago

Sports23 hours agoStart time set for Game 1 in Maple Leafs-Bruins playoff series – Toronto Sun