Real eState

Montreal home sales down 39% in December from year ago, real estate organization says

|

|

/cloudfront-us-east-1.images.arcpublishing.com/tgam/74BZZ7JC75ON7LOPURMTA26XCM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/tgam/74BZZ7JC75ON7LOPURMTA26XCM.jpg)

The Quebec Professional Association of Real Estate Brokers says home sales in Montreal last month fell 39 per cent from a year earlier to a level not seen in December since 2014.

The real estate organization says sales for the month amounted to 2,232 and contributed to a 2022 sales total of 21,371, 20 per cent below 2021.

The board says it’s typical for December to bring fewer sales and new listings, but the 2,359 properties that hit the Montreal market last month was a level not seen since 2002.

New listings in the month represented a seven per cent decline from the year before, but 2022 still saw two per cent more new properties on the market than in 2021.

Median prices for single-family homes fell three per cent from the year before to $510,000, while condos edged down one per cent to $375,000 and plexes sank six per cent to $690,000.

Charles Brant, director of the association’s market analysis department, says the figures reflect the market’s “wait-and-see attitude.”

“On the one hand, buyers are hoping that market conditions will improve in their favour. Sellers, on the other hand, are hoping for a stabilization of the market,” he says, in a release.

“Active listings continue to rise significantly due to a build-up effect, which could help to vindicate buyers in the coming months.”

Real eState

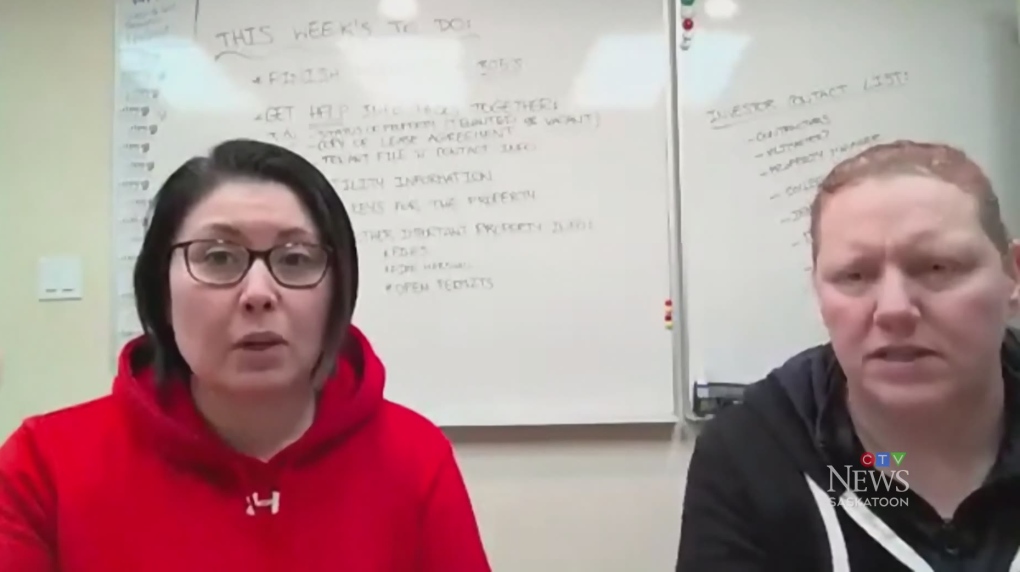

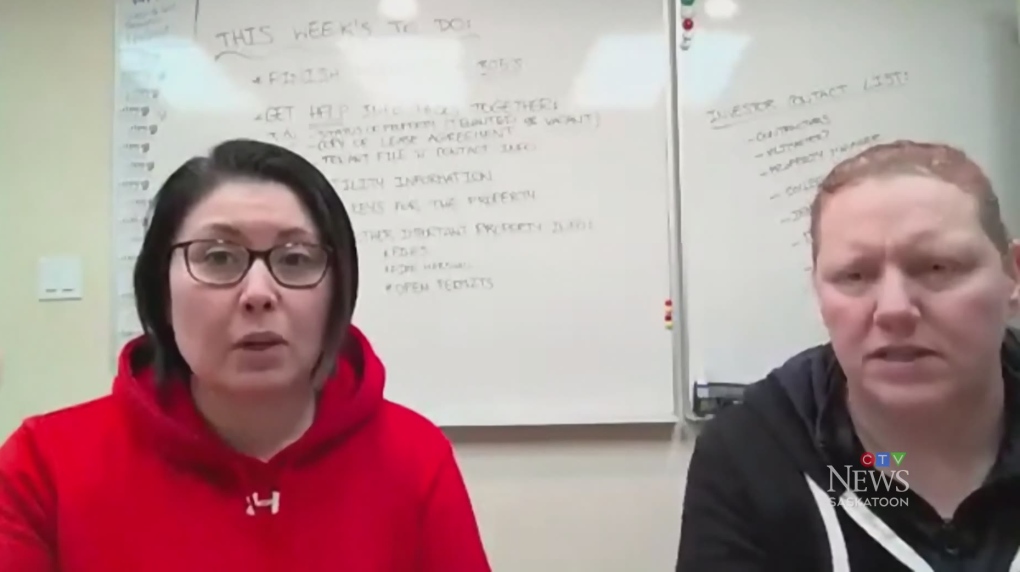

Sask. real estate company that lost investors' millions reaches settlement – CTV News Saskatoon

The founders of a Saskatoon real estate investment company that left investors with millions of dollars in losses have reached a settlement with Saskatchewan’s financial and consumer watchdog.

In a settlement with the Financial and Consumer Affairs Authority (FCAA) approved earlier this month, Rochelle Laflamme and Alisa Thompson, the founders of the now-defunct company Epic Alliance, have agreed to pay fines totalling $300,000, and are restricted from selling and promoting investment products for 20 years.

In 2022, a court-ordered investigation found that $211.9 million dollars invested in the company by multiple investors were mostly gone.

The meltdown of Epic Alliance resulted in significant financial losses for more than 120 investors, mainly from British Columbia and Ontario.

The company offered a “hassle-free” landlord program — offering to manage homes for out-of-province investors.

Under the landlord program, the investor would take out the mortgage on the home and Epic Alliance would assume responsibility for finding tenants and maintaining the property.

Many of the homes actually sat vacant as the company promised the investor a 15 per cent guaranteed rate of return on their investment.

A Saskatoon attorney representing some of the investors told CTV News in 2022 the pair were “using new money to pay old money.”

“Investment products should generate returns on (their) own, not by acquiring new money,” Mike Russell said.

The company also offered a “fund-a-flip” program, where investors could buy homes through Epic Alliance — which would oversee improvements and upgrades — and then sell for a profit, often advertised as a 10 per cent return on a one-year investment.

In their settlement with the FCAA, Laflamme and Thompson admit to selling investments when they were not licenced to do so, and continuing to raise investment money after the FCAA had ordered them to stop.

What the settlement doesn’t address are any allegations of fraud.

“The settlement agreement is silent on the issue of misrepresentations and / or fraud,” the FCAA panel wrote in its April 5 decision.

“There are no facts before the panel to evaluate whether the respondents engaged in misrepresentations or fraud vis-à-vis their investors. Furthermore, the statement of allegations did not allege the respondents’ conduct was fraudulent … the respondents’ culpability is limited to these specific violations of the Securities Act.”

Because there was no finding of fraud, the FCAA ruled it was not necessary to permanently ban Laflamme and Thompson from the investment industry.

“A permanent ban is not appropriate in these circumstances given that there is no agreement or finding that the respondents were fraudulent,” the decision says.

“A 20-year prohibition from involvement in the capital markets of Saskatchewan is significant.”

While the FCAA acknowledges the effect Laflamme and Thompson’s conduct had on their investors, the settlement does not include any compensation for them.

According to the FCAA, 96 investors paid an estimated $4.3 million to Epic Alliance over six years.

In January 2022, Laflamme and Thompson hosted a Zoom meeting to inform investors of the company’s imminent demise.

According to a transcript of the call included in a court filing, the company’s financial situation was described as a “s–t sandwich.”

“Unfortunately, anybody who had any unsecured debts … it’s all gone. Everything is gone. There is no business left and that’s what it is,” the transcription said.

Laflamme and Thompson started Epic Alliance in 2013.

—With files from Keenan Sorokan

Real eState

Hidden Billions in Tokyo Real Estate Lure Activist Hedge Funds

|

|

The long-concealed market value of Tokyo’s largest skyscrapers is being unveiled by activist investors.

In Japan, there’s a huge gap — 22 trillion yen ($143 billion) by one estimate — between how companies value their real estate assets on their books, versus what those same properties would fetch if sold in the current market. That comes from two factors: First, many of the island nation’s firms have held onto properties for decades, each year writing down the cost of fixed assets due to annual depreciation, a common accounting practice. But at the same time, property prices have soared.

Real eState

Real estate in Canada: Housing starts down – CTV News

Canada Mortgage and Housing Corp. says the annual pace of housing starts in March declined seven per cent compared with February.

The national housing agency says the seasonally adjusted annual rate of housing starts amounted to 242,195 units in March compared with 260,047 in February.

When looking at year-over-year figures, actual housing starts in large urban centres were up 16 per cent to 17,052 units last month compared with 14,756 units in March 2023. The year-over-year increase was driven by higher multi-unit starts, up 19 per cent, and higher single-detached starts, up two per cent.

Actual housing starts were 10 per cent higher in Toronto and 15 per cent higher in Vancouver year-over-year because of an increase in multi-unit starts. Montreal’s actual starts dipped one per cent, dragged down by lower multi-unit starts.

The annual rate of rural starts was estimated at 21,452 units.

TD economist Rishi Sondhi said housing starts continue to trend “at a solid pace,” even with the month-over-month decline in March, supported by elevated prices and firm pre-construction sales in the past.

But he cautioned that further decreases to the number of starts are likely in the months to come.

“While governments are actively looking for ways to enhance supply, we think that housing starts are likely to decline further this year, on the back of more recent weakness in pre-sales activity,” he said in a note.

“What’s more, industry analysis suggests that financing for purpose-built rental units currently under construction was obtained when borrowing conditions were more favourable. As they’ve turned tougher, this segment of the market could be impacted.”

Month-to-month starts can fluctuate significantly since the launch of larger multi-unit developments can skew numbers. Adjusted starts in March were up 27 per cent in Vancouver, driven by an increase in multi-unit starts, while Toronto and Montreal declined 26 per cent and five per cent, respectively, due to decreases in multi-unit starts.

To smooth out those swings and give a clearer picture of the upcoming housing supply trend, CMHC also reports a six-month moving average of the adjusted rate.

In March, the indicator showed starts at 243,957, down 1.6 per cent from 247,971 in February.

“The slight decline in multi-unit housing starts in March likely just reflects the volatile nature from one month to the next of these large projects,” Desjardins economist Kari Norman said in a note.

“Looking forward, the gradual unwinding of interest rate hikes expected to begin this June will bring cautious optimism to housing starts. However, this optimism is tempered by challenges such as construction labour shortages, inflation in building materials costs and weaker homebuilder sentiment.”

She said those factors could potentially slow the momentum seen in early 2024, despite a favourable shift in monetary policy.This report by The Canadian Press was first published April 16, 2024.

-

Media18 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Tech22 hours ago

Tech22 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Real eState21 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Sports21 hours ago

Sports21 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Health24 hours ago

Health24 hours agoOpioid-related deaths between 2019 and 2021 across 9 Canadian provinces and territories

-

Science21 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Investment18 hours ago

Investment18 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca

-

News23 hours ago

Montrealers conduct a sit-in to demand that Scotiabank divest from Elbit Systems