(Bloomberg) — An investment decision on a $25 billion gas pipeline from Nigeria to Morocco that could supply the fuel to Europe will be taken next year, the head of the West African nation’s state oil company said.

The Nigerian National Petroleum Co. and Morocco’s National Office of Hydrocarbons and Mines signed a memorandum of understanding last month that inched the long-gestating project closer to reality. The conduit is one of two such initiatives the NNPC is promoting in an effort to capitalize on European demand for new sources of gas after Russia’s invasion of Ukraine.

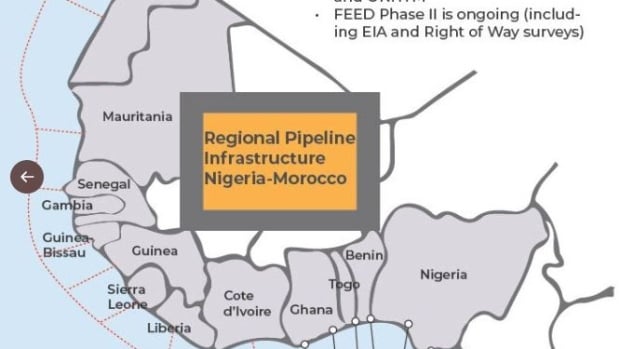

“We will take a final investment decision next year,” NNPC Chief Executive Officer Mele Kyari said in an interview in Abuja, Nigeria’s capital. Discussions around financing are ongoing, he said, without disclosing the institutions interested in backing the 5,600-kilometer (3,840-mile) pipeline that would deliver gas to 11 countries along the African coast on its way to Morocco, before connecting to Spain or Italy.

The 15-nation Economic Community of West African States is also a signatory to the MOU.

The project will cost $20-25 billion to build and will be constructed in phases, according to Kyari, who anticipates the first segment would take three years to finish and the others five years. Following a previous agreement in 2018, the Moroccan state agency MAP said the pipeline could take as long as 25 years to complete. Nigeria’s gas exports are currently limited to shipments from Nigeria LNG Ltd., a joint venture between NNPC and international energy companies including Shell Plc and Eni SpA.

Read: Nigeria-Morocco Pipeline Inches Toward Providing Gas to Europe

Nigeria possesses Africa’s largest proven gas reserves at about 200 trillion cubic feet, most of which is untapped, flared or re-injected into oil wells. The government says it wants to monetize much more of that resource, for domestic use and export, to replace crude as the country’s key commodity. Quadrupling gas production in the next four years is “very realizable,” according to Kyari.

The NNPC has also revived a longstanding proposal for a separate transcontinental gas pipeline that would travel about 4,400 kilometers through the Sahara Desert to Algeria for onward transport to Europe.

“We have seen the opportunity to bring back every gas pipeline project that you can think of,” Kyari said. “It is a matter of who needs it and who’s ready to pay for it.”

A more immediate concern for Nigeria is its oil output, which has been declining steadily since 2020 and hit a multi-decade low of less than 1.2 million barrels per day in August. Kyari and the government blame massive levels of theft and vandalism on the pipelines that crisscross the Niger Delta.

Illegal Pipeline

Nigerian security forces recently uncovered an illegal pipeline connected to an onshore facility that had transported pilfered crude 4 kilometers out to sea “undetected” for nine years, Kyari told lawmakers last week.

While the OPEC+ alliance agreed Oct. 5 to slash global daily output by 2 million barrels, Nigeria is trying to reverse its slump and raise output to its quota permitted by the cartel. The country can add an additional 500,000 barrels a day before the end of November by reopening the Shell-operated Trans-Niger Pipeline and Forcados terminal and introducing new evacuation routes, Kyari said.

The NNPC hired new private security contractors in August to protect the pipelines, some of which are connected to militant leaders that once waged a war against the oil companies before accepting a government amnesty in 2009.

Read: Ex-Militant Tapped to Protect Nigerian Pipelines He Once Blew Up

Recently transformed into a fully commercial venture, the NNPC is eyeing expansion in multiple areas. Kyari said he is “creating the largest upstream company in the country and potentially in Africa,” although he declined to comment on the firm’s efforts to acquire permits that Exxon Mobil Corp. agreed to sell to Seplat Energy Plc.

The NNPC has already added 380 filling stations to its fuel retail business through the purchase of Lagos-based OVH Energy Marketing Ltd. that was announced this month. The company is also looking to grow its presence in the power sector, both by building new gas-fueled power plants and buying facilities put up for sale by Nigeria’s privatization agency, Kyari said.

The company will be “IPO ready” next year, according to Kyari. It will be up to the government, however, to decide whether and when to list shares, he said.

©2022 Bloomberg L.P.

Source link

Related