Real eState

Real estate market storm clouds are gathering

|

|

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/CLSRN6O5IZF27CXASQYVBFCJTE.jpg)

A home for sale in Toronto’s Annex neighbourhood on July 18.Fred Lum/The Globe and Mail

Real estate industry professionals who help homeowners grapple with rising interest rates and crushing debt are trying to keep up with the volume of new business these days.

“We’re aware that the storm is brewing and likely to get worse,” warns Toronto-based real estate lawyer Mark Morris.

Today credit has tightened, extensions are rife and defaults are rising, says the principal with LegalClosing.ca. The process of buying and selling was “very clean” when there was an abundance of money flowing through the system, Mr. Morris explains, but now that stream has slowed to a trickle.

Some buyers appeal to sellers for more time to come up with the financing they need to close a deal, and defaults are also rising, says the lawyer, who has 15 to 20 problem files on his desk on a given day. Purchasers planning to rely on a home equity line of credit, or HELOC, to buy an additional property are finding that avenue closed.

Mr. Morris is carefully watching the new build segment, where he sees peril ahead. He points to the many people who signed a contract with a builder before construction on a new project began. A number of those buyers count on being able to sell the contract to another party without ever taking possession of the property.

When prices were rising rapidly, speculators often made hefty profits on so-called assignment sales.

He sees complications on the horizon because many of those original buyers cannot afford to finalize the purchase when the unit is finished – especially in today’s economy.

In order to rein in inflation, the Bank of Canada has raised its benchmark rate four times since March to its current level of 2.5 per cent.

Few people will be surprised to learn, Mr. Morris says, that lenders were often lax in extending financing to builders without requiring strong proof that their buyers in the pre-construction market were property qualified.

Investors on shaky financial ground are facing the completion of their units without the ability to trade in the unregulated assignment market.

“That market is now illiquid,” Mr. Morris says. “Buyers will find they cannot assign the product away if they can’t afford it.”

In the current environment, Samantha Brookes, chief executive of Mortgages of Canada, is advising prospective buyers they cannot skip any steps in applying for a mortgage pre-approval. Lenders have become much more stringent about making sure a borrower is creditworthy.

“They want documents up front,” she says. “Consumers have to know they have to have their information ready.”

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NHIOXX6LRZCMJHVEGQTU2JQRME.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NHIOXX6LRZCMJHVEGQTU2JQRME.jpg)

While interest rates have been far higher in previous decades, the debt levels consumers carry today swamp those of the past, Mr. Morris says.Fred Lum/The Globe and Mail

In some cases, Ms. Brookes is seeing three or four people from one family applying for one mortgage in order to buy a property.

“The parents and the kids are all on title just to buy one home,” she says. “They’re trying to make it work.”

Ms. Brookes urges buyers in the current market to make sure that their offer is conditional on financing.

“Do not waive any type of conditions on financing, no matter what anyone tells you,” she says.

Ms. Brookes also recommends that buyers have a short closing period of four or five weeks in order to avoid the problem of the property declining in value before the appraisal is complete.

As rates have shot up, Ms. Brookes says, her firm has had to cut back on its marketing because they are overwhelmed with clients who need to refinance an existing mortgage or they run into problems when the loan is up for renewal.

“A lot of people are looking for solutions.”

In the most dire cases, a homeowner may have had a fixed-term mortgage with an interest rate of 1.89 per cent, for example, only to have the lender present them with a rate of 5.89 per cent at renewal.

“A lot of them already have sticker shock,” she says of the consumers renewing today.

Ms. Brookes can often find a resolution for borrowers by extending the amortization period, which can stretch to as long as 40 years, she says.

“We stop bankruptcies quite frequently.”

Some homeowners have let things slide to the extent that they have defaulted on mortgage payments, received letters from the lender, and eventually had the bank foreclose.

“We have people come to us who have already been locked out of their house by the sheriff,” she says. “They leave it until the last minute.”

Ms. Brookes says mortgage brokers can help some borrowers in such a predicament refinance, pay the arrears and pay the fees and penalties that pile up on a daily basis.

She figures that more homeowners are going to be facing financial challenges as rates continue to climb and more mortgages come up for renewal.

“I do believe by September or October we’re going to see a lot of people jump ship.”

Mr. Morris sees significant risk in the heavy debt loads that many Canadians have accumulated in recent years. People have borrowed against their home equity to pay for major expenditures in the past, but the practice of drawing HELOCs for everyday expenses has accelerated in recent years, he says.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/644EOUJQPFDRPOSRVSTPU3UHFI.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/644EOUJQPFDRPOSRVSTPU3UHFI.jpg)

A home for sale in Toronto’s Annex neighbourhood on July 18.Fred Lum/The Globe and Mail

“People started using houses as bank accounts five or six years ago,” he says, pointing out that people who borrow to maintain their lifestyle continually need to borrow more. “I’m not certain people appreciate how much homes have become part of salary,” Mr. Morris says.

Household budgets are already becoming stretched, he says, and the Bank of Canada is likely to raise rates again at upcoming meetings.

Many Bay Street economists are expecting the central bank’s key rate to end up at 3.25 per cent or 3.5 per cent this year as policy makers try to tame runaway prices. Inflation in Canada reached an annualized rate of 8.1 per cent in June to mark a four-decade high.

The central bank has identified lofty levels of household debt and rich home prices as the top two vulnerabilities in the country’s economy. Bank of Canada governor Tiff Macklem says his primary focus is getting inflation back to target.

While interest rates have been far higher in previous decades – rising above 20 per cent in the early 1980s – the debt levels consumers carry today swamp those of the past, Mr. Morris adds.

Mr. Morris fears that higher debt-servicing costs could lead to a tipping point that forces a wave of people to sell their homes at the same time real estate prices are in decline. The combination can lead to a downward spiral, he warns.

Meanwhile, the buyer’s remorse that saw real estate deals falling apart before closing has calmed down after the tumult of early spring, he says.

At that time, buyers who purchased in the heady days of February and March were sometimes distressed to find that prices had fallen in the two to three months between the time the agreement was struck and the deal closed.

“Suddenly people were caught in the shift because they had no knowledge of what was coming,” he says.

The transition was painful for people who had purchased a new home before selling their existing property, he says.

“That type of deal has largely worked its way through the system,” he says, because most sales that took place when prices were at their peak have already closed.

Now he is dealing with the upheaval of tighter credit and higher rates.

“Rising interest rates are really, really really, starting to bite.”

A wave of listings is already here, he says, adding that the wave is likely to swell.

At the same time, borrowers who need to go to private lenders for a second mortgage are facing interest rates of 18 per cent or more, Mr. Morris says.

Mr. Morris has harsh criticism for Mr. Macklem and his assurances to Canadian businesses and consumers in July, 2020 that interest rates would remain low for a long time to come.

“People relied on it,” Mr. Morris says. “It was extreme negligence to give the assurance, even with the storm clouds brewing.”

Mr. Macklem recently reiterated his view that a soft landing is possible for the Canadian economy.

Mr. Morris believes that the only scenario that might save the real estate market is a recession. A contraction in the economy may already be underway, he adds, and that in turn could lead the central bank to lower interest rates once again.

Still, he is not hoping for that grim outcome because it would cause severe economic pain.

“It brings hardship on people. It’s going to be very difficult for many Canadians.”

Your house is your most valuable asset. We have a weekly Real Estate newsletter to help you stay on top of news on the housing market, mortgages, the latest closings and more. Sign up today.

Real eState

Montreal tenant forced to pay his landlord’s taxes offers advice to other renters

|

|

David Siscoe has some advice for fellow renters across the country: get proof that your landlord is paying their taxes, or at least make sure you’ve got a property manager who’s responsible.

Mr. Siscoe is the Montreal tenant who was audited and assessed by Canada Revenue Agency in 2018 and ordered to pay six years’ worth of his non-resident landlord’s withholding taxes, as reported recently by the Globe and Mail. Mr. Siscoe says he did not know his landlady was a non-resident.

He also didn’t know that tenants renting from a non-resident are required to withhold and remit 25 per cent of their rent to CRA each month, unless they have a property manager doing it for them, or if the non-resident has made alternate arrangements to pay their taxes.

“How is there no onus on the CRA to make sure that tenants are aware of this?” he asks. “I didn’t have a clue.”

The CRA had been unable to collect from his overseas landlord. He was then assessed for the unpaid withholding taxes, as well as compounded interest and penalties that added up to about $80,000, he says. In March, 2023, he took the Minister of National Revenue to Tax Court and lost.

Foreign landlord fails to pay taxes, CRA goes after tenant

The only break he was given was a reduction in the number of years he owed for, from six to three. He says he now owes around $43,000, although he believes more interest and penalties have since accrued. And he’s already paid nearly double that amount in accounting and legal fees.

Mr. Siscoe and his wife were paying nearly $3,000 a month in rent at 501-4175 Rue Sainte Catherine ouest, in Westmount, Que., an enclave of Montreal. Mr. Siscoe is a 1988 Canadian Olympic athlete and two-time taekwondo world champion who owns a gym.

The 61-year-old said he still hasn’t settled his debt with CRA, and his lawyer told him that it’s unlikely they’ll be willing to negotiate.

“They were acting like a dog on a bone,” he says of his initial communications with the tax agency. “They proceeded to suggest that we were knowingly paying a non-Canadian resident money, and I was a little flabbergasted.”

“I said, ‘You are trying to suggest I knowingly paid her 100 per cent of the rent because I wanted to be burdened with her tax implications? Is that what you are trying to suggest?’ I felt like this is a joke somehow.” Mr. Siscoe explained that he had rented unit 501 for more than 20 years, going back to 1996. He says that in 2010, the landlord told him to start making the rent payments to his sister. The new lease agreement had a Montreal address on it, and he hadn’t paid attention to the fact that the new landlady had signed the document in Italy, he says. Mr. Siscoe said she visited the apartment a few times over the years, and it was only after he got audited that he discovered she was living in Italy. After he realized he was on the hook for her tax bill, he and his wife and their kids moved out of the unit a few months later.

Mr. Siscoe did not want to share his landlady’s contact information for this story, on advice of counsel.

After the Siscoe family moved out, they learned that the former landlady had put the condo on the market, and Mr. Siscoe notified the CRA that they had an opportunity to collect the taxes she owed. He never found out if they tried.

In court documents, Mr. Siscoe argued that his landlord had given a Canadian address on the deed of sale when she purchased the unit; she had a Canadian social insurance number; and his rent cheques were going to a TD Canada account in Montreal.

Also in court documents, the CRA provided evidence that showed the landlord hadn’t filed income tax returns; she didn’t have any links to property in Canada other than the rental unit; her phone number on the lease was an Italian phone number; she had used an Italian e-mail address to correspond with Mr. Siscoe; and she had told the CRA auditor she lived in Italy.

The withholding tax has been around for decades. The problem for tenants arises when a non-resident landlord doesn’t pay it. And non-resident owned properties represent a substantial share of the secondary rental market in Canada.

Considering the risk to tenants – amid a housing crisis – Mr. Siscoe wonders why CRA didn’t put a lien against the rental property, or at least act to collect on the debt when the property sold.

Mr. Siscoe’s lawyer, Mr. Luu, says that all the CRA must do is establish liability to collect on the debt, and he said there doesn’t appear to be a guideline on how they do that.

“Whether the CRA could have collected the rent in some other way does not impact his liability under the law. The CRA and the Tax Court have to apply the law as it is written.

“That’s why if we want any meaningful change, we need to change the law and it’s for the Department of Finance to intervene.”

In an e-mail response, Caroline Theriault, deputy spokesperson and media relations manager for the Department of Finance, said that the requirement for renters helps to ensure that CRA obtains information on rental income non-residents might be earning in Canada. It also “helps facilitate collection of the resulting tax,” she said.

“This does not cost renters anything,” said Ms. Thériault, adding that it is standard practice.

A CRA spokesperson said in an e-mail that they encourage non-resident landlords to hire property managers. Otherwise, tenants are required to withhold the amount and fill out a Form NR4.

“If the non-resident fails to remit, the tenant is responsible for the full amount,” said the statement.

CRA’s practice is to “make every effort” to assess the non-resident owner rather than the individual tenant.

The agency pointed to a legal website that offered tips on ways renters can protect themselves, including a land title search on the landlord, asking the landlord for a certificate of residency, writing an indemnity clause into the lease agreement, and being on the lookout for any requests to redirect rent payment to someone else.

Adam Chambers, Conservative shadow Minister for National Revenue, which oversees the CRA, took issue with the policy and called the CRA’s reaction “cruel measures in the tax code that unfairly punish renters who have done no wrong.”

Real estate lawyer Ron Usher, who is general counsel for the Society of Notaries Public of B.C., where a non-resident owns one in 10 new condos, says that for every sale by a nontax resident, a clearance certificate from CRA must be obtained.

“Until CRA provides it, the notary will retain the amount in trust.”

To prevent Mr. Siscoe’s situation, he suggests a system whereby CRA is notified of any non-tax-resident real estate purchases. At that point, CRA would send the purchaser notice of tax obligations and issue an individual tax number if they don’t qualify for a social insurance number.

Mr. Siscoe said he is doing his best not to dwell on the situation. But he wants Canadian renters to beware.

“Don’t get me wrong. If me being angry could change the outcome, yes, I would be angry. But I’m not going to let them take more from me than they’ve taken,” he says.

“As an athlete, I spent my career travelling around the world, holding my country’s flag … but your own country can say, ‘Let’s screw him over.’”

He and his wife are renting another place, but it’s different this time.

“Right away I said [to the landlord], ‘I need to know you are paying your Canadian taxes, and I need it in writing.’”

Real eState

Judge Approves $418 Million Settlement That Will Change Real Estate Commissions

|

|

A settlement that will rewrite the way many real estate agents are paid in the United States has received preliminary approval from a federal judge.

On Tuesday morning, Judge Stephen R. Bough, a United States district judge, signed off on an agreement between the National Association of Realtors and home sellers who sued the real estate trade group over its longstanding rules on commissions to agents that they say forced them to pay excessive fees.

The agreement is still subject to a hearing for final court approval, which is expected to be held on Nov. 22. But that hearing is largely a formality, and Judge Bough’s action in U.S. District Court for the Western District of Missouri now paves the way for N.A.R. to begin implementing the sweeping rule changes required by the deal. The changes will likely go into full effect among brokerages across the country by Sept. 16.

N.A.R., in a statement from spokesman Mantill Williams, welcomed the settlement’s preliminary approval.

“It has always been N.A.R.’s goal to resolve this litigation in a way that preserves consumer choice and protects our members to the greatest extent possible,” he said in an email. “There are strong grounds for the court to approve this settlement because it is in the best interests of all parties and class members.”

N.A.R. reached the agreement in March to settle the lawsuit, and a series of similar claims, by making the changes and paying $418 million in damages. Months earlier, in October, a jury had reached a verdict that would have required the organization to pay at least $1.8 billion in damages, agreeing with homeowners who argued that N.A.R.’s rules on agent commissions forced them to pay excessive fees when they sold their property.

The group, which is based in Chicago and has 1.5 million members, has wielded immense influence over the real estate industry for more than a century. But home sellers in Missouri, whose lawsuit against N.A.R. and several brokerages was followed by multiple copycat claims, successfully argued that the group’s rule that a seller’s agent must make an offer of commission to a buyer’s agent led to inflated fees, and that another rule requiring agents to list homes on databases controlled by N.A.R. affiliates stifled competition.

By mandating that commission be split between agents for the seller and buyer, N.A.R., and brokerages who required their agents to be members of N.A.R., violated antitrust laws, according to the lawsuits. Such rules led to an industrywide standard commission that hovers near 6 percent, the lawsuits said. Now, agents will be essentially blocked from making those commission offers, a shift that will, some industry analysts say, lower commissions across the board and eventually force down home prices as a result.

Real estate agents are bracing for pain.

“We are concerned for buyers and potentially how we will get paid for working with buyers moving forward,” said Karen Pagel Guerndt, a Realtor in Duluth, Minn. “There’s a lot of ambiguity.”

The preliminary approval of the settlement comes as the Justice Department reopens its own investigation into the trade group. Earlier this month, the U.S. Court of Appeals for the District of Columbia overturned a lower-court ruling from 2023 that had quashed the Justice Department’s request for information from N.A.R. about broker commissions and how real estate listings are marketed. They now have the green light to scrutinize those fees and other N.A.R. rules that have long confounded consumers.

“This is the first step in bringing about the long awaited change,” said Michael Ketchmark, the lawyer who represented the home sellers in the main lawsuit. “Later this summer, N.A.R. will begin changing the way that homes are bought and sold in our country and this will eventually lead to billions of dollars and savings for homeowners.”

Under the settlement, homeowners who sold homes in the last seven years could be eligible for a small piece of a consolidated class-action payout. Depending on how many homeowners file claims by the deadline of May 9, 2025, that could mean tens of millions of Americans.

Real eState

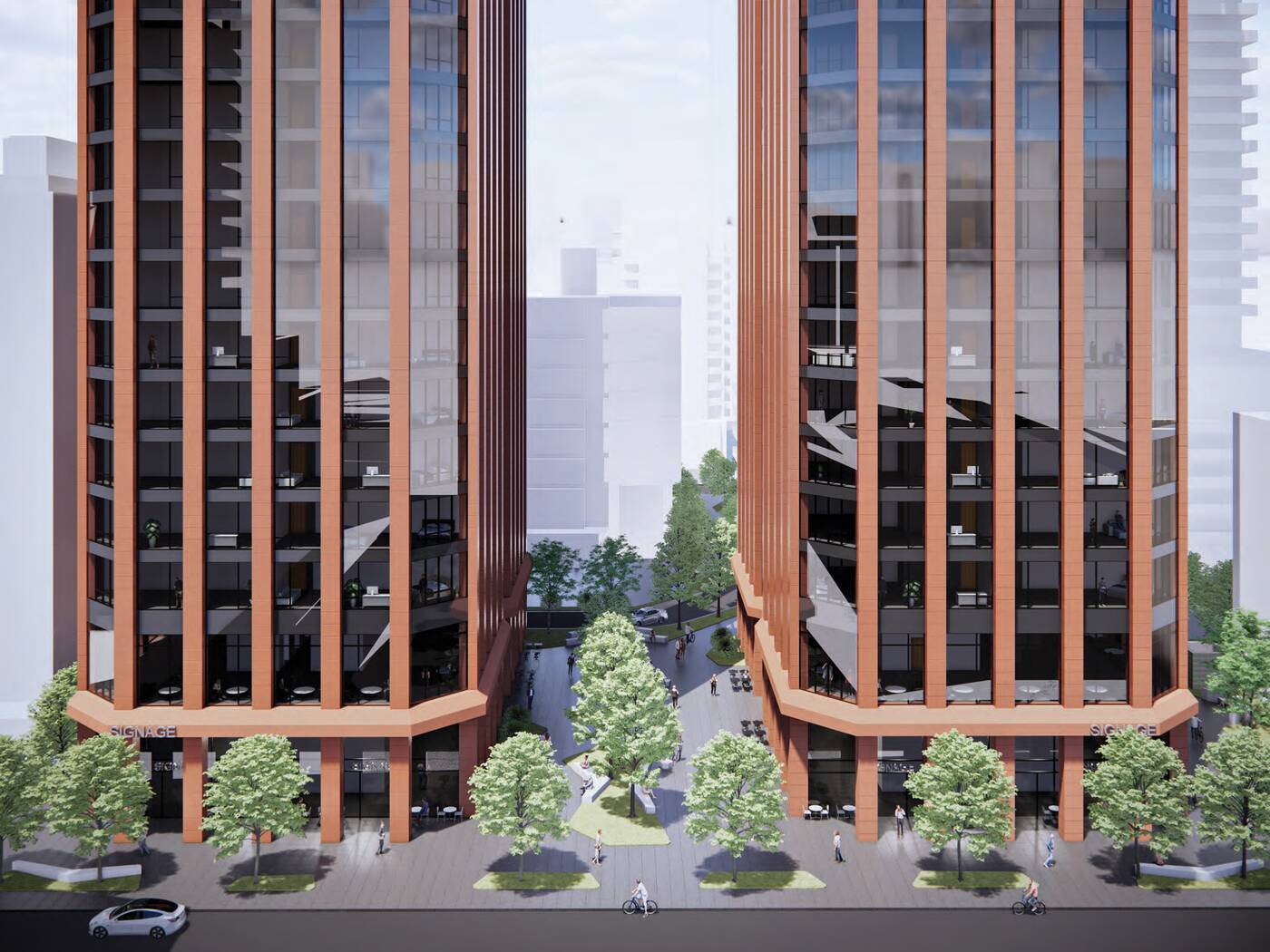

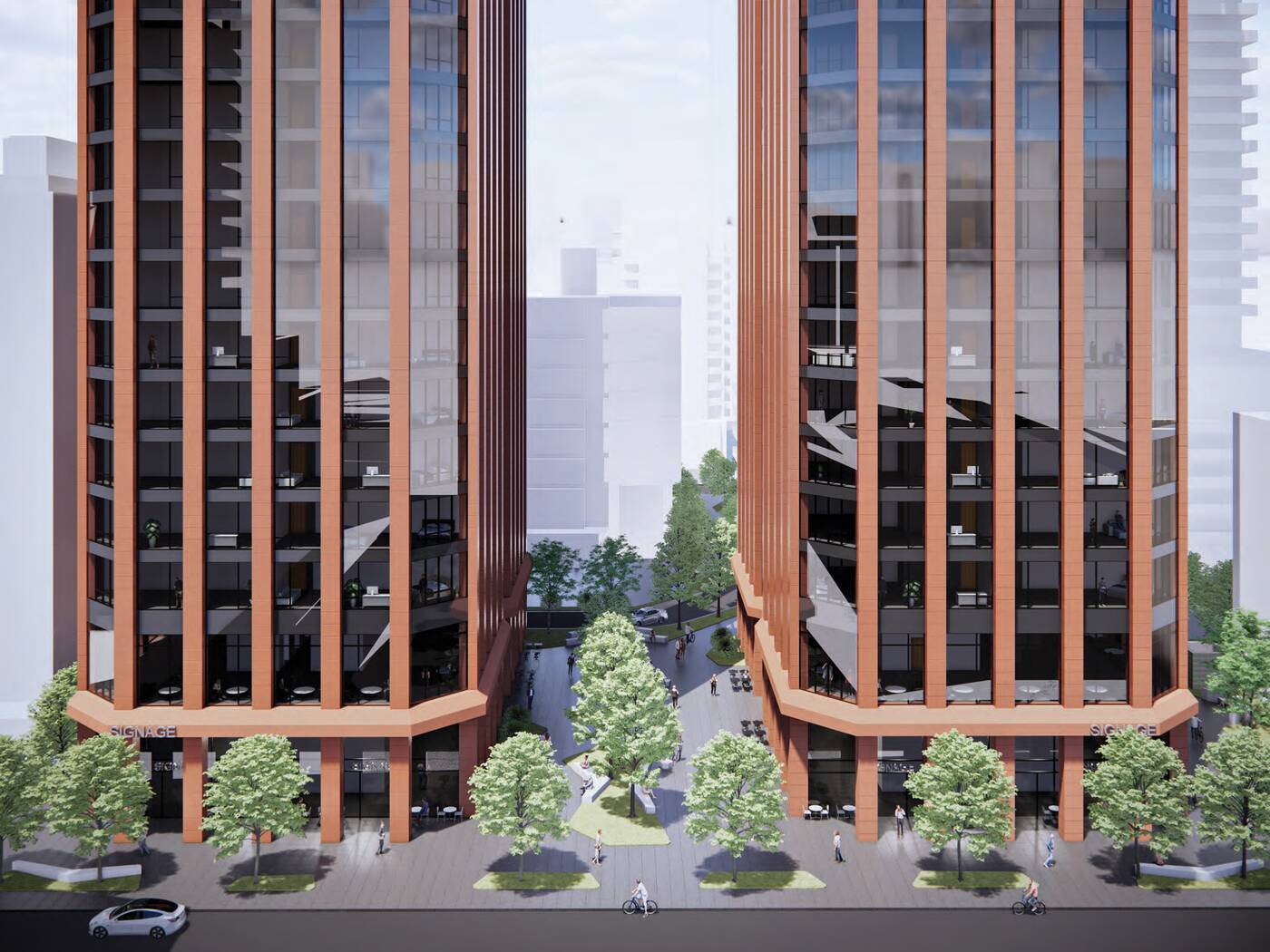

Two matching megacomplexes to totally transform Toronto neighbourhood

|

|

A pair of twinned proposals aim to completely redefine the skyline of Toronto’s midtown area with an architectural statement that would set the neighbourhood apart from other high-rise clusters in the city.

Two separate proposals from developer Madison Group at 110 and 150 Eglinton Avenue East have been resubmitted to city planners, calling for two pairs of mixed-use condominium towers with standout designs unlike anything that exists in the city today.

In a surprising twist from a developer not exactly known for breaking the bank on architecture, the proposals now boast brand-new complementary designs from acclaimed firm Rafael Viñoly Architects.

The 110 Eglinton site, currently home to a pair of mid-rise office buildings, would be demolished and built out with two 58-storey towers.

A few doors to the east, the 150 Eglinton site includes a handful of mid-rise and low-rise commercial buildings along Eglinton, wrapping around Redpath Avenue. These buildings would also be demolished and replaced with a pair of 61-storey towers.

All four towers will feature matching designs boasting red aluminum cladding forming vertical piers that accentuate the towers’ heights, though there will be some key differences between the pairs at 110 and 150 Eglinton.

150 Eglinton East

The 58-storey towers at 110 Eglinton East will be linked via an enormous floating bridge spanning levels five through 10, framing a large open public space below and supporting an elevated residential amenity floor above.

The 61-storey towers lack a skybridge, but will also feature amenity levels with panoramic views, including spaces on the 28th and 40th floors.

At heights of just over 236 metres, these four towers all stand taller than anything that exists in the neighbourhood as of 2024.

The combined proposals would add a staggering 3,364 condominium units to the neighbourhood, along with new retail and office space to maintain employment uses along this evolving corridor.

One standout of the proposals is a series of privately-owned publicly accessible spaces measuring over 5,000 square metres across the combined sites.

Among the publicly-accessible spaces proposed are the aforementioned area below the bridge at 110 Eglinton, along with pedestrian walkways that will allow foot traffic to filter through the block between Eglinton and Roehampton Avenue to the north.

It’s the type of proposal one would expect to be met with significant local backlash. However, early feedback from the neighbourhood is surprisingly positive.

Local city councillor Josh Matlow took to X to voice his support for the project, calling it “genuinely exciting.”

“The architecture is beautifully designed,” said Matlow, hyping up locals with a promise that renderings of the new public space would wow the community. It’s remarkable for our community and city — like bringing Rockefeller Center to midtown Toronto,” said Matlow.

-

Health19 hours ago

Health19 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Health23 hours ago

Health23 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

News16 hours ago

Amid concerns over ‘collateral damage’ Trudeau, Freeland defend capital gains tax change

-

Art20 hours ago

Random: We’re In Awe of Metaphor: ReFantazio’s Box Art

-

Investment24 hours ago

Investment24 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

Art13 hours ago

The unmissable events taking place during London’s Digital Art Week

-

Media19 hours ago

Vaughn Palmer: B.C. premier gives social media giants another chance

-

Art24 hours ago

Penetang couple 'saddened' after complaint forces folk art removal – MidlandToday