Investment

Seeking Balance Following Market Extremes – AGF Perspectives

Author: Stephen Duench

March 9, 2023

The dramatic rotation in market leadership that defined equity returns during the first month of 2023 has become less acute in more recent weeks, but investors still need to be careful about its influence on portfolio positioning going forward.

Namely, it’s crucial to find a balance between this year’s early winners and losers. For instance, while some investors might want to load up more on outperforming sectors like Information Technology and real estate income trusts (REITs), this may not be prudent given the extreme nature of the outperformance that took place in January.

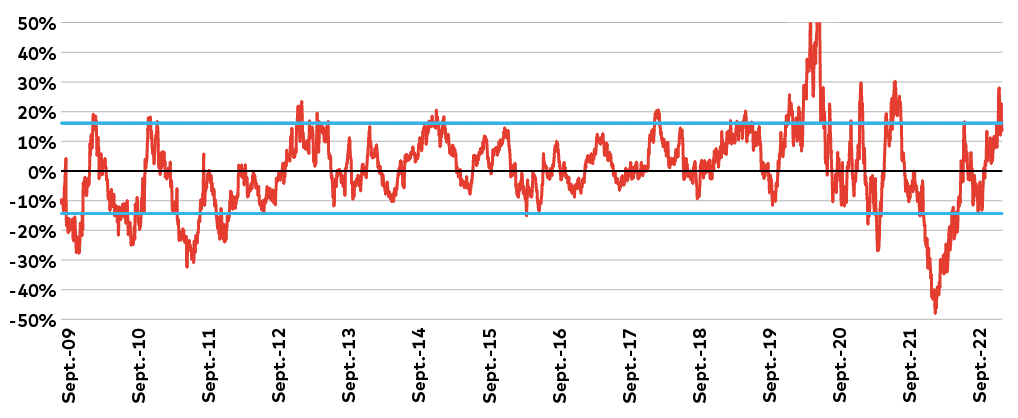

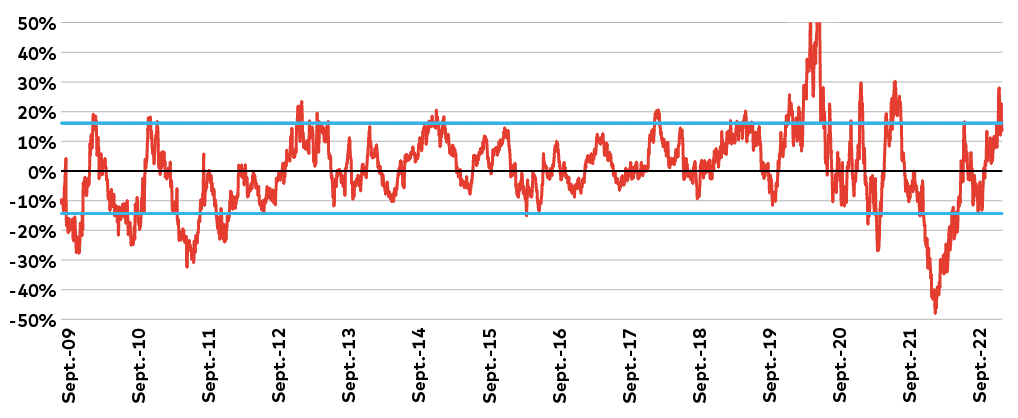

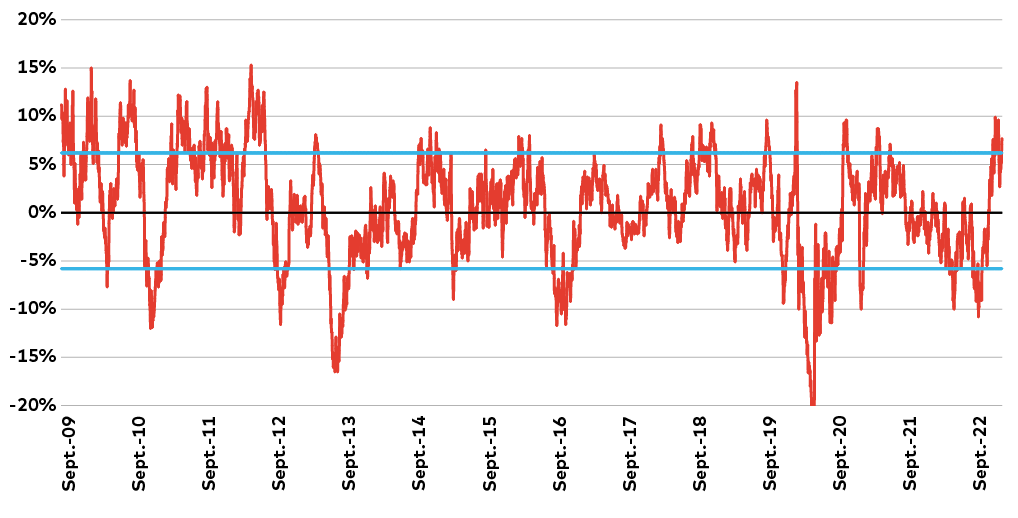

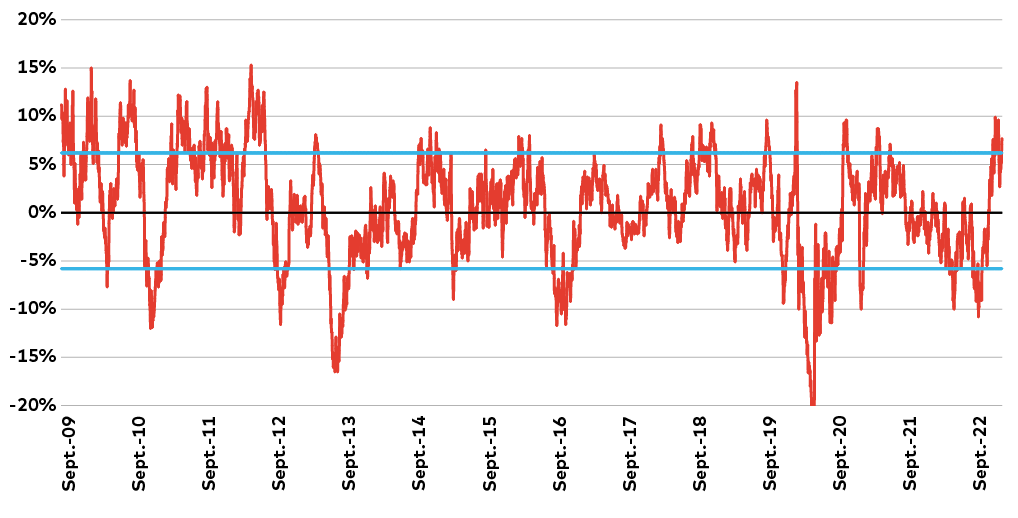

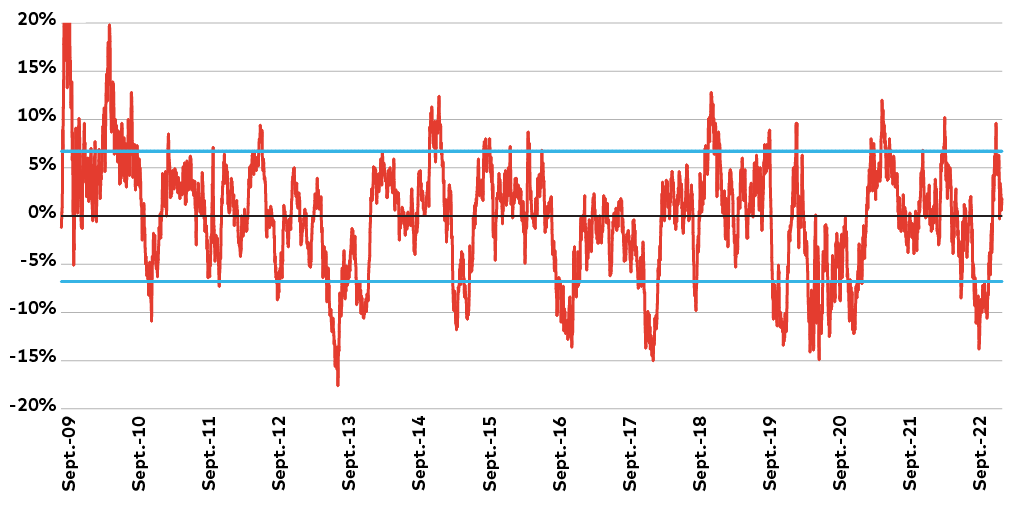

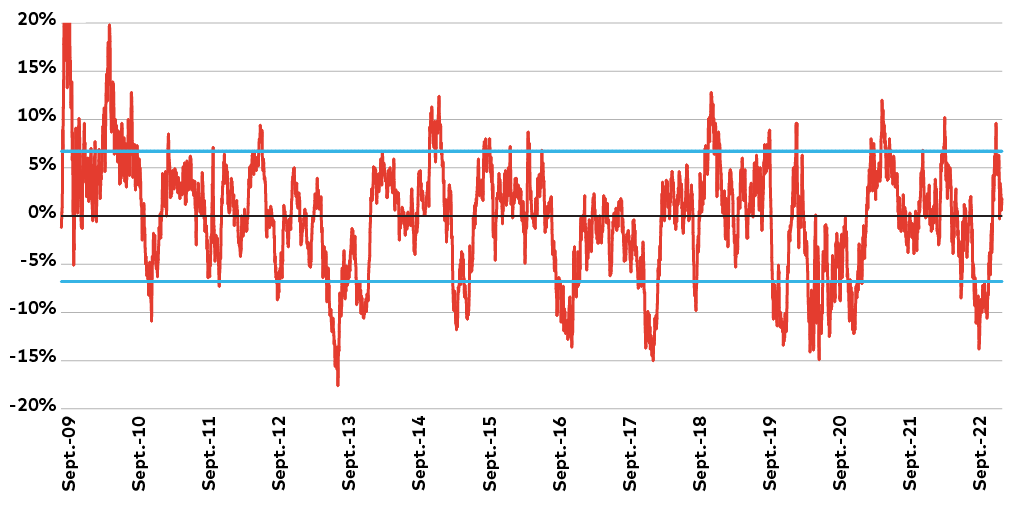

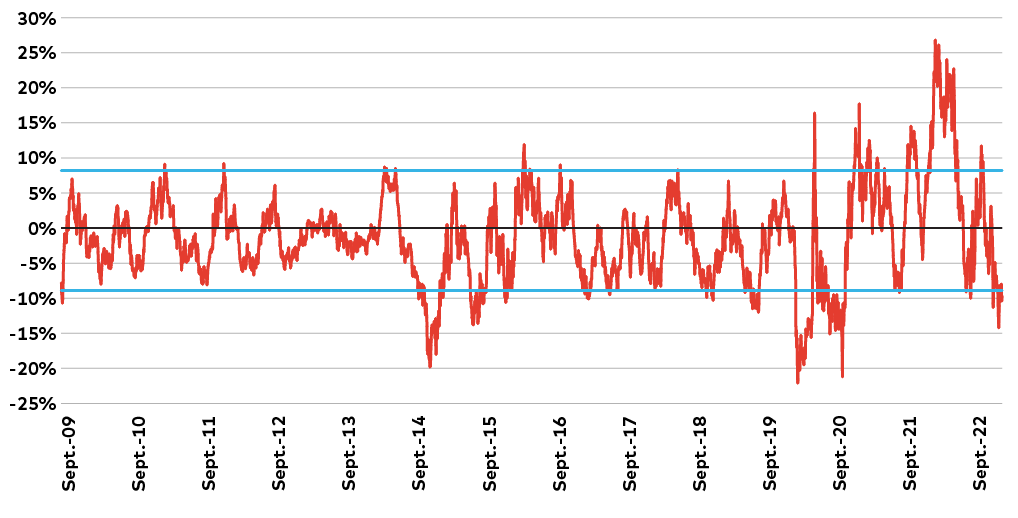

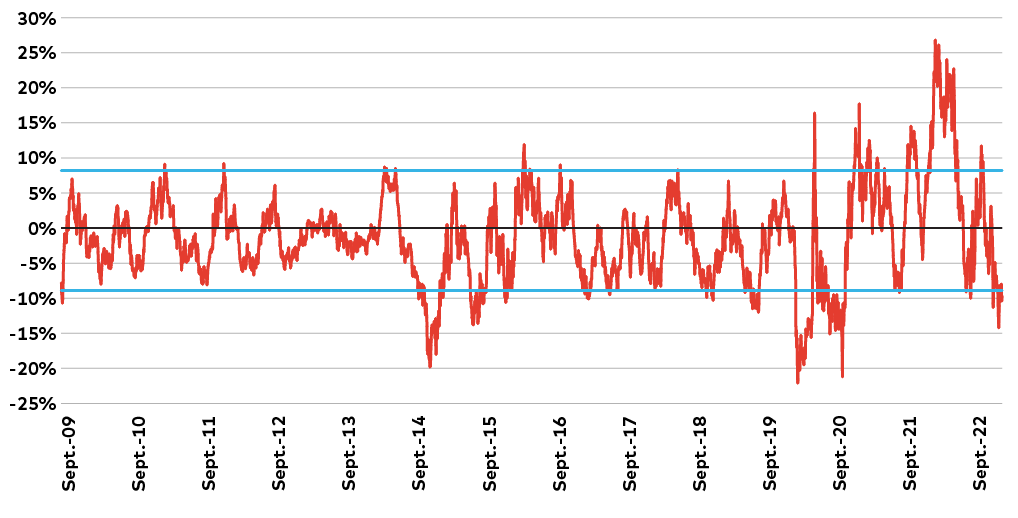

In fact, the rolling three-month relative performance of these two sectors was near or above the “upper bound” level at which future returns begin to wane – relatively speaking – both in Canada and the United States.

Canada Information Technology: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX Information Technology Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

U.S. Information Technology: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P Information Technology Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

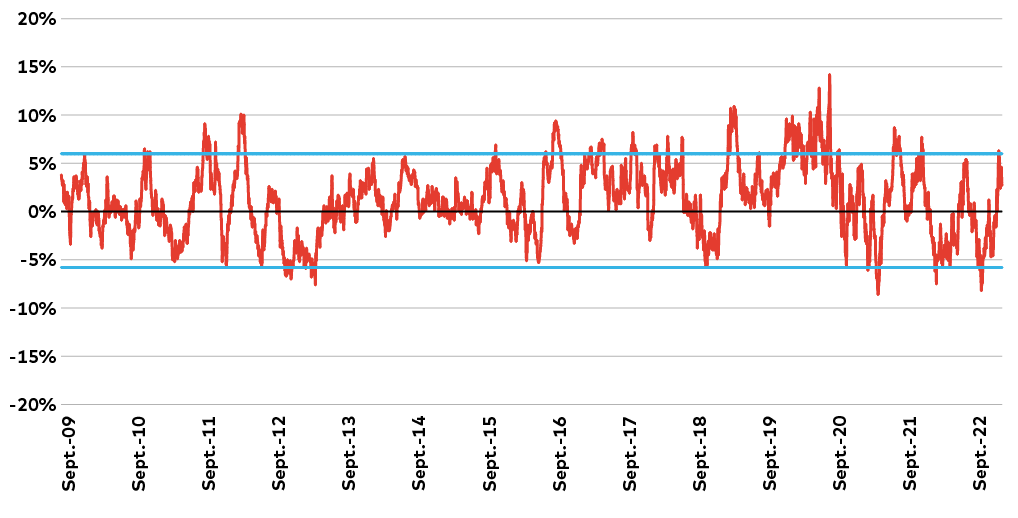

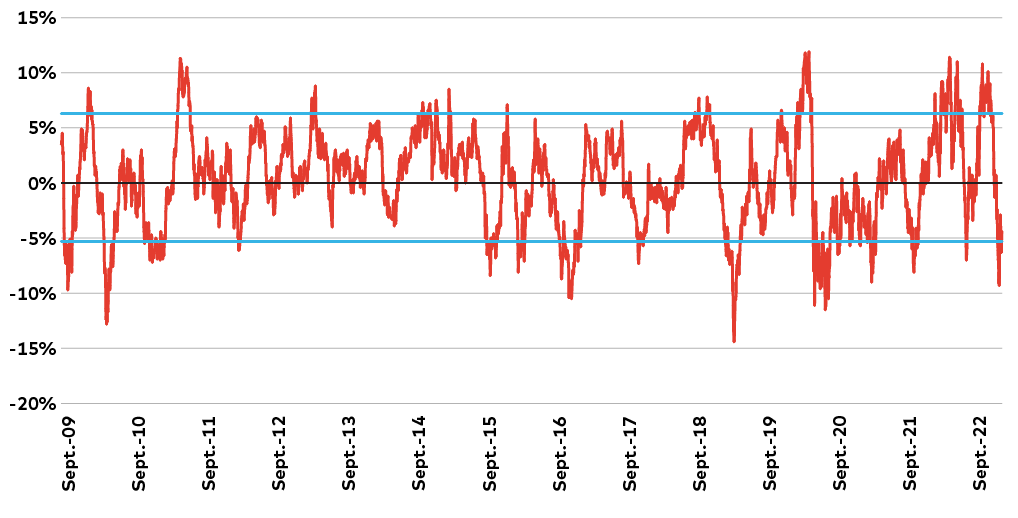

Canada REITs: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX REIT Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

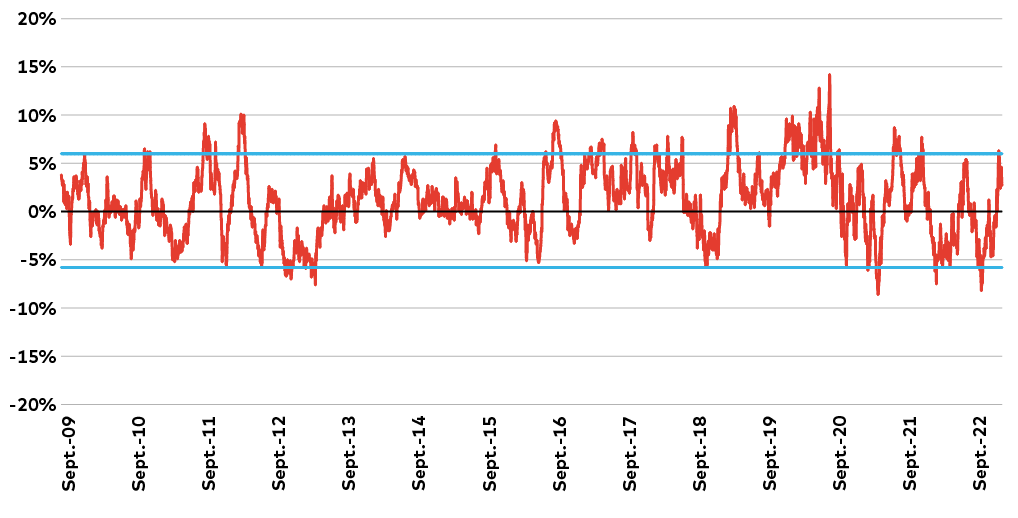

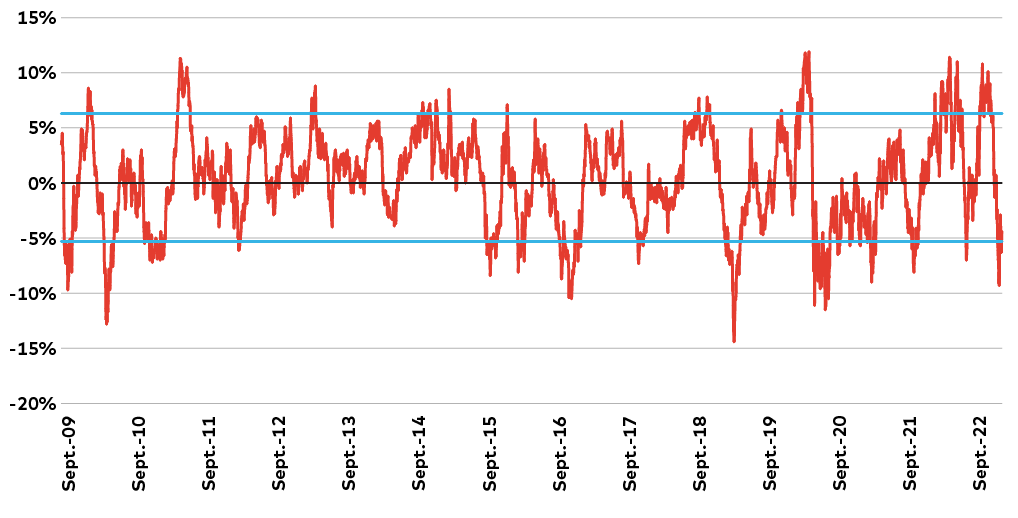

U.S. REITs: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P REIT Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

By extension, it’s probably not wise to completely neglect this year’s early losers, which include sectors like Canadian Energy and U.S. Healthcare, both of which underperformed at near or below the “lower bound” level that future relative returns begin to improve.

Canada Energy: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX Energy Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

U.S. Healthcare: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P Healthcare Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

To be clear, that doesn’t mean investors should do the complete opposite. Selling all your winners and buying the losers in hopes of a complete reversal in market leadership is a very difficult proposition to make given the uncertainty of the current market environment.

A better approach for many might be a “core and contrarian” strategy that maintains exposure to the strongest performing winners in a portfolio, while adding select laggards that show high conviction quality attributes.

As an example, from a dividend investing perspective, the REITs remain fertile ground for opportunities despite the sector’s outsized gains earlier this year. Moreover, there are several Energy and Healthcare names with great attributes that are even more attractive for having been on the wrong side of the rotation in market leadership. Not only are their yields higher for it today, but they’re also expected to keep growing at a time when dividend growth could become scarce as other companies brace for the potential of a severe economic downturn.

Ultimately, market extremes like those we experienced to start 2023 can be difficult to navigate, but by maintaining a balanced approach, investors are better positioned to navigate the risks, while taking advantage of the opportunities that arise.

The views expressed in this blog are those of the authors and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Commentary and data sourced Bloomberg, Reuters and company reports unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of March 1, 2023 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

RO:20230307-2770966

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2023 AGF Management Limited. All rights reserved.

Investment

'I was always so proud of it': Charlie Munger had a ready reply when asked to name the investment he liked most – Yahoo Finance

To say Charlie Munger lived a long, full and rich life is putting it both mildly and literally.

The Berkshire Hathaway sidekick of billionaire Warren Buffett died in November just weeks short of his 100th birthday. His estimated net worth? A mere $2.2 billion, according to Forbes.

Don’t miss

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

-

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here’s how

-

‘It’s not taxed at all’: Warren Buffett shares the ‘best investment’ you can make when battling rising costs — take advantage today

Indeed, Munger was an investing legend — and just as much a font of no-nonsense wisdom and wit. Regarding the extravagant purchases consumers love, he once quipped, “Who in the hell needs a Rolex watch?”

As investors, we arguably need to measure time in a different kind of way: that is, ticking off the moments until we trade big-ticket spending for even an ounce of Munger’s golden investment guidance.

In one video capturing Munger’s remarks from the 2022 Daily Journal ($DJCO) Annual Meeting, he shares the story of a big win … and the following year, a bad flop.

Munger’s best investment ever

Munger’s musings on the extremes of his financial life were sparked by a certain Wes in Miami, who asked him, “In your storied investment career, which investment did you like the most?”

“Well, that’s rather interesting,” Munger replied, his trusty Diet Coke can sitting in front of him. He mentioned the World Book Encyclopedia, which he remembered from his youth as a product sold door to door. “It was easy for a child who wasn’t necessarily a brilliant student.”

And as an investment, the World Book provided volume after volume of wealth. ”Berkshire made $50 million pre-tax per year out of that business for years and years and years. I was always so proud of it because I grew up with it and it helped me.”

The World Book triumph follows a pattern of Buffett and Munger buying into successful businesses whose products they loved, including Dairy Queen, See’s Candies, and yes, Coca-Cola.

Berkshire Hathaway also followed a model that almost seems old fashioned today: it invested in companies whose stocks were undervalued; that is, when the intrinsic value per share dips below the current market share price.

Read more: Suze Orman says Americans are poorer than they think — but having a dream retirement is so much easier when you know these 3 simple money moves

World Book only ceased to return monstrous profits when, as Munger noted, “a man named Bill Gates came along and decided he was going to give away a free encyclopedia with every damn bit of software.”

The World Book success story boils down to the kind of simple principle Munger loved so much: buy in companies whose products and profit potential you believe in, especially after you study the numbers and marketplace dominance.

“It’s still a marvelous product,” Munger said, “and it wasn’t good that we lost what World Book was doing for this civilization. World Book helped me get ahead in life.”

Charlie’s folly

But even the most successful market gurus have their crash-and-burn moments. Munger had no trouble recalling the dud that haunted him at the Daily Journal’s 2023 meeting: Alibaba “was one of the worst mistakes I’ve ever made.”

Munger said he was “over-charmed” by online retailing and “got a little out of focus” when it came time to invest his money in Alibaba. In fact, Munger acknowledged that he used leverage to buy the stock— a tactic he has frowned on in the past — because “the opportunities were so ridiculously good I thought it was desirable to do that.”

Munger initially bought about 165,000 Alibaba shares in the first quarter of 2021 and increased that to 602,060 shares in the fourth quarter. But he then cut that back to 300,000 shares in the first quarter of 2022.

The lesson Munger learned and that we can especially benefit from today is that the market’s bright shiny objects may distract us from doing our homework. E-commerce, he said, wasn’t a slam dunk but just another form of retail where a business has to prove its viability, just like a brick-and-mortar store.

This story should be familiar to anyone who has jumped on an IPO from a much-hyped company, only to see its stock falter days afterward. Trump Media, for example, recently dropped below $30 a share, compared to an IPO price that soared above $70.

As for his particular market tumble, Munger’s response was pure Munger: “I keep rubbing my own nose in my own mistakes like I’m doing now because I think it’s good for [me].”

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Investment

TFSAs, RRSPs and more could see changes in allowed investments – Investment Executive

“It’s a useful and probably much needed exercise,” said Carl Hinzmann, partner with Gowling WLG in Toronto. “If they can get the [qualified investments definitions] down to a singular definition, I think it would be significantly easier for the investment community that’s trying to provide advice and develop products.”

Holding a non-qualified or prohibited investment can lead to severe tax consequences: the plan would incur a 50% tax on the fair market value of the non-qualified or prohibited investment at the time it was acquired or changed status, and the investment’s income also would be taxable.

The consultation asked stakeholders to consider whether updated rules should favour Canada-based investments. Hinzmann likened this to the debate about whether pension funds should invest more domestically.

“I don’t think tax legislation is the appropriate way to tell pension funds to invest their money, so why [do that to] ordinary Canadians?” he said.

To achieve the goal of favouring Canadian investments, Hinzmann said the government could either require a certain percentage of domestic investments or treat domestic investments more favourably within a plan. Canada had a foreign content limit for RRSPs and RRIFs from 1971 to 2005, which ranged from 10% to 30%.

The budget acknowledged that the qualified investment rules “can be inconsistent or difficult to understand” due to their many updates since their introduction in 1966.

For example, different plans have slightly different rules for making investments in small businesses; certain types of annuities are qualified investments only for RRSPs, RRIFs and RDSPs; and certain pooled investment products are qualified investments only if they are registered with the Canada Revenue Agency.

“There’s no good policy reason” for the inconsistencies, Hinzmann said, adding that the purpose of the rules is to ensure registered plans hold stable, liquid products and that the planholder does not gain a personal tax advantage.

By having unwieldy, inconsistent rules, “all you’re really doing is increasing costs for the people offering these investment services to Canadians,” he said.

The budget asked for suggestions on how to improve the regime. In addition to questioning whether the rules should favour Canadian investments, the budget asked stakeholders to consider the pros and cons of harmonizing the small-business and annuities rules; whether crypto-backed assets should be considered qualified investments; and whether a registration process is indeed required for certain pooled investment products.

Hinzmann said the consultation’s highlighting of crypto-backed assets suggests the government may be questioning whether investment funds that hold cryptocurrency should be included in registered plans, though he acknowledged the government also could wish to expand the types of crypto products allowed.

Cryptocurrency itself is a non-qualifying investment in registered plans.

The qualified investments consultation ends July 15.

Qualified, non-qualifying and prohibited investments

Registered plans are allowed to hold a wide range of investments, including cash, GICs, bonds, mutual funds, ETFs, shares of a company listed on a designated exchange, and private shares under certain conditions. These are called qualified investments.

However, investments such as land, general partnership units and cryptocurrency are generally non-qualifying investments. (A cryptocurrency ETF is qualified if it’s listed on a designated exchange.)

A prohibited investment is property to which the planholder is “closely connected.” This includes a debt of the planholder or a debt or share of, or an interest in, a corporation, trust or partnership in which the planholder has an interest of 10% or more. A debt or a share of, or an interest in, a corporation, trust or partnership in which the planholder does not deal at arm’s length also is prohibited.

A registered plan that acquires or holds a non-qualified or prohibited investment is subject to a 50% tax on the fair market value of the investment at the time it was acquired or became non-qualified or prohibited. However, a refund of the tax is available if the property is disposed of, unless the planholder acquired the investment knowing it could become non-qualified or prohibited.

Income from a non-qualified investment is considered taxable to the plan at the highest marginal rate. Income earned by a prohibited investment is subject to an advantage tax of 100%, payable by the planholder.

A non-qualified investment that is also a prohibited investment is treated as prohibited.

Investment

Bill Morneau slams Freeland’s budget as a threat to investment, economic growth

|

|

Finance Minister Chrystia Freeland’s predecessor Bill Morneau says there was talk of increasing the capital gains tax when he was on the job — but he resisted such a change because he feared it would discourage investment by companies and job creators.

He said Canada can expect that investment drought now, in response to a federal budget that targets high-end capital gains for a tax hike.

“This was very clearly something that, while I was there, we resisted. We resisted it for a very specific reason — we were concerned about the growth of the country,” he said at a post-budget Q&A session with KPMG, one of the country’s large accounting firms.

Morneau, who served as Prime Minister Justin Trudeau’s finance minister from 2015 to 2020 before leaving after reports of a rift, said Wednesday that Freeland’s move to hike the inclusion rate from one-half to two-thirds on capital gains over $250,000 for individuals, and on all gains for corporations and trusts, is “clearly a negative to our long-term goal, which is growth in the economy, productive growth and investments.”

Morneau said the wealthy, business owners and corporations — the people most likely to face a higher tax burden as a result of Freeland’s change — will think twice about investing in Canada because they stand to make less money on their investments.

“We’ve created a disincentive and that’s very difficult. I think we always have to recognize any measure that creates a disincentive for investment not only impacts us within the country but also impacts foreign investors that are looking at our country,” he said.

“I don’t think there’s any way to sugarcoat it. It’s a challenge. It’s probably very troubling for many investors.”

KPMG accountants on hand for Morneau’s remarks said they’ve already received calls from some clients worried about how the capital gains change will affect their investments.

Praise from progressives

While Freeland’s move to tax the well-off to pay for new spending is catching heat from wealthy businesspeople like Morneau, and from the Canadian Chamber of Commerce, progressive groups said they were pleased by the change.

“We appreciate moves to increase taxes on the wealthiest Canadians and profitable corporations,” said the Canadian Labour Congress.

“We have been calling on the government to fix the unfair tax break on capital gains for a decade,” said Katrina Miller, the executive director of Canadians for Tax Fairness. “Today we are pleased to see them take action and decrease the tax gap between wage earners and wealthy investors.”

“This is how housing, pharmacare and a Canada disability benefit are afforded. If this is the government’s response to spending concerns, let’s bring it on. It’s about time we look at Canada’s revenue problem,” said the Canadian Centre for Policy Alternatives.

The capital gains tax change was pitched by Freeland as a way to make the tax system fairer — especially for millennials and Generation Z Canadians who face falling behind the economic status of their parents and grandparents.

“We are making Canada’s tax system more fair by ensuring that the very wealthiest pay their fair share,” Freeland said Tuesday after tabling her budget in Parliament.

WATCH: New investment to lead ‘housing revolution in Canada,’ Freeland says

Finance Minister and Deputy Prime Minister Chrystia Freeland said this year’s federal budget will pave the way for Canada to build more homes at a pace not seen since the Second World War. The new investment and changes to funding models will also cut through red tape and break down zoning barriers for people who want to build homes faster, she said

The capital gains tax, which the government says will raise about $19 billion over five years, is also being pitched as a way to help pay for the government’s ambitious housing plan.

The plan is geared toward young voters who have struggled to buy a home. Average housing prices in Canada are among the highest in the world and interest rates are at 20-year highs.

Tuesday’s budget document says some wealthy people who make money off asset sales and dividends — instead of income from a job — can face a lower tax burden than working and middle-class people.

Morneau, who comes from a wealthy family and married into another one, is on the board of directors of CIBC and Clairvest, a private equity management firm that manages about $4 billion in assets.

According to government data, only 0.13 per cent of Canadians — people with an average income of about $1.4 million a year — are expected to pay more on their capital gains as a result of this change.

But there’s also a chance less wealthy people will pay more as a result of the change.

Put simply, capital gains occur when you sell certain property for more than you paid for it.

While capital gains from the sale of a primary residence will remain untaxed, the tax change could affect the sales of cottages and other seasonal and investment properties, along with stocks and mutual funds sold at a profit.

A cottage bought years ago and sold for a gain of more than $250,000 would see part of the proceeds taxed at the new higher rate.

But there’s some protection for people who sell a small business or a farming or fishing property — the lifetime capital gains exemption is going up by about 25 per cent to $1.25 million for those taxpayers.

Freeland said Tuesday she anticipates some blowback.

“I know there will be many voices raised in protest. No one likes paying more tax, even — or perhaps particularly — those who can afford it the most,” she said.

“Tax policy is not only, or chiefly, the province of accountants or economists. It belongs to all of us because it is how we decide what kind of country we want to live in and what kind of country we want to build.”

Morneau had little praise for what his successor included in her fourth budget.

Morneau said Canada’s GDP per capita is declining, growth is limited and productivity is lagging other countries — making the country as a whole less wealthy than it was.

Canada has a growth problem, Morneau warns

The government is more interested in rolling out new costly social programs than introducing measures that will reverse some of those troubling national wealth trends, he said.

“Canada is not growing at the pace we need it to grow and if you can’t grow the size of the pie, it’s not easy to figure out how to share the proceeds,” he said.

“You think about that first before you add new programs and the government’s done exactly the opposite.”

The U.S. has a “dynamic investment culture,” something that has turbo-charged economic growth and kept unemployment at decades-low levels, Morneau said. Canada doesn’t have that luxury, he said.

He said Freeland hasn’t done enough to rein in the size of the federal government, which has grown on Trudeau’s watch.

The deficit is now roughly double what it was when he left office, Morneau noted.

“There wasn’t enough done to reduce spending,” he said, while offering muted praise for the government’s decision to focus so much of its spending on the housing conundrum. “The priority was appropriate.”

-

Tech21 hours ago

Tech21 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

Sports21 hours ago

Sports21 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post

-

Science24 hours ago

Science24 hours agoAstronomers discover Milky Way's heaviest known black hole – Xinhua

-

News19 hours ago

Toronto airport gold heist: Police announce nine arrests – CP24

-

Media23 hours ago

NPR's liberal bias: Editor exposes media's lack of viewpoint diversity – USA TODAY

-

News16 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Tech19 hours ago

Tech19 hours agoVenerable Video App Plex Emerges As FAST Favorite – Forbes

-

Investment15 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum