Investment

Thailand sees GDP, investment boost if joins CPTPP trade pact – TheChronicleHerald.ca

By Orathai Sriring and Kitiphong Thaichareon

BANGKOK (Reuters) – Thailand could expect a boost to its economic growth, investment and exports to help offset the negative impact of the new coronavirus pandemic if it participates in an Asia-Pacific trade agreement, the commerce ministry said on Monday.

The country has before said it aimed to seek membership of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), as competition intensifies in electronics and agriculture from rivals such as Vietnam and Malaysia.

Membership is opposed by opposition parties and some business groups.

But Auramon Supthaweethum, director general of the Department of Trade Negotiations, said on Monday it would boost Thailand’s gross domestic product (GDP) by 0.12%, or 13.3 billion baht ($409.61 million), with investment up 5.14%, and exports up 3.47%.

Without that, the economy will lose 26.6 billion baht, or 0.25% of GDP, with investment down 0.49% and exports down 0.19%, she said in a statement, citing the ministry’s study on CPTPP membership.

“After the coronavirus pandemic, trade and investment rules will change… It’s necessary for Thailand to seek new partners or trade pacts, such as CPTPP, to make it competitive for trade and attractive for investment,” Auramon said.

The study will be presented to the cabinet to decide whether Thailand will join the pact, Auramon said. The cabinet meets every Tuesday, but it is not clear whether this week’s session will debate the matter.

If Thailand decides to join, it will set up a committee to negotiate rules and conditions. The decision would then need approval from parliament, Auramon said.

Those opposed to membership include Move Forward opposition partly leader Pita Limjaroenrat, who has said it would have a negative impact on the economy.

Member countries, including Japan and Canada, signed the CPTPP deal in 2018 without the United States.

The original 12-member agreement, known as the Trans-Pacific Partnership (TPP), was thrown into limbo in early 2017 when President Donald Trump withdrew from it.

(Additional reporting by Patpicha Tanakasempipat; editing by Barbara Lewis)

Investment

Ukraine prime minister calls for more investment in war-torn country during Chicago stop of US visit – Toronto Star

/* OOVVUU Targeting */

const path = ‘/news/world/united-states’;

const siteName = ‘thestar.com’;

let domain = ‘thestar.com’;

if (siteName === ‘thestar.com’)

domain = ‘thestar.com’;

else if (siteName === ‘niagarafallsreview.ca’)

domain = ‘niagara_falls_review’;

else if (siteName === ‘stcatharinesstandard.ca’)

domain = ‘st_catharines_standard’;

else if (siteName === ‘thepeterboroughexaminer.com’)

domain = ‘the_peterborough_examiner’;

else if (siteName === ‘therecord.com’)

domain = ‘the_record’;

else if (siteName === ‘thespec.com’)

domain = ‘the_spec’;

else if (siteName === ‘wellandtribune.ca’)

domain = ‘welland_tribune’;

else if (siteName === ‘bramptonguardian.com’)

domain = ‘brampton_guardian’;

else if (siteName === ‘caledonenterprise.com’)

domain = ‘caledon_enterprise’;

else if (siteName === ‘cambridgetimes.ca’)

domain = ‘cambridge_times’;

else if (siteName === ‘durhamregion.com’)

domain = ‘durham_region’;

else if (siteName === ‘guelphmercury.com’)

domain = ‘guelph_mercury’;

else if (siteName === ‘insidehalton.com’)

domain = ‘inside_halton’;

else if (siteName === ‘insideottawavalley.com’)

domain = ‘inside_ottawa_valley’;

else if (siteName === ‘mississauga.com’)

domain = ‘mississauga’;

else if (siteName === ‘muskokaregion.com’)

domain = ‘muskoka_region’;

else if (siteName === ‘newhamburgindependent.ca’)

domain = ‘new_hamburg_independent’;

else if (siteName === ‘niagarathisweek.com’)

domain = ‘niagara_this_week’;

else if (siteName === ‘northbaynipissing.com’)

domain = ‘north_bay_nipissing’;

else if (siteName === ‘northumberlandnews.com’)

domain = ‘northumberland_news’;

else if (siteName === ‘orangeville.com’)

domain = ‘orangeville’;

else if (siteName === ‘ourwindsor.ca’)

domain = ‘our_windsor’;

else if (siteName === ‘parrysound.com’)

domain = ‘parrysound’;

else if (siteName === ‘simcoe.com’)

domain = ‘simcoe’;

else if (siteName === ‘theifp.ca’)

domain = ‘the_ifp’;

else if (siteName === ‘waterloochronicle.ca’)

domain = ‘waterloo_chronicle’;

else if (siteName === ‘yorkregion.com’)

domain = ‘york_region’;

let sectionTag = ”;

try

if (domain === ‘thestar.com’ && path.indexOf(‘wires/’) = 0)

sectionTag = ‘/business’;

else if (path.indexOf(‘/autos’) >= 0)

sectionTag = ‘/autos’;

else if (path.indexOf(‘/entertainment’) >= 0)

sectionTag = ‘/entertainment’;

else if (path.indexOf(‘/life’) >= 0)

sectionTag = ‘/life’;

else if (path.indexOf(‘/news’) >= 0)

sectionTag = ‘/news’;

else if (path.indexOf(‘/politics’) >= 0)

sectionTag = ‘/politics’;

else if (path.indexOf(‘/sports’) >= 0)

sectionTag = ‘/sports’;

else if (path.indexOf(‘/opinion’) >= 0)

sectionTag = ‘/opinion’;

} catch (ex)

const descriptionUrl = ‘window.location.href’;

const vid = ‘mediainfo.reference_id’;

const cmsId = ‘2665777’;

let url = `https://pubads.g.doubleclick.net/gampad/ads?iu=/58580620/$domain/video/oovvuu$sectionTag&description_url=$descriptionUrl&vid=$vid&cmsid=$cmsId&tfcd=0&npa=0&sz=640×480&ad_rule=0&gdfp_req=1&output=vast&unviewed_position_start=1&env=vp&impl=s&correlator=`;

url = url.split(‘ ‘).join(”);

window.oovvuuReplacementAdServerURL = url;

CHICAGO (AP) — Ukraine Prime Minister Denys Shmyhal kicked off a United States visit Tuesday with multiple stops in Chicago aimed at drumming up investment and business in the war-torn country.

He spoke to Chicago-area business leaders before a joint news conference with Penny Pritzker, the U.S. special representative for Ukraine’s economic recovery, and her brother, Illinois Gov. J.B. Pritzker.

function buildUserSwitchAccountsForm()

var form = document.getElementById(‘user-local-logout-form-switch-accounts’);

if (form) return;

// build form with javascript since having a form element here breaks the payment modal.

var switchForm = document.createElement(‘form’);

switchForm.setAttribute(‘id’,’user-local-logout-form-switch-accounts’);

switchForm.setAttribute(‘method’,’post’);

switchForm.setAttribute(‘action’,’https://www.thestar.com/tncms/auth/logout/?return=https://www.thestar.com/users/login/?referer_url=https%3A%2F%2Fwww.thestar.com%2Fnews%2Fworld%2Funited-states%2Fukraine-prime-minister-calls-for-more-investment-in-war-torn-country-during-chicago-stop-of%2Farticle_15ada14e-b83e-5396-9b2d-0997cf4689bd.html’);

switchForm.setAttribute(‘style’,’display:none;’);

var refUrl = document.createElement(‘input’); //input element, text

refUrl.setAttribute(‘type’,’hidden’);

refUrl.setAttribute(‘name’,’referer_url’);

refUrl.setAttribute(‘value’,’https://www.thestar.com/news/world/united-states/ukraine-prime-minister-calls-for-more-investment-in-war-torn-country-during-chicago-stop-of/article_15ada14e-b83e-5396-9b2d-0997cf4689bd.html’);

var submit = document.createElement(‘input’);

submit.setAttribute(‘type’,’submit’);

submit.setAttribute(‘name’,’logout’);

submit.setAttribute(‘value’,’Logout’);

switchForm.appendChild(refUrl);

switchForm.appendChild(submit);

document.getElementsByTagName(‘body’)[0].appendChild(switchForm);

function handleUserSwitchAccounts()

window.sessionStorage.removeItem(‘bd-viafoura-oidc’); // clear viafoura JWT token

// logout user before sending them to login page via return url

document.getElementById(‘user-local-logout-form-switch-accounts’).submit();

return false;

buildUserSwitchAccountsForm();

console.log(‘=====> bRemoveLastParagraph: ‘,0);

Investment

Canada Pension Plan investment board to host public meeting in Calgary – CTV News Calgary

The Canada Pension Plan (CPP) investment board will be hosting a public meeting from 6 to 8 p.m. on April 16 at the BMO Centre.

Registration for the public is closed, but organizers say there is room for some walk-ins.

The board hosts public meetings across Canada every two years to update people on the fund’s performance, governance and investment approach.

The pension plan has been a hot topic in Alberta over the last year, after the provincial government released a commissioned report exploring the possibility of an Alberta Pension Plan (APP).

According to the report, if Alberta gave the required three-year notice to quit the CPP, it would be entitled to $334 billion, or about 53 per cent of the fund by 2027.

However, critics say that is an overestimation.

Premier Danielle Smith has said she will not call a referendum on the topic until the Office of the Chief Actuary releases an updated number.

More information on the public meetings can be found on the CPP Investments’ website.

Investment

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April – Yahoo Finance

The artificial intelligence (AI) space is red-hot right now. Companies across every industry are looking to capitalize on the technology, and are investing heavily to gain an edge over the competition. That’s true in the social media space, where advertisers are keen to get in front of the right audience for them.

While the social media landscape is jam-packed with competition, one company is separating itself from the pack. Meta Platforms (NASDAQ: META) is making strides across various aspects of the AI realm, and its performance over the competition shows.

Let’s dig in to why now is a lucrative opportunity to invest in Meta as the long-term AI narrative plays out.

The profit machine is up and running

One of the most appealing aspects of Meta is how efficiently management runs the business. In 2023, Meta grew revenue 16% year over year to $135 billion. However, the company increased income from operations by a whopping 62% year over year to $46.7 billion.

By expanding its operating margin, Meta recognized significant growth on the bottom line as well. Last year, the company generated $43 billion in free cash flow. With such a robust financial profile, Meta is well-positioned to invest profits back into the business as well as reward shareholders.

Investing for the future

During Meta’s fourth-quarter earnings call in February, investors learned how the company is deploying its cash heap. For starters, it has increased its share repurchase program by $50 billion. This is encouraging to see as it could imply that management views Meta stock as a good value.

But perhaps more exciting was the announcement of a quarterly dividend. Many high-growth tech companies are not in a financial position to pay a dividend — or instead choose to reinvest profits into research and development or marketing strategies. Meta’s new dividend certainly sets the company apart from many of its peers, and is a nice sweetener for long-term shareholders.

Another way Meta is using its cash flow is in the realm of artificial intelligence. Like many enterprises, Meta relies heavily on sophisticated graphics processing units (GPUs) from Nvidia. However, Meta has been hinting for a while that the company is investing in its own hardware. Earlier this month, Meta announced that an updated version of its training and inference chips, called MTIA, is now available.

This is important for a couple of reasons. Namely, in-house chips will allow Meta to “control the whole stack” and scale back its reliance on semiconductors from third parties. Additionally, given the company’s knowledge base of data that it collects from social media platforms Facebook, Instagram, and WhatsApp, these new chips put Meta in a position to improve its targeted recommendation models and ad campaigns through the power of generative AI.

A compelling valuation

Meta competes with a number of players in the social media landscape. Alphabet is one of the company’s top competitors given that it operates the world’s top-two most visited websites: YouTube and Google. However, in 2023 Alphabet only grew its core advertising business by 6% year over year. By contrast, Meta’s advertising segment increased 16%.

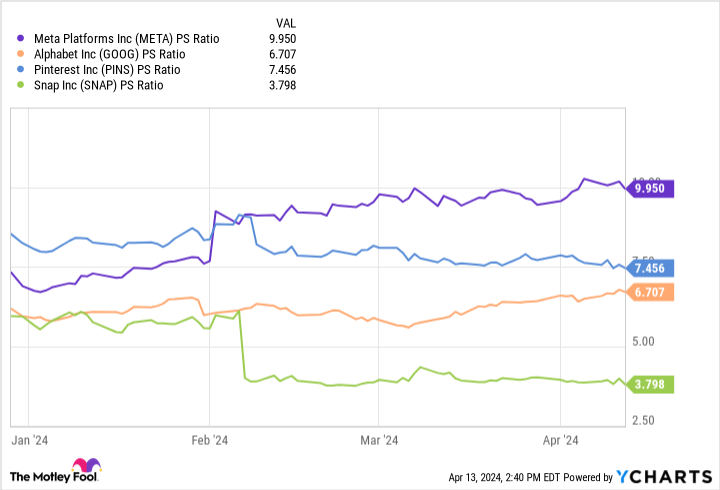

While Meta’s price-to-sales (P/S) ratio of 10 is higher than many of its social media peers, the company’s growth in the highly competitive and cyclical advertising landscape may warrant the premium.

Additionally, considering Meta’s price-to-free-cash-flow ratio of about 31 is actually trading relatively in line with its 10-year average of 32, the stock might not be as expensive as it appears.

Overall, I am optimistic about Meta’s aggressive ambitions in artificial intelligence — an investment that is yet to play out. The AI narrative is going to be a long-term story. But I see Meta as extremely well-equipped to take advantage of secular themes fueling AI, and benefiting across its entire business.

The combination of a dividend, share buybacks, consistent cash flow, and a compelling AI play make Meta stick out in a highly contested AI landscape. I think now is a great opportunity to scoop up shares in Meta and prepare to hold for the long term.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, and Pinterest. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April was originally published by The Motley Fool

-

Media18 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Tech22 hours ago

Tech22 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Real eState22 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Sports21 hours ago

Sports21 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Health24 hours ago

Health24 hours agoOpioid-related deaths between 2019 and 2021 across 9 Canadian provinces and territories

-

Science22 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Investment19 hours ago

Investment19 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca

-

News23 hours ago

Montrealers conduct a sit-in to demand that Scotiabank divest from Elbit Systems