Real eState

Top-10 CRE transactions in Toronto/GTA during 2019

|

|

“Toronto continues to be the No. 1 place to invest or look for real estate in Canada from an investor standpoint, both domestic and foreign,” Altus Group’s vice-president of data operations Ray Wong said while discussing the Top-10 2019 CRE transactions in the GTA with RENX. “It was sort of a continuation of 2018.”

Topping the charts in 2019 were a development land transaction and a multiresidential portfolio sale.

First Gulf‘s $690-million sale of the East Harbour Lands to Cadillac Fairview was the largest single-property transaction. The 38-acre site is located three kilometres from the downtown core.

Toronto city council approved the East Harbour Master Plan in 2018. It provides for 10 million square feet of commercial development including office, hotel, retail, institutional, entertainment and cultural space.

“The urban landscape will continue to be in demand, as well as opportunities for expansion and growth, especially on the commercial side and residential side,” said Wong. “So, that created quite a buzz in the marketplace based on that acquisition.”

Late in December, Starlight Investments closed on a major portfolio deal, acquiring 44 multiresidential high-rise buildings from Continuum REIT for $1.735 billion. The majority of the sites are spread across the GTA, though some of the properties are also located in Hamilton and Ottawa.

In all, Starlight acquired 6,271 units in the buildings, which include towers at 2450 and 2460 Weston Rd., 125 Bamburgh Circle and 77 Roehampton Ave., among others.

Meanwhile, the Atrium on Bay acquisition ranked third. H&R REIT (HR-UN-T) sold the 1,079,870-square-foot office and retail complex to KingSett Capital & TD Greystone Asset Management for $640 million.

“It’s such a good asset to have,” said Wong. “It’s always been a well-performing asset.”

Investment activity declined in 2019

Speaking of performance, though final numbers are not yet available the overall volume of investment activity decreased across Canada during 2019. The Toronto region also saw lower investment, but not for lack of interest from investors.

“It’s not because Toronto capital wasn’t available,” Wong said. A combination of factors contributed to the lower numbers, including a “limited number of opportunities” available to purchasers and the scale of properties on the market.

There was also more caution from potential buyers.

“What we were finding with some of the investors is that they were a little bit more selective . . . on the assets and the properties that they bid on.”

Wong contrasted the current environment to 2017 when “we saw a number of bidders in the marketplace.” At that time, he said, there was “a lineup of buyers” for assets coming onto the market.

“You still have a few buyers, but not the same amount of buyers,” Wong said.

Toronto industrial remains hot sector

Industrial properties continued to be prized assets in 2019, with two transactions on the Top-10 list.

“The GTA industrial vacancy rate is less than one per cent,” Wong said, noting for Q3 it was at 0.8 per cent.

With escalating rents and continuing demand for e-commerce space, the industrial sector “continues to do well from both the tenant perspective/investor standpoint, as well as the owner-users.” As a result, there is record buyer interest.

“It’s the first time, third-quarter 2019, that industrial has hit over a billion dollars of transactions. So, it shows you the amount of demand there is for industrial assets in the GTA.”

It’s also an asset class that is consistent across the country.

“You’re also seeing that in Vancouver,” he said, adding the West Coast city’s industrial vacancy rate is hovering in the two per cent range.

“So, industrial has performed well across the board, just because of the growth of e-commerce and the demand for warehouse distribution space.”

Here are the rest of the Top-10 GTA transactions, according to Altus data:

Oxford Properties Group and the Canada Pension Plan Investment Board (CPPIB) sold Dynamic Funds Tower for $473 million. The 650,000-square-foot downtown Toronto complex was acquired by GWL Realty Advisors (50 per cent), Investors Group (25 per cent) and OPTrust (25 per cent).

“That’s a core downtown asset,” said Wong, noting there are “very low office vacancy rates downtown.”

The Dynamic Funds Tower complex includes: Dynamic Funds Tower at 1 Adelaide St. E., a 30-storey LEED Gold-certified office tower; 20 Victoria St., a nine-storey boutique office building; and 85 Yonge St., a three-storey retail building.

Sixty-one acres of residential land was sold to Aspen Ridge Homes by Celestica for $348 million.

“That’s the old IBM Celestica site,” said Wong. He called the redevelopment site a “fantastic parcel” due to the Metrolinx Crosstown LRT expansion along Eglinton and Don Mills.

Aspen Ridge Homes’ Crosstown plan encompasses 18 condo buildings and 30 townhome buildings housing more than 10,000.

It’ll also boast 300,000 square feet of office space, restaurants and cafes, more than five acres of parks and playgrounds, and a large community centre.

Gazit Globe created a joint venture with Dori Segal’s Gazit TripLLLe Canada and a private investor to purchase this low-rise office and complex at Yonge Street and York Mills Road in December for about $240 million from Manulife Investment Management.

Sitting atop the York Mills subway station, the 570,000-square-foot complex includes about 35,000 square feet of retail.

It’s situated in a neighbourhood which is undergoing major redevelopment and intensification, with seven active multiresidential projects on the go and several more planned.

TD Bank Group purchased a 30 per cent stake in this 1.2 million-square-foot office tower, which remains under construction by Cadillac Fairview, for $229 million.

“We have it as ICI land, but that’s the new office building that Cadillac Fairview is building,” Wong said, noting TD will also be the anchor tenant in the building.

TD Bank Group will occupy 840,000 square feet over 33 floors of the downtown tower, which is now owned 50 per cent by Cadillac Fairview and 20 per cent by Investment Management Corporation of Ontario (IMCO).

The Ontario Teachers’ Pension Plan will occupy 340,000 square feet in the now fully leased, 46-storey building valued at approximately $760 million.

An aerial view of the Rossland Park community in Oshawa.

The 911-unit Rossland Park property in Oshawa was sold to Q Residential by H. Kassinger Construction Limited for $220 million. The property includes about three dozen townhome, low-rise and high-rise buildings in a 50-acre park-like setting bordering Rossland Road between Wilson Avenue and Ritson Road.

“That deal is just representative of the demand for multires in the market,” Wong said, adding “even in Oshawa, there’s sizable demand for that type of asset.”

AIMCo purchased this suburban Richmond Hill data centre property from a joint venture between Urbacon Properties Limited and Summit Industrial Income REIT for $215 million. It’s part of a larger development at the Barker business park site, which currently includes two data centres but is designed to contain as many as five of the facilities at full build-out.

The 118,135-square-foot property is located near Highway 404 and Elgin Mills Road East.

10. 2200 Yukon Court

Another major industrial transaction: DSV Solutions Inc. sold the 1.1 million-square-foot Milton property for $180 million to London Life Insurance Company (45 per cent), GWL Realty Advisors (25 per cent), Canada Life Insurance Company (20 per cent), and Canada Life Assurance Company (10 per cent).

Real eState

The real estate sector's unique view of 2024 — and what's to come – Yahoo Finance

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Despite a rough few days for the S&P 500, which is still comfortably in the green this year (up 6%), one sector of the stock market is feeling more pain than the rest.

The perception that rates might stay higher for longer is hammering the real estate sector, even as debate rages about how many times — if any — the Federal Reserve will cut rates this year.

The group is far and away the worst performer in the S&P 500 for 2024, down more than 10%. The bulk of those declines have come in the past two weeks, as Treasury yields have climbed to their highest level since November and investors traverse the acceptance phase that the hoped-for cuts are not on their way.

Now investors are faced with the question of whether to buy the dip or, to quote another market cliché, risk trying to catch a falling knife.

One real estate investor said the rent indicators she’s seeing in real time are encouraging on the inflation front. That’s in contrast to the much-criticized rental barometers that the Fed relies on.

“If you take into account real-time shelter costs, it’s much lower than what’s in the prints,” Uma Moriarity, senior investment strategist at CenterSquare, told Yahoo Finance. “We think inflation is trending in the right direction.”

That’s why she’s still confident in three rate cuts this year — a view, of course, that the market has been moving away from. It’s also why she’s still confident in real estate. That, plus the fact that stocks are relatively cheap.

Read more: What the Fed rate decision means for loans and mortgages

The reasons that real estate stocks suffer when rates are on the rise are twofold. First off, the companies tend to carry a lot of debt, and as rates go higher, it becomes more difficult to service or refinance that debt. Secondly, with relatively high dividend yields, the stocks compete with instruments like money market funds for investing dollars.

It’s traditionally been tough for real estate stocks to rally in the face of rising rates. But if Moriarty — and Citigroup — are right, they might not be rising for as long as the broader market anticipates.

Julie Hyman is the co-anchor of Yahoo Finance Live, weekdays 9 a.m.-11 a.m. ET. Follow her on Twitter @juleshyman, and read her other stories.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance

Real eState

Celebrity real estate agent Mauricio Umansky explains when housing prices will come down – Fox Business

Real eState

Real Estate Stocks Fall As Mortgage Rates Rise To 4-Month Highs: 'Inflation Is Proving Tougher To Bring D – Benzinga

Real estate stocks slid at Wednesday’s market open, weighed down by the latest disappointing data on housing starts and a spike in mortgage rates, darkening the outlook for the sector.

By 9:00 a.m. EST, the Real Estate Select Sector SPDR Fund XLRE had dropped by 0.3%. This marked its fourth consecutive day of losses and set a course for its lowest close since the end of November 2023.

The fund has also slipped below its 200-day moving average, a critical long-term benchmark, signaling that investor sentiment has turned negative.

The average interest rate for 30-year fixed-rate mortgages with loan balances up to $766,550 climbed by 12 basis points to 7.13% for the week ending Apr. 12, 2024, according to the latest figures from the Mortgage Bankers Association. This rate is the highest recorded since early December.

On Wednesday, the yield on a 30-year Treasury bond, a key benchmark for long-term mortgage rates, traded at 4.75%, at the highest since mid-November 2023, as Fed Chair Powell admitted that there has been a lack of progress in the disinflation trend.

Chart: Real Estate Stocks Fall Below Key Long-Term Moving Average As Inflation Bites Again

Weaknesses In Multifamily Segment Continue

Joel Kan, MBA’s Vice President and Deputy Chief Economist, explained the rise in rates, stating, “Rates increased for the second consecutive week, driven by incoming data indicating that the economy remains strong and inflation is proving tougher to bring down.”

Despite the uptick in mortgage rates, there was a 3.3% week-over-week increase in the Market Composite Index, which measures mortgage loan application volume.

Kan further noted, “Application activity picked up, possibly as some borrowers decided to act in case rates continue to rise. Purchase applications were the primary driver of this increase, although they are still about 10% lower than last year’s levels. There was a slight uptick in refinance applications, mainly due to a 3% rise in conventional applications.”

Chart: US 30-Year Mortgage Rates Rose To The Highest Level Since Late November

The real estate market’s challenges are linked to affordability and a shrinking availability as the supply of new homes falls.

Andrew Foran, an economist at Toronto Dominion Securities, commented on the trend in home building, “Homebuilding activity moderated in March as weakness in the multifamily segment persisted and the single-family segment gave back most of its considerable gain from the prior month.”

Data revealed a 14.7% month-over-month decline in housing starts in March, with the figures dropping to 1.32 million annualized units, significantly below the anticipated 1.49 million.

Both the single-family and multifamily sectors experienced declines, with single-family starts down by 12.4% (or 145,000 units) and multifamily starts plummeting by 21.7% (or 83,000 units). This retreat in multifamily starts marked the lowest level since April 2020.

Additionally, residential permits decreased more than expected in March, falling by 4.3% month-over-month to 1.46 million annualized units. This included a 5.7% drop in single-family permits—the first decline in fifteen months—and a 1.2% reduction in multifamily permits.

Rising & Falling

The weakest performers among real estate stocks with a market cap of at least $1 billion on Wednesday were:

| Name | 1-day %chg |

|---|---|

| Prologis, Inc. PLD | -6.55% |

| First Industrial Realty Trust, Inc. FR | -3.33% |

| STAG Industrial, Inc. STAG | -2.89% |

| EastGroup Properties, Inc. EGP | -2.89% |

| Rexford Industrial Realty, Inc. REXR | -2.35% |

Those showing the highest gains were:

| Name | 1-day %chg |

|---|---|

| SL Green Realty Corp. SLG | 3.18% |

| Opendoor Technologies Inc. OPEN | 2.55% |

| Medical Properties Trust, Inc. MPW | 2.49% |

| eXp World Holdings, Inc. EXPI | 2.32% |

| Vornado Realty Trust VNO | 2.25% |

Now Read: Best REITs to Buy in April

Image: Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

-

Tech18 hours ago

Tech18 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Science24 hours ago

Science24 hours agoNasa confirms metal chunk that crashed into Florida home was space junk

-

News20 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Investment24 hours ago

Investment24 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth

-

Politics23 hours ago

Politics23 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Health14 hours ago

Health14 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Science23 hours ago

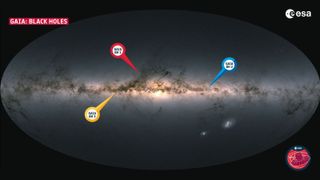

Science23 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Tech20 hours ago

Tech20 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca