Economy

Wealth, Housing and Retail Show How Canada's Economy Is Healing – Bloomberg

The Yaletown neighbourhood of Vancouver.

A year into the pandemic, Canada’s economy is showing clear signs it’s on a path to a full recovery.

The country added 259,200 jobs in February, more than three times what economists were expecting, Statistics Canada reported Friday. That follows other data this month indicating Canada’s economy is on pace to fully repair damage from the pandemic at least one year ahead of what most analysts were expecting only weeks ago.

And that’s despite lockdowns that closed large parts of the economy in December and January. In just two months, the policy debate has turned from whether to provide additional stimulus, to when to pull back on support.

Here are some highlights, 12 months after the first Covid-19 restrictions were imposed.

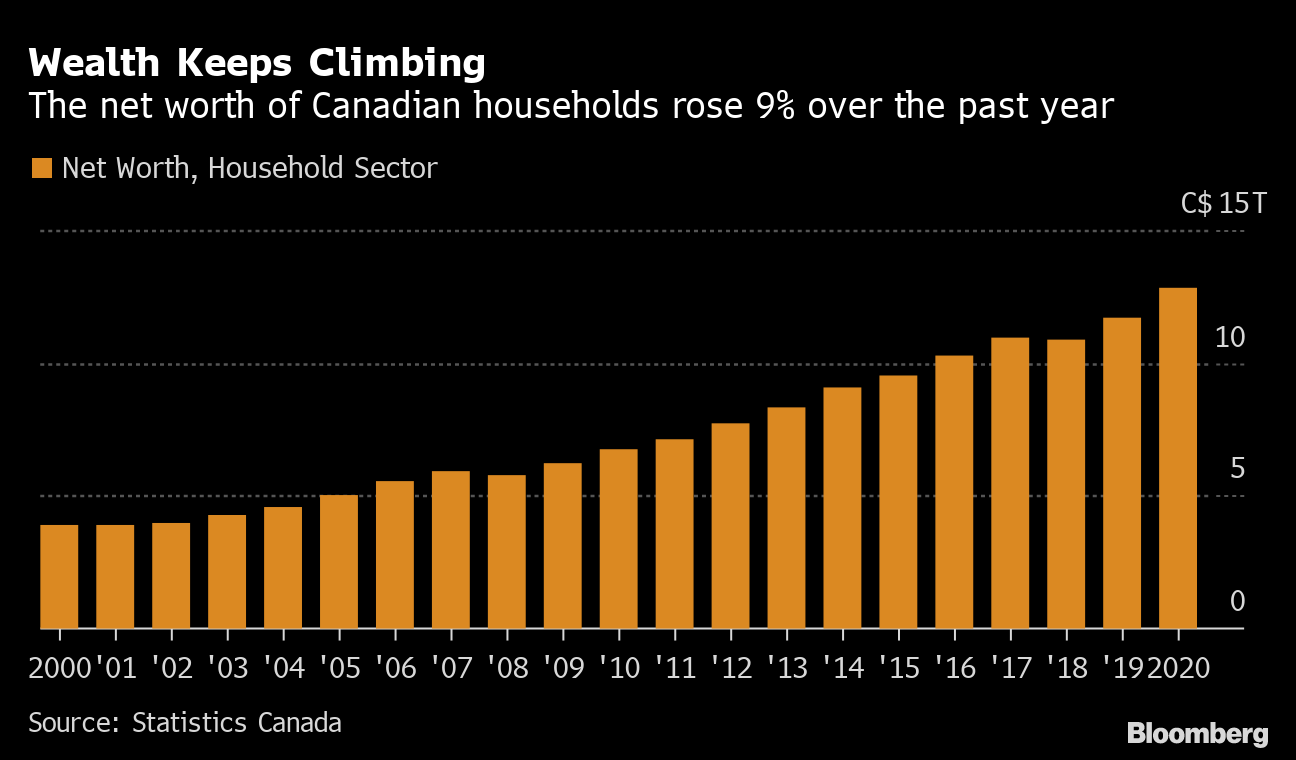

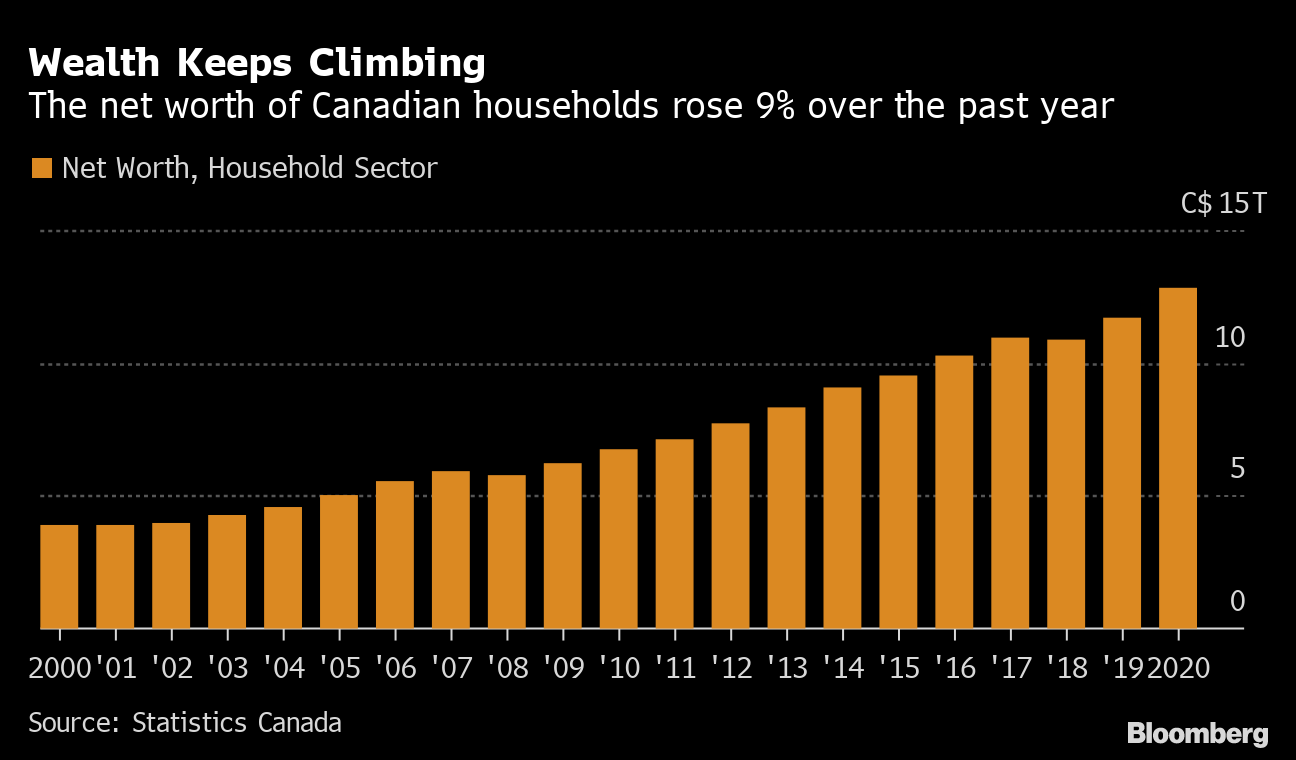

Wealth Keeps Climbing

The net worth of Canadian households rose 9% over the past year

Source: Statistics Canada

.chart-js display: none;

In the midst of a deep economic crisis, Canadians became a whole lot richer.

The nation’s households saw their net worth jump by more than C$1 trillion ($800 billion) last year, according to a separate report Friday from the statistics agency. That’s despite a downturn that saw 3 million people lose jobs and the unemployment rate jump to historic highs.

Generous government income support during the pandemic, along with fewer opportunities to spend, resulted in stronger household balance sheets. Low borrowing costs encouraged Canadians to buy properties. Others decided to put money into stocks or other assets.

On a per capita basis, household net worth reached a record C$332,000, up about C$24,000 since the end of 2019.

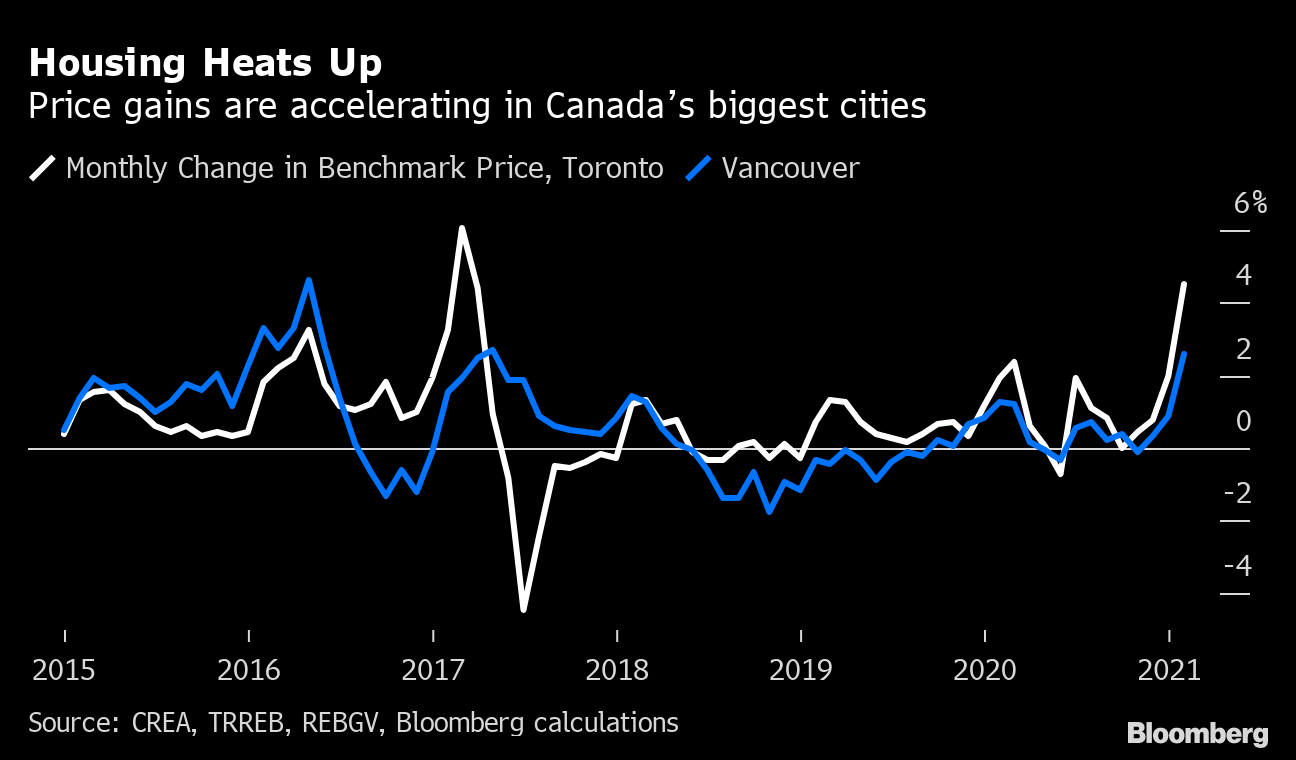

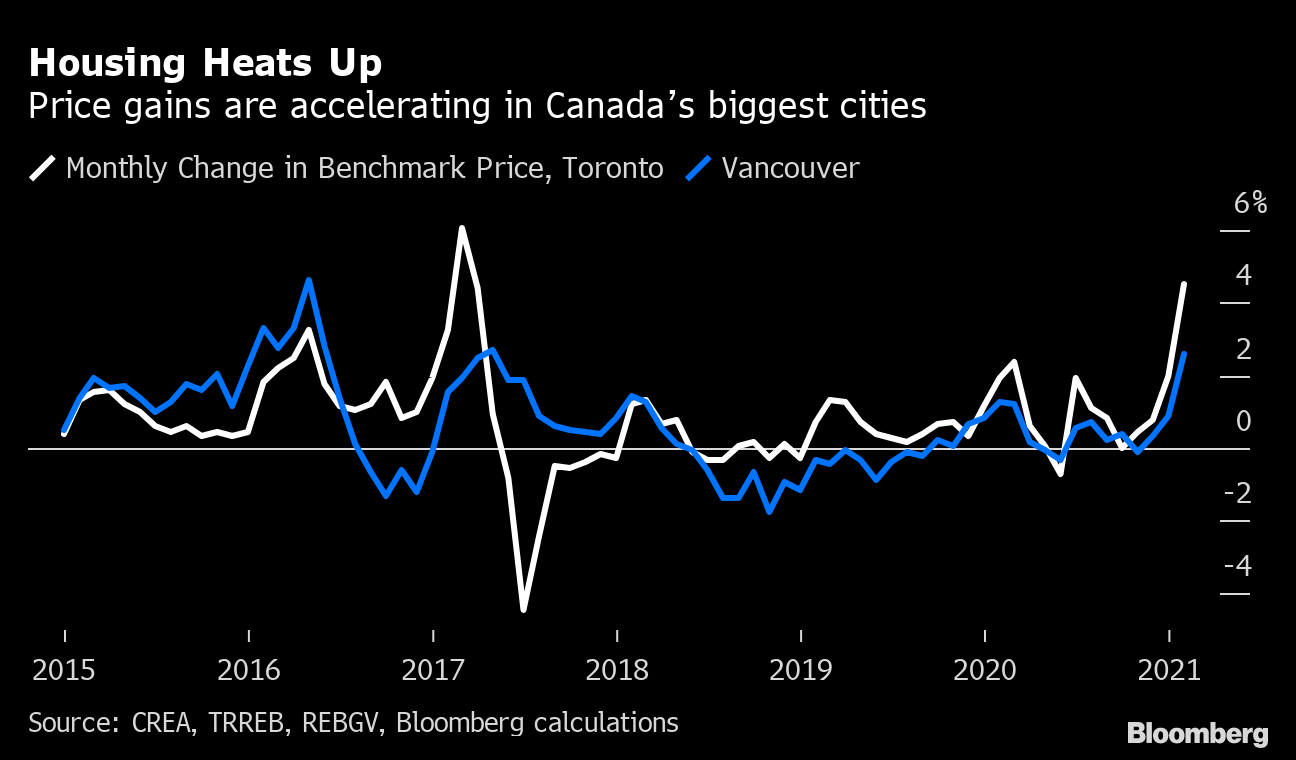

Housing Heats Up

Price gains are accelerating in Canada’s biggest cities

Source: CREA, TRREB, REBGV, Bloomberg calculations

.chart-js display: none;

The value of homes and land owned by households, which grew by C$642 billion last year, was the main contributor to that boost in wealth.

It was a strange year for real estate. Some saw the pandemic as the trigger for a major correction. Instead, the residential real estate market has been a bright spot in Canada’s recovery story, with sales and prices for single-family homes reaching records in many metro areas as consumers search for more space and take advantage of low borrowing costs.

To economist David Rosenberg, things have gone too far.

“This might be one of the biggest bubbles of all time,” the founder of Rosenberg Research & Associates in Toronto told BNN Bloomberg Television on Wednesday.

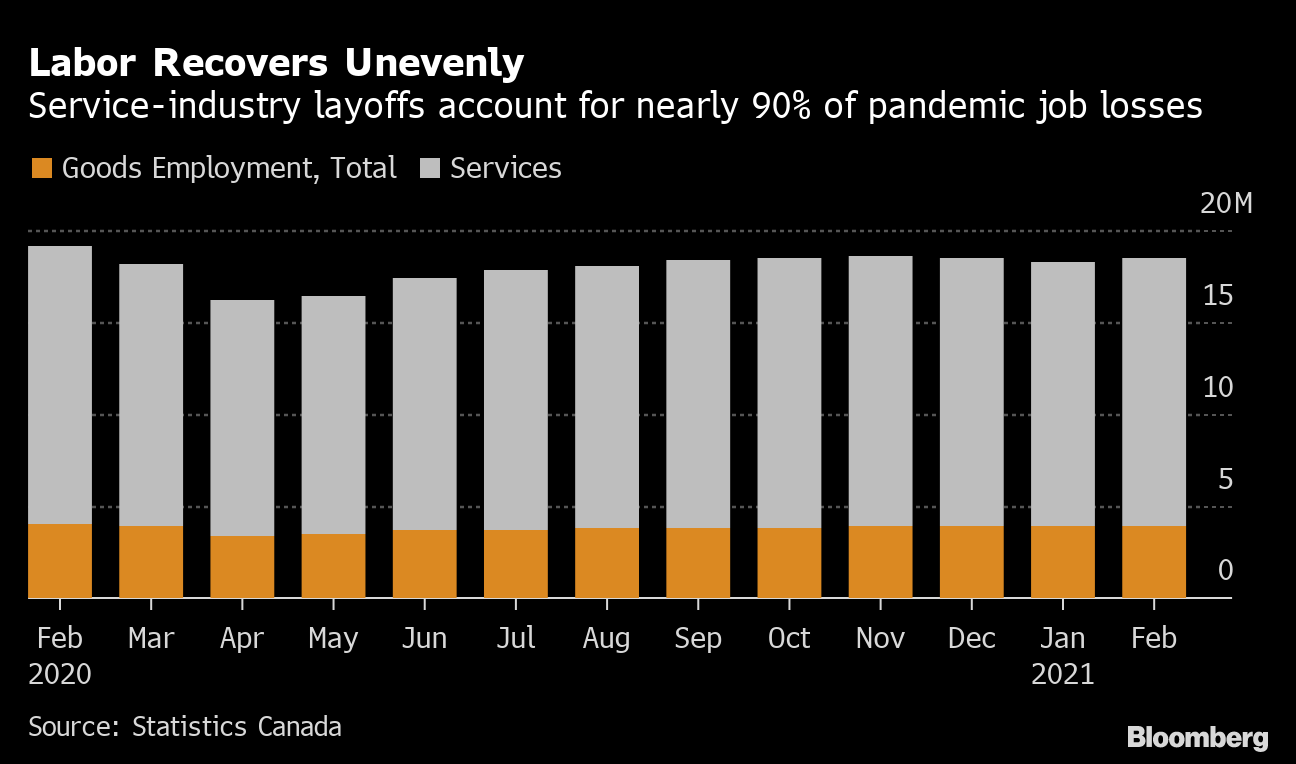

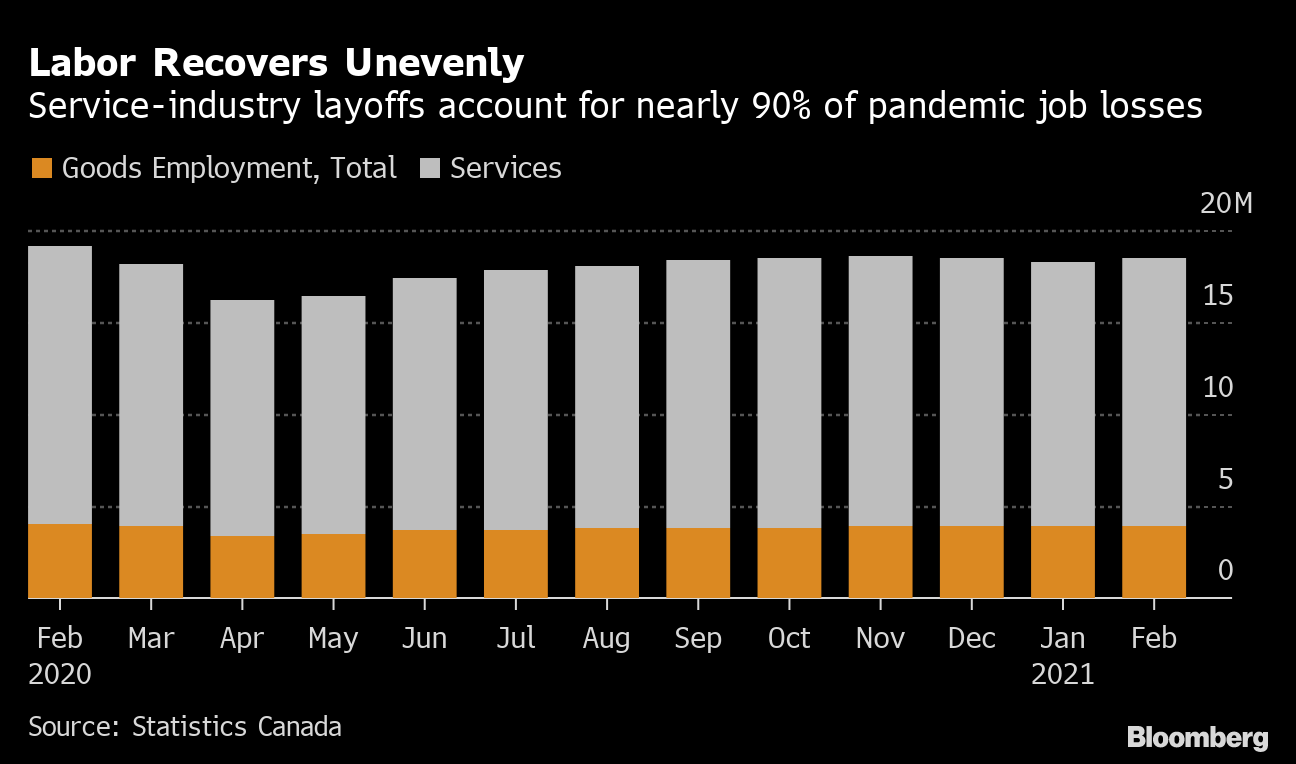

Labor Recovers Unevenly

Service-industry layoffs account for nearly 90% of pandemic job losses

Source: Statistics Canada

.chart-js display: none;

While almost 1 million Canadians are still gravely impacted from the pandemic — either through lost jobs or substantially fewer hours — the nation’s labor market has recovered most of its losses. At its worst point, 5 million Canadians had lost jobs or were working less than half their usual hours, one-quarter of the labor force.

The lingering damage is increasingly confined to a subgroup of largely high-contact sectors: accommodation and food, retail and recreation. These are largely lower-wage workers, disproportionately young and female.

It’s a double whammy for some of these groups. Lower-waged workers are more likely to be renters rather than homeowners. Not only are their chances of being unemployed higher, they also haven’t benefited from the rise in home prices.

Shopping Habits Shift

Covid-19 reshaped how Canadians spent their money in 2020

Source: Statistics Canada

.chart-js display: none;

Consumption did drop last year, but the data also show households — with confidence back at pre-pandemic levels — were spending money when they were allowed to shop. Consumption on services like haircuts fell by C$66 billion last year, while travel expenditures were down more than C$30 billion. But anything to do with housing was a blockbuster year, while spending on durable good items was down just C$4 billion in 2020.

Another case in point was retail. Most retailing sub-sectors returned to pre-pandemic levels of sales and some have more than offset losses early on in the crisis.

In aggregate, Canadian retailers recorded a 1.4% drop in sales to C$606 billion last year but that was because of a collapse in April and obscures a surge since then. In December, sales were up 4.5% from year earlier levels.

Yet the uneven nature of the rebound is evident here as well. Grocery stores and building material retailers posted double-digit annual growth. Clothiers, meanwhile, reported double-digit declines.

Economy

Stumbling Toward a Deal — as the Economy Surges – AGF Perspectives

Insights and Market Perspectives

CONGRESS IS STUMBLING TOWARD PASSAGE of legislation late this week that would provide enormous aid to Ukraine, Israel and Taiwan. It’s a VERY messy process — typically — that has obscured the major development for financial markets: red hot economic growth, far exceeding expectations.

WE’LL GET TO THE CONGRESSIONAL BRAWL in a second, but first — dramatic economic growth is having a major impact on interest rates, with the Atlanta Fed GDP Now predicting economic growth at 2.8%, after yesterday’s blowout retail sales report.

EVEN CHINA, considered a basket case a few months ago, is blasting off — with Beijing reporting 5.3% first quarter economic growth.

WITH THE U.S. TEN YEAR BOND YIELD now above 4.5%, this has to be a shock for the Federal Reserve, which may be frozen for months to come — unable to cut rates as long as the economy is growing above trend with inflation not falling to the Fed’s 2% goal.

THERE SURELY WON’T BE ANY FISCAL RESTRAINT, as Congress moves awkwardly toward passage of a nearly $100 billion spending package for allies.

THIS IS A VERY FLUID fluid environment — even a Tik-Tok ban is included — with House Speaker Mike Johnson preparing four separate bills in a dizzying process that may require support from Democrats — which could cost Johnson his job.

BOTTOM LINE: This is sausage-making at its ultimate, as Democrats prepare to bail out Johnson, as angry right wingers demand provisions to protect the border, and as aid seems increasingly likely — surely for Israel, probably for Ukraine. It’s only Tuesday, there’s a long way to go; details won’t come into focus for a few more days.

IN THE MEANTIME, THE ECONOMY CONTINUES TO ROAR — it’s too strong, in our opinion, to be sustainable.

THESE DRAMATIC STORIES MAY HAVE TO TAKE A BACK SEAT as the gleeful media is obsessed with the Donald Trump trial. The buzz after the first day was whether Trump dozed off yesterday during the jury selection process, Our advice to Trump — get some espresso, the last thing you want is opponents calling you “sleepy Don.”

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

The views expressed in this blog are provided as a general source of information based on information available as of the date of publication and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Speculation or stated believes about future events, such as market or economic conditions, company or security performance, or other projections represent the beliefs of the author and do not necessarily represent the view of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and AGF accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. Any financial projections are based on the opinions of the author and should not be considered as a forecast. The forward looking statements and opinions may be affected by changing economic circumstances and are subject to a number of uncertainties that may cause actual results to differ materially from those contemplated in the forward looking statements. The information contained in this commentary is designed to provide you with general information related to the political and economic environment in the United States. It is not intended to be comprehensive investment advice applicable to the circumstances of the individual.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is a registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

©2024 AGF Management Limited. All rights reserved.

Economy

China’s economy beats expectations, growing 5.3 percent in first quarter – Al Jazeera English

Statistics agency says economy has made ‘good start’ to the year under the leadership of Chinese President Xi Jinping.

China’s economy grew faster than expected in the first three months of the year, a boost for policymakers grappling with a property-sector crisis, weak consumer demand and mounting government debt.

Gross domestic product (GDP) grew by 5.3 percent in the first quarter, data released by the National Bureau of Statistics (NBS) showed on Tuesday, comfortably above forecasts and up from a 5.2 percent expansion in the previous quarter.

By sector, industrial production and agriculture grew by 6.1 percent and 3.8 percent, respectively, while services grew by 5 percent, according to NBS data.

The NBS said in a statement that the economy had made a “good start” under “the strong leadership” of the Central Committee of the Communist Party of China and President Xi Jinping.

“As a result, the policies continued to take effect, production and demands maintained stable and witnessed an increase, employment and prices were generally stable, market confidence continued to boost, and high-quality development made new progress,” the statistics agency said.

The stronger-than-expected figures came days after China reported that exports and imports declined 7.5 percent and 1.9 percent, respectively, in March, missing expectations.

The world’s second-largest economy has struggled to sustain a recovery from the COVID-19 pandemic amid a range of longstanding structural challenges, including a hugely indebted real estate sector and a shrinking population.

Fitch Ratings earlier this month downgraded China’s sovereign credit outlook to negative, citing “increasing risks to China’s public finance outlook” as Beijing attempts to move away from real estate-led growth.

Beijing last month set a 5 percent growth target for 2024, a rate that would beat most developed economies but be among the country’s slowest expansions since 1990.

Officials have unveiled a number of fiscal and monetary policy measures to boost the economy, including $1.8 trillion in spending on major construction and infrastructure projects.

Economy

China’s economy grew 5.3% in first quarter, beating expectations – CityNews Halifax

HONG KONG (AP) — China’s economy expanded at a faster than expected pace in the first three months of the year, helped by policies aimed at stimulating growth and stronger demand, the government said Tuesday.

The world’s second-largest economy expanded at a 5.3% annual pace in January-March, beating analysts’ forecasts of about 4.8%, official data show. Compared to the previous quarter, the economy grew 1.6%.

China’s economy has struggled to bounce back from the COVID-19 pandemic, with a slowdown in demand and a property crisis weighing on its growth.

The better-than-expected data Tuesday came days after China reported its exports sank 7.5% in March compared to the year before, while imports also weakened. Inflation cooled, reflecting deflationary pressures resulting from slack demand amid a crisis in the property sector.

Industrial output for the first quarter was up 6.1% compared to the same time last year, and retail sales grew at an annual pace of 4.7%. Fixed investment, in factories and equipment, grew 4.5% compared to the same period a year earlier.

The strong growth in January-March was supported by “broad manufacturing outperformance,” festivities-boosted household spending due to the Lunar New Year holidays and policies that helped boost investments, according to China economist Louise Loo of Oxford Economics.

“However, ‘standalone’ March activity indicators suggest weakness coming through post-Lunar New Year,” she said. “External demand conditions also remain unpredictable, as seen in March’s sharp export underperformance.”

Loo noted that an unwinding of excess inventory, normalization of household spending after the holidays and a cautious approach to government spending and other stimulus will affect growth in this quarter.

Policymakers have unveiled a raft of fiscal and monetary policy measures as Beijing seeks to boost the economy. China has set an ambitious gross domestic product (GDP) growth target of about 5% for 2024.

Such strong growth usually would push share prices across the region higher. But on Tuesday, Asian shares fell sharply after stocks retreated on Wall Street.

The Shanghai Composite index lost 1.4% and the Hang Seng in Hong Kong lost 1.9%. The benchmark for the smaller market in Shenzhen, in southern China, lost 2.8%.

Stronger growth in the region’s biggest economy normally would be seen as a positive for its neighbors, which increasingly rely on demand from China to power their own economies. However, strong growth figures are also viewed as a signal that the government will hold back on further stimulus.

Zen Soo, The Associated Press

-

Media20 hours ago

DJT Stock Plunges After Trump Media Files to Issue Shares

-

Business19 hours ago

FFAW, ASP Pleased With Resumption of Crab Fishery – VOCM

-

Media19 hours ago

Marjorie Taylor Greene won’t say what happened to her Trump Media stock

-

Business20 hours ago

Javier Blas 10 Things Oil Traders Need to Know About Iran's Attack on Israel – OilPrice.com

-

Politics20 hours ago

Politics20 hours agoIn cutting out politics, A24 movie 'Civil War' fails viewers – Los Angeles Times

-

Media18 hours ago

Trump Media stock slides again to bring it nearly 60% below its peak as euphoria fades – National Post

-

Art21 hours ago

It’s Time to Remove Father Rupnik’s Art – National Catholic Register

-

Investment21 hours ago

A Once-in-a-Generation Investment Opportunity: 1 Top Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April … – Yahoo Finance