Investment

Why Canada Continues to Attract Real Estate Investors

|

|

Real estate experts, foreign investors, and Canada’s citizens unanimously agree that Canada has everything it takes to create better living opportunities and, therefore, become one of the most sought-after destinations globally. Besides, real estate in Canada is competitively priced, vast, and has a reasonable appreciation rate. The hassle-free legal system in Canada is another reason why foreign investors flock to Canada. A comparative study of real estate in the UK, US, Spain, or France will help you realize that Canadian real estate is not very expensive. You will find cheaper land in Canada and a myriad of real estate options to invest in.

As the Canadian economy strengthens, more people are expected to migrate to this country, leading to a rise in demand for properties. According to real estate experts, this growing demand will boost the property values radically in years to come. In contrast to the high standard of living, Canada’s cost is lower than in many other countries. In Canada, foreign investors can buy cold properties that they probably couldn’t have afforded in their own countries. The most significant advantage is that you don’t have to be a resident of Canada to purchase property in the country. This puts foreign investors in an enviable position to invest in a higher quality purchase in Canada than their homelands. Owing to the abundant land available, overcrowding will never be an issue in this incredibly beautiful country. Besides, Canada has a diverse property portfolio that can please even the most fastidious buyer.

The best part of being a foreign investor is that you virtually get to enjoy almost all the privileges and benefits as any other citizen and yet, not go through the painful ordeal of applying for immigration acceptance. Thus, as a foreign investor, you can open a bank account in the country and have your land and car. Alternatively, you can make Canada your new home by permanently settling in this country like millions of Europeans who have already decided here. This explains why Canada is the third most popular emigration destination. The ever-increasing popularity of Canada will continue to attract more people in the future. This popularity of Canada among expatriates ensures a steady supply of money in the property market.

A quick look at the figures mentioned below will throw light on the Canadian property market’s past performance. Listed below are the rising prices of a single-family home in Vancouver:

- 1961 – CAD $13,500

- 1974 – CAD $48,000

- 1982 – CAD $120,000

- 2007 – CAD $475,000

Canada provides excellent rental opportunities for real estate investors. Thus, if you purchase apartments and townhouses in some of the hottest areas in Canada, you can enjoy a steady income and cash flow in the form of rent. This allows you to enjoy capital appreciation and build equity in the long run. No matter what the reason may be for your investment, Canada has an effortless buying procedure, and you can close a property deal in a short time.

Investment

Canada Pension Plan investment board to host public meeting in Calgary – CTV News Calgary

The Canada Pension Plan (CPP) investment board will be hosting a public meeting from 6 to 8 p.m. on April 16 at the BMO Centre.

Registration for the public is closed, but organizers say there is room for some walk-ins.

The board hosts public meetings across Canada every two years to update people on the fund’s performance, governance and investment approach.

The pension plan has been a hot topic in Alberta over the last year, after the provincial government released a commissioned report exploring the possibility of an Alberta Pension Plan (APP).

According to the report, if Alberta gave the required three-year notice to quit the CPP, it would be entitled to $334 billion, or about 53 per cent of the fund by 2027.

However, critics say that is an overestimation.

Premier Danielle Smith has said she will not call a referendum on the topic until the Office of the Chief Actuary releases an updated number.

More information on the public meetings can be found on the CPP Investments’ website.

Investment

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April – Yahoo Finance

The artificial intelligence (AI) space is red-hot right now. Companies across every industry are looking to capitalize on the technology, and are investing heavily to gain an edge over the competition. That’s true in the social media space, where advertisers are keen to get in front of the right audience for them.

While the social media landscape is jam-packed with competition, one company is separating itself from the pack. Meta Platforms (NASDAQ: META) is making strides across various aspects of the AI realm, and its performance over the competition shows.

Let’s dig in to why now is a lucrative opportunity to invest in Meta as the long-term AI narrative plays out.

The profit machine is up and running

One of the most appealing aspects of Meta is how efficiently management runs the business. In 2023, Meta grew revenue 16% year over year to $135 billion. However, the company increased income from operations by a whopping 62% year over year to $46.7 billion.

By expanding its operating margin, Meta recognized significant growth on the bottom line as well. Last year, the company generated $43 billion in free cash flow. With such a robust financial profile, Meta is well-positioned to invest profits back into the business as well as reward shareholders.

Investing for the future

During Meta’s fourth-quarter earnings call in February, investors learned how the company is deploying its cash heap. For starters, it has increased its share repurchase program by $50 billion. This is encouraging to see as it could imply that management views Meta stock as a good value.

But perhaps more exciting was the announcement of a quarterly dividend. Many high-growth tech companies are not in a financial position to pay a dividend — or instead choose to reinvest profits into research and development or marketing strategies. Meta’s new dividend certainly sets the company apart from many of its peers, and is a nice sweetener for long-term shareholders.

Another way Meta is using its cash flow is in the realm of artificial intelligence. Like many enterprises, Meta relies heavily on sophisticated graphics processing units (GPUs) from Nvidia. However, Meta has been hinting for a while that the company is investing in its own hardware. Earlier this month, Meta announced that an updated version of its training and inference chips, called MTIA, is now available.

This is important for a couple of reasons. Namely, in-house chips will allow Meta to “control the whole stack” and scale back its reliance on semiconductors from third parties. Additionally, given the company’s knowledge base of data that it collects from social media platforms Facebook, Instagram, and WhatsApp, these new chips put Meta in a position to improve its targeted recommendation models and ad campaigns through the power of generative AI.

A compelling valuation

Meta competes with a number of players in the social media landscape. Alphabet is one of the company’s top competitors given that it operates the world’s top-two most visited websites: YouTube and Google. However, in 2023 Alphabet only grew its core advertising business by 6% year over year. By contrast, Meta’s advertising segment increased 16%.

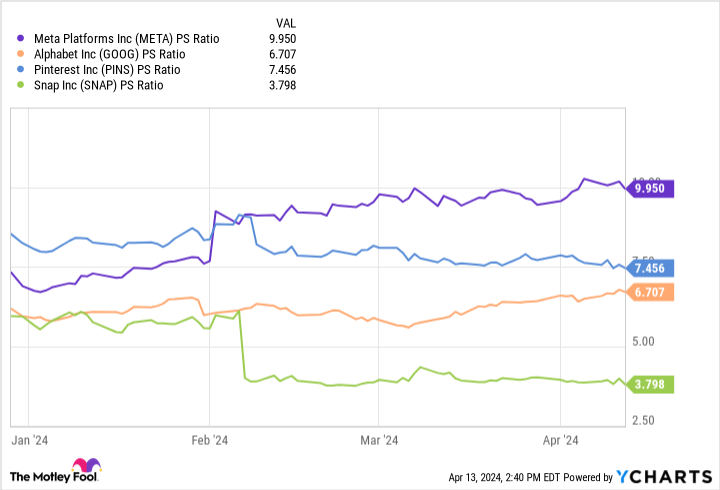

While Meta’s price-to-sales (P/S) ratio of 10 is higher than many of its social media peers, the company’s growth in the highly competitive and cyclical advertising landscape may warrant the premium.

Additionally, considering Meta’s price-to-free-cash-flow ratio of about 31 is actually trading relatively in line with its 10-year average of 32, the stock might not be as expensive as it appears.

Overall, I am optimistic about Meta’s aggressive ambitions in artificial intelligence — an investment that is yet to play out. The AI narrative is going to be a long-term story. But I see Meta as extremely well-equipped to take advantage of secular themes fueling AI, and benefiting across its entire business.

The combination of a dividend, share buybacks, consistent cash flow, and a compelling AI play make Meta stick out in a highly contested AI landscape. I think now is a great opportunity to scoop up shares in Meta and prepare to hold for the long term.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, and Pinterest. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April was originally published by The Motley Fool

Investment

Goldman Sachs Backs AI in Hospitals With $47.5 Million Kontakt.io Investment – BNN Bloomberg

(Bloomberg) — The growth equity unit of Goldman Sachs Group Inc. has invested $47.5 million in Kontakt.io, a startup that helps hospital managers make decisions about patients, beds and equipment.

It’s the 39th investment in health care from the bank’s growth equity division and the deal is “a good example of what is coming down the pipe” for its portfolio, according to Christian Resch, the UK-based the Goldman partner who led the financing and will sit on Kontakt.io’s board.

Kontakt.io, formed in Poland in 2014, makes small bluetooth-connected devices that stick on hospital equipment and software for managing the data collected by the sensors. The idea is to track practically everything inside a hospital — from patient beds to ultrasound machines — to help managers make decisions about capacity and replacement. The startup wants to build out an AI system that can offer suggestions to managers. It bills for the entire tracking system, rather than solo sensors.

Philipp von Gilsa, Kontakt.io’s chief executive officer, said his business helps health-care operators curb inefficiencies and manage pressures like crippling nursing shortages. “Hospitals are extremely, extremely wasteful in how they treat their resources,” he said. “We help them address that and, at the end of the day, save money.”

Health-care and life sciences IT spend is expected to continue rising, growing 8.3% in 2023 to $245.8 billion, according to Gartner estimates. But that money hasn’t always found its way to startups, which have struggled to compete with entrenched medical suppliers and navigate byzantine health-care networks. While many startups offer tools for managing health records or apps for patient use, Kontakt.io is focused on operations. The company pointed to a 2019 study that found roughly a quarter of US health spending was wasted due to issues like fraud and administrative hassles.

Kontakt.io has largely grown without major outside capital. It first marketed to a range of sectors interested in tracking indoor data, but has since homed in on health care, which now provides 80% of its sales, according to von Gilsa.

The startup has “roughly 500” enterprise customers, he said, including HCA Healthcare Inc. and the UK’s National Health Service. Von Gilsa declined to share revenue but said 2022 sales exceeded the $7.5 million his company raised before Goldman’s funding, and revenues tripled in the last twelve months. Kontakt.io, he said, has been profitable for the last four years.

With the financing, which came solely from Goldman, von Gilsa plans to hire more engineers to build an automated system for hospital staff using artificial intelligence. Machines will offer recommendations for daily decisions like how to stock certain machines or when to move patients into surgery.

Some 4 million devices in circulation give the startup an edge in building this AI, according to von Gilsa, who said the large quantities of data gathered by Kontakt.io sensors can help train its models.

Larger rivals, like GE HealthCare Technologies Inc., have also touted recent AI features designed to streamline hospital operations. Goldman’s Resch said Kontakt.io’s integration of sensors and software gave the bank confidence in its prospects.

©2024 Bloomberg L.P.

-

Business24 hours ago

FFAW, ASP Pleased With Resumption of Crab Fishery – VOCM

-

Media24 hours ago

Marjorie Taylor Greene won’t say what happened to her Trump Media stock

-

Media15 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Media23 hours ago

Trump Media stock slides again to bring it nearly 60% below its peak as euphoria fades – National Post

-

Business23 hours ago

Tesla May Be Headed For Massive Layoffs As Woes Mount: Reports – InsideEVs

-

Tech19 hours ago

Tech19 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Sports18 hours ago

Sports18 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Sports23 hours ago

Sports23 hours agoPoints and payouts: Scottie Scheffler cements FedExCup top spot with Masters win, earns $3.6M – PGA TOUR – PGA TOUR