OPEC+ hopes to reduce global storage volumes with their production cuts, and hopes to extend them through at least, the summer. OPEC’s regular meeting in Vienna is coming up and of course the Russians will be invited as they hold the key to realizing the 9.7 mm BOPD cut now in effect through June. Their hope is to extend these cuts beyond the June-30th expiration through September, 1st. These cuts, as painful as they are to the economies of the OPEC member states, and that of Russia as well, are necessary in order for the cuts to deliver their number planned goal-reduction of U.S. storage.

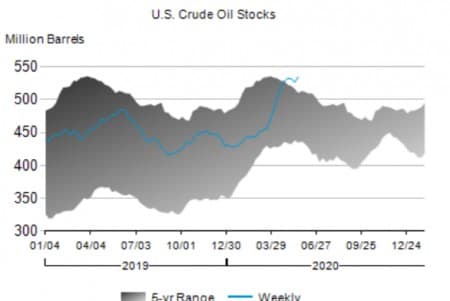

As you can see in this graphic from the Energy Information Agency, (EIA) crude storage, thanks to recent unrestrained U.S. production, and the Covid-19 demand destruction, is well above the 5-range. This insulates the oil market from the higher prices the Saudis and the Russians would like and need to have. We think that the market is on track to absorb these excess barrels and deliver inventory levels well toward the lower bound of the five-year range, and will discuss in this article how this will happen.

OPEC+ meeting this week

Once again there some minor fractures in the uneasy alliance between Saudi and the Russians. The Russians in particular distress about the cuts they’ve agreed to take, as they operate a number of semi-public companies, notably among them-Rosneft, (ROSN.MM) that have contractual delivery requirements. Symbolic perhaps of that distress Rosneft’s CEO, Igor Sechin was quoted in a recent Reuter’s article with conflicting commentary between its desire to fulfill contracts, and abide by the OPEC+ agreement.

“Rosneft has told the energy ministry it would be difficult to maintain cuts to the end of the year, as it has had to cut shipments to major buyers, such as Glencore (GLEN.L) and Trafigura, despite good demand, two sources close to the talks said on condition of anonymity.”

“There is no doubt Rosneft will strictly fulfill all obligations under supply contracts with its foreign and Russian counterparties despite output cuts made by the company as a part of OPEC+ deal,” Rosneft CEO Igor Sechin said in a statement on Friday.”

Related: Three Reasons Oil Prices Are Bouncing Back

The Saudis on the other hand, are desperate for these cuts to finally drive prices higher. The Kingdom of Saudi Arabia, also known as ‘KSA’, had been on a spending spree in the years leading up to the 2014 decision to crash prices, and drive higher cost producers-notably U.S shale out of business. This was a calculated ‘Hail-Mary’ sort of action that misfired badly in 2017 as shale producers figured out how to keep drilling with $50 dollar oil.

Commissioned in 2016, and known as the Vision 2030 plan, KSA began a capital intensive program to remake their economy by the year 2030. The timing could have been better for this initiative. Now, with over half a decade of reduced prices and slashed market share, they are burning through their cash reserves. KSA needs things to turn around, and quickly.

I am not predicting the complete breakdown we saw early this year, between the two. There’s too much at stake for both countries to resort to that extreme once again. My expectation is that KSA will get most of what they want later this week. That is bullish for oil prices and should continue the steady recovery seen throughout March.

Current compliance is less than stellar

A troubling component of the cuts for OPEC is the spotty compliance by some members. A recent Reuter’s article documented compliance of about 74% of stated production goals for OPEC. Interestingly the key laggards were countries that flirt with anarchy, but somehow manage to deliver oil totals in excess of agreed limit. Among them, Iraq, Venezuela, Nigeria, Libya, and Iran.

The good news is their production is so stressed by domestic strife, international sanctions, and general lawlessness that these overages just don’t matter a great deal in the grand scheme of things “oil”. Particularly when stacked against the resolve of KSA, and Russia to restrict production in the hope of higher prices.

What will deliver the reduced storage sought by OPEC+?

In a recent previous OilPrice article, I discussed in depth what it would take for oil prices to continue moving higher. In it, I forecast that there could be a discrepancy of as much as 6-8 mm BOPD between global demand and supply. The actual decline driven by reduced drilling and completions, doesn’t have to be this high though to be supportive of a steadily increasing price for oil.

As OPEC+ grapples with compliance and a questionable commitment to production restraints on the part of Russia to reduce inventories in America, the actual amount of production restraint needed to meet this goal is only about 3-mm BOPD. With 210 left in the year, a disparity of 3-mm BOPD will work off most of the current excess in supply by year’s end with some left over for good measure.

Related: World’s Top Solar Panel Producer Opens New Mega Factory

This is a figure we are easily on track to meet, as a result of OPEC’s efforts, and the falling production from U.S. shale. Shale producers actually have some solidarity with KSA and Russia, as they need substantially higher prices as well to stay in business. The decline rate for shale, 60-70 percent of initial production, requires new drilling of at least 500 active rigs to deliver incremental production above the decline rate. We are currently at about 60% of that number.

Your takeaway

Last week we saw significant builds in oil supplies as reported by the EIA. The ability of oil to stay in the green in the face of that bearish news bodes well for continued price improvement.

From severe contango in late-April the price of the NYMEX futures contract has moved steadily higher toward backwardation – an expectation of higher prices in the out months, than being received today. Also declining is the spread between the NYMEX contract-WTI and Brent. Last month it was well over $5.50. As of the end of May, it had flattened to $3.87, nearly two dollars in a month.

This supports the thesis that as drilling remains below the decline rate for shake, and if OPEC+ extends its production cuts to the fall, oil prices should rise significantly higher.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com: