Economy

BOE Rate Hike Looks More Likely With UK Economy Showing Resilience

|

|

(Bloomberg) — Britain’s economy is showing signs of unexpected resilience in a batch of data published Thursday, firming up the case for another interest-rate increase.

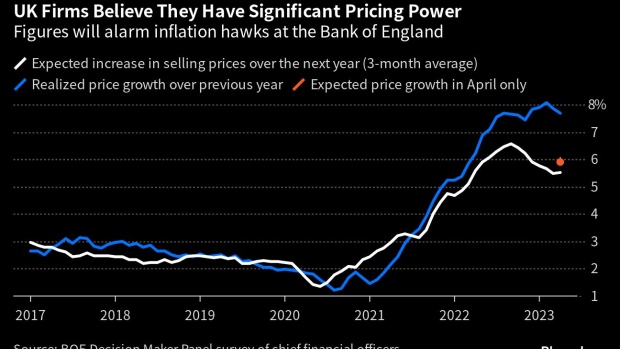

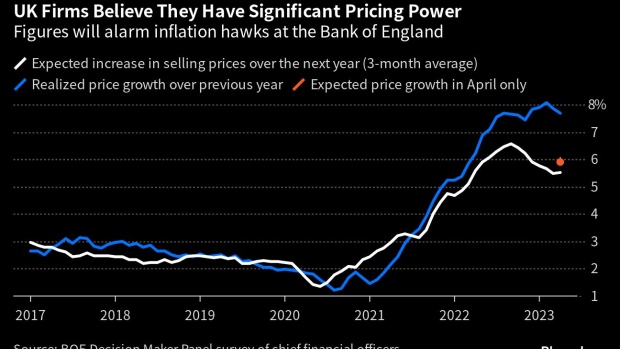

Robust figures showing mortgage approvals bouncing back to a five-month high, stronger consumer borrowing and an upward revision to a closely-watched survey of purchasing managers all suggested an economy that’s likely to eek out more growth than expected. Separate figures on inflation expectations also indicated firms expect an even sharper rise in their own prices over the next year.

Together, the readings are likely to lock in bets on a quarter-point rate-hike from the Bank of England on May 11 and fuel speculation of further increases in the months ahead. That marks a sharp contrast with the US, where the Federal Reserve indicated Wednesday that it may pause a rapid series of rate increases.

In Britain, it’s the housing market that’s surprising on the upside. Economists had been expecting property prices to fall as much as 10% this year after a jump in mortgage rates. Instead, the BOE showed the number of approvals for new loans strengthened to a five-month high of 52,000 in March from 44,100 the previous month.

“The UK housing market continues its convincing rebound following the chaos of the mini-Budget,” said Tom Bill, head of UK residential research at Knight Frank. “Price declines appear to be bottoming out and transactions clearly hit their low-point in January. Buyers have accepted the new normal for mortgage rates as stability returns to the lending market.”

That forward-looking measure chimes with reports in the past few weeks from lenders Nationwide Building Society and Halifax showing prices are rising. While net lending for property purchases stalled in March after rising £700 million ($880 million) the month before, the approvals figure gives an indication of how activity may unfold in the months ahead.

The housing market is steady despite the average interest rate on newly drawn mortgages picking up to 4.41% in March, up from 4.24%, according to BOE data published Thursday.

What Bloomberg Economics Says …

“Mortgage approvals increased in March as some households took advantage of mortgage rates edging down from recent highs. While the collapse in the demand for homes may be bottoming out, approvals remain at levels that point to subdued activity and imply the correction in the UK housing market is not over yet.”

—Niraj Shah, Bloomberg Economics. Click for the REACT.

Imogen Pattison, economist at Capital Economics, cautioned that mortgage approvals are unlikely to rise further from their “still weak level.”

“We don’t think that mortgage rates can fall any further until the Bank of England cuts interest rates, which isn’t yet on the horizon,” she said.

Money markets are almost fully pricing in a quarter-point increase in the BOE’s benchmark lending rate to 4.5% on May 11 and a peak of 5% by September.

Other indicators released Thursday included:

- Consumer borrowing also grew strongly in the latest month, rising £1.6 billion in March, more than economists had expected. Those figures cover car loans, credit cards and personal lines of credit.

- The final estimate of the composite purchasing managers’ index pointed to the UK private sector growing at its fastest pace in a year. It rose further into growth territory to a reading of 54.9 in April, up sharply from the first estimate of 53.9.

- The BOE’s monthly decision maker panel showed that chief financial officers downgraded their year-ahead inflation expectations despite predicting a sharper increase in their own output prices. Year-ahead output price inflation was expected to be 5.9% in April, up from 5.3% the previous month.

- Money supply figures continued to indicate weakness in the economy. The BOE’s M4 measure fell sharply in the month of March, reducing growth from a year ago to 0.4% from 1.1% the previous month.

Read more:

- Powell Opens Door to June Pause, Stresses Inflation Job Not Done

- UK House Prices Rise for First Time in Eight Months

- UK Economists See One More Rate Hike From Bank of England

- Thatcher Adviser Says BOE Is ‘Hopelessly’ Wrong on Inflation

–With assistance from Andrew Atkinson.

Economy

U.S. economic growth slowed more than expected in first quarter

|

|

The U.S. economy grew at its slowest pace in nearly two years as a jump in imports to meet still-strong consumer spending widened the trade deficit, but an acceleration in inflation reinforced expectations that the Federal Reserve would not cut interest rates before September.

The slowdown in growth reported by the Commerce Department in a snapshot of first-quarter gross domestic product on Thursday also reflected a slower pace of inventory accumulation by businesses and downshift in government spending. Domestic demand remained strong last quarter.

“This report comes in with mixed messages,” said Olu Sonola, head of economic research at Fitch. “If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach.”

Gross domestic product increased at a 1.6 per cent annualized rate last quarter, the Commerce Department’s Bureau of Economic Analysis said. Growth was largely supported by consumer spending. Economists polled by Reuters had forecast GDP rising at a 2.4 per cent rate, with estimates ranging from a 1.0 per cent pace to a 3.1 per cent rate.

The economy grew at a 3.4 per cent rate in the fourth quarter. The first quarter growth’s pace was below what U.S. central bank officials regard as the non-inflationary growth rate of 1.8 per cent.

Inflation surged, with the personal consumption expenditures (PCE) price index excluding food and energy increasing at a 3.7 per cent rate after rising at 2.0 per cent pace in the fourth quarter.

The so-called core PCE price index is one of the inflation measures tracked by the Fed for its 2 per cent target. The central bank has kept its policy rate in the 5.25 per cent-5.50 per cent range since July. It has raised the benchmark overnight interest rate by 525 basis points since March of 2022.

Consumer spending grew at a still-solid 2.5 per cent rate, slowing from the 3.3 per cent growth pace rate notched in the fourth quarter.

Economists worry that lower-income households have depleted their pandemic savings and are largely relying on debt to fund purchases. Recent data and comments from bank executives indicated that lower-income borrowers were increasingly struggling to keep up with their loan payments.

Business inventories increased at a $35.4-billion rate after rising at a $54.9-billion pace in the fourth quarter. Inventories subtracted 0.35 percentage point from GDP growth.

The trade deficit chopped off 0.86 percentage point from GDP growth. Excluding inventories, government spending and trade, the economy grew at a 3.1 per cent rate after expanding at a 3.3 per cent rate in the fourth quarter.

Economy

U.S. growth slowed sharply last quarter to 1.6% pace, reflecting an economy pressured by high rates – BNN Bloomberg

WASHINGTON — The U.S. economy slowed sharply last quarter to a 1.6 per cent annual pace in the face of high interest rates, but consumers — the main driver of economic growth — kept spending at a solid pace.

Thursday’s report from the Commerce Department said the gross domestic product — the economy’s total output of goods and services — decelerated in the January-March quarter from its brisk 3.4 per cent growth rate in the final three months of 2023.

A surge in imports, which are subtracted from GDP, reduced first-quarter growth by nearly 1 percentage point. Growth was also held back by businesses reducing their inventories. Both those categories tend to fluctuate sharply from quarter to quarter.

By contrast, the core components of the economy still appear sturdy. Along with households, businesses helped drive the economy last quarter with a strong pace of investment.

The import and inventory numbers can be volatile, so “there is still a lot of positive underlying momentum,” said Paul Ashworth, chief North America economist at Capital Economics.

The economy, though, is still creating price pressures, a continuing source of concern for the Federal Reserve. A measure of inflation in Friday’s report accelerated to a 3.4 per cent annual rate from January through March, up from 1.8 per cent in the last three months of 2023 and the biggest increase in a year. Excluding volatile food and energy prices, so-called core inflation rose at a 3.7 per cent rate, up from 2 per cent in fourth-quarter 2023.

From January through March, consumer spending rose at a 2.5 per cent annual rate, a solid pace though down from a rate of more than 3 per cent in each of the previous two quarters. Americans’ spending on services — everything from movie tickets and restaurant meals to airline fares and doctors’ visits — rose 4 per cent, the fastest such pace since mid-2021.

But they cut back spending on goods such as appliances and furniture. Spending on that category fell 0.1 per cent, the first such drop since the summer of 2022.

The state of the U.S. economy has seized Americans’ attention as the election season has intensified. Although inflation has slowed sharply from a peak of 9.1 per cent in 2022, prices remain well above their pre-pandemic levels.

Republican critics of President Joe Biden have sought to pin responsibility for high prices on Biden and use it as a cudgel to derail his re-election bid. And polls show that despite the healthy job market, a near-record-high stock market and the sharp pullback in inflation, many Americans blame Biden for high prices.

Last quarter’s GDP snapped a streak of six straight quarters of at least 2 per cent annual growth. The 1.6 per cent rate of expansion was also the slowest since the economy actually shrank in the first and second quarters of 2022.

The economy’s gradual slowdown reflects, in large part, the much higher borrowing rates for home and auto loans, credit cards and many business loans that have resulted from the 11 interest rate hikes the Fed imposed in its drive to tame inflation.

Even so, the United States has continued to outpace the rest of the world’s advanced economies. The International Monetary Fund has projected that the world’s largest economy will grow 2.7 per cent for all of 2024, up from 2.5 per cent last year and more than double the growth the IMF expects this year for Germany, France, Italy, Japan, the United Kingdom and Canada.

Businesses have been pouring money into factories, warehouses and other buildings, encouraged by federal incentives to manufacture computer chips and green technology in the United States. On the other hand, their spending on equipment has been weak. And as imports outpace exports, international trade is also thought to have been a drag on the economy’s first-quarter growth.

Kristalina Georgieva, the IMF’s managing director, cautioned last week that the “flipside″ of strong U.S. economic growth was that it was ”taking longer than expected” for inflation to reach the Fed’s 2 per cent target, although price pressures have sharply slowed from their mid-2022 peak.

Inflation flared up in the spring of 2021 as the economy rebounded with unexpected speed from the COVID-19 recession, causing severe supply shortages. Russia’s invasion of Ukraine in February 2022 made things significantly worse by inflating prices for the energy and grains the world depends on.

The Fed responded by aggressively raising its benchmark rate between March 2022 and July 2023. Despite widespread predictions of a recession, the economy has proved unexpectedly durable. Hiring so far this year is even stronger than it was in 2023. And unemployment has remained below 4 per cent for 26 straight months, the longest such streak since the 1960s.

Inflation, the main source of Americans’ discontent about the economy, has slowed from 9.1 per cent in June 2022 to 3.5 per cent. But progress has stalled lately.

Though the Fed’s policymakers signaled last month that they expect to cut rates three times this year, they have lately signaled that they’re in no hurry to reduce rates in the face of continued inflationary pressure. Now, a majority of Wall Street traders don’t expect them to start until the Fed’s September meeting, according to the CME FedWatch tool.

Economy

Germans Debate Longer Hours and Later Retirement as Economic Growth Falters – Bloomberg

German politicians and business leaders, despairing a weak economy, are lately broaching a once taboo topic: claiming their compatriots don’t work enough. They may have a point.

German Finance Minister Christian Lindner fired the latest salvo in this fractious debate last week when he said that “in Italy, France and elsewhere they work a lot more than we do.” Economy Minister Robert Habeck, a Green Party representative, grumbled in March about workers striking, something a country beset by labor shortages “cannot afford.” (Later that month train drivers secured a 35-hour workweek instead of 38, for the same pay.) Signaling his opposition to a four-day work week, Deutsche Bank AG Chief Executive Officer Christian Sewing in January urged Germans “to work more and work harder.”

-

Real eState20 hours ago

Montreal tenant forced to pay his landlord’s taxes offers advice to other renters

-

Media19 hours ago

B.C. online harms bill on hold after deal with social media firms

-

Investment20 hours ago

Investment20 hours agoMOF: Govt to establish high-level facilitation platform to oversee potential, approved strategic investments

-

Politics20 hours ago

Politics20 hours agoPolitics Briefing: Younger demographics not swayed by federal budget benefits targeted at them, poll indicates

-

News19 hours ago

Just bought a used car? There’s a chance it’s stolen, as thieves exploit weakness in vehicle registrations

-

Science19 hours ago

Science19 hours agoGiant prehistoric salmon had tusk-like spikes used for defence, building nests: study

-

Tech19 hours ago

Tech19 hours agoCalgary woman who neglected elderly father spared jail term

-

Real eState18 hours ago

Luxury Real Estate Prices Hit a Record High in the First Quarter