Economy

Canada economy shrinks for first time in eight months, hit by U.S. auto strike – Financial Post

OTTAWA — Canada’s economy unexpectedly shrank by 0.1% in October, the first monthly decline since February, partly because of a U.S. auto strike that hit manufacturing, Statistics Canada data indicated on Monday.

Analysts in a Reuters poll had forecast a gain of 0.1% following a 0.1% advance in September. Goods-producing industries posted a 0.5% loss while service sectors were essentially unchanged.

October’s growth figures were the latest in a string of disappointing data that analysts say could put pressure on the Bank of Canada to mull a rate cut.

“Today’s report may be seem easy to dismiss on its face given the strike-related disruption was well known in advance, but moving past that impact reveals some concerning weaknesses,” said Brian DePratto, a director at TD Economics.

“Don’t write off monetary easing in 2020 just yet.”

The central bank has held its key rate unchanged since October 2018 even as several of its counterparts, including the U.S. Federal Reserve, have eased. In October it forecast fourth quarter annualized Canadian growth would be 1.3% but analysts now say that is likely to be too optimistic.

“Because some of the softness is likely temporary, we look for growth to snap back above 2% in the first quarter of 2020,” said Robert Kavcic, senior economist at BMO Capital Markets.

The manufacturing sector contracted by 1.4%, the fourth decline in five months. Durable manufacturing dropped by 2.3% as a strike by the United Auto Workers prompted some Canadian plants and parts producers to scale back production.

The Bank of Canada’s next fixed rate announcement date is Jan 22 and market expectations, as reflected in the overnight index swaps markets, show operators expect it to stay put.

Statscan said retail trade in October fell by 1.1%, the largest decline since March 2016, on broad-based weakness. Transportation and warehousing rose by 0.6% on strength in the aviation sector, both in passengers and cargo.

“Although the Canadian economy is going through a soft patch in the fourth quarter, some of it is due to temporary disruptions that should be reversed early next year,” said Paul Ashworth, chief North American economist at Capital Economics.

(Reporting by David Ljunggren; Editing by Andrew Heavens and Alistair Bell)

Economy

Russia to grow faster than all advanced economies says IMF – BBC.com

An influential global body has forecast Russia’s economy will grow faster than all of the world’s advanced economies, including the US, this year.

The International Monetary Fund (IMF) expects Russia to grow 3.2% this year, significantly more than the UK, France and Germany.

Oil exports have “held steady” and government spending has “remained high” contributing to growth, the IMF said.

Overall, it said the world economy had been “remarkably resilient”

“Despite many gloomy predictions, the world avoided a recession, the banking system proved largely resilient, and major emerging market economies did not suffer sudden stops,” the IMF said.

The IMF is an international organisation with 190 member countries. They are used by businesses to help plan where to invest, and by central banks, such as the Bank of England to guide its decisions on interest rates.

The group says that the forecasts it makes for growth the following year in most advanced economies, more often than not, have been within about 1.5 percentage points of what actually happens.

Despite the Kremlin being sanctioned over its invasion of Ukraine, the IMF upgraded its January predictions for the Russian economy this year, and said while growth would be lower in 2025, it would be still be higher than previously expected at 1.8%.

Investments from corporate and state owned enterprises and “robustness in private consumption” within Russia had promoted growth alongside strong exports of oil, according to Petya Koeva Brooks, deputy director at the IMF.

Russia is one of the world’s biggest oil exporters and in February, the BBC revealed millions of barrels of fuel made from Russian oil were still being imported to the UK despite sanctions.

Away from Russia, the IMF downgraded its forecasts across Europe and for the UK this year, predicting 0.5% growth this year, making the UK the second weakest performer across the G7 group of advanced economies, behind Germany.

The G7 also includes France, Italy, Japan, Canada and the US.

Growth is set to improve to 1.5% in 2025, putting the UK among the top three best performers in the G7, according to the IMF.

However, the IMF said that interest rates in the UK will remain higher than other advanced nations, close to 4% until 2029.

The group expects the UK to have the highest inflation of any G7 economy in 2023 and 2024.

Chancellor Jeremy Hunt said the IMF’s figures showed that the UK economy was turning a corner.

“Inflation in 2024 is predicted to be 1.2% lower than before, and over the next six years we are projected to grow faster than large European economies such as Germany or France – both of which have had significantly larger downgrades to short-term growth than the UK,” he said.

Conflict in the Middle East

Economists at the IMF warned that if the Israel-Hamas conflict escalates further in the Middle East it could lead to rising food and energy prices around the world.

Continued attacks on ships in the Red Sea and the ongoing war in Ukraine could also affect the so far “remarkably resilient” global economy, it said.

A potential spike in food, energy and transport costs would see lower-income countries hardest hit, it added.

Economy

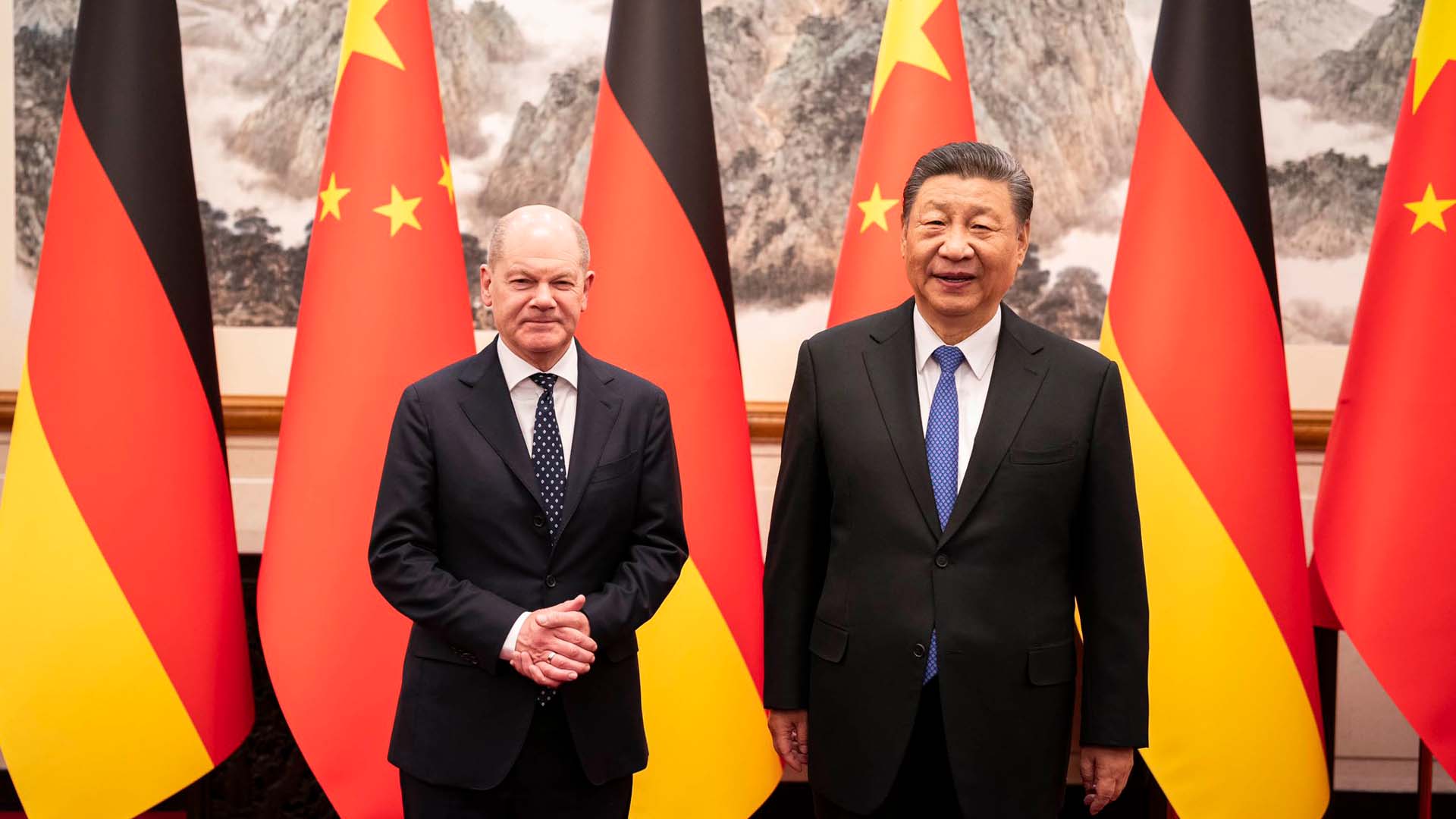

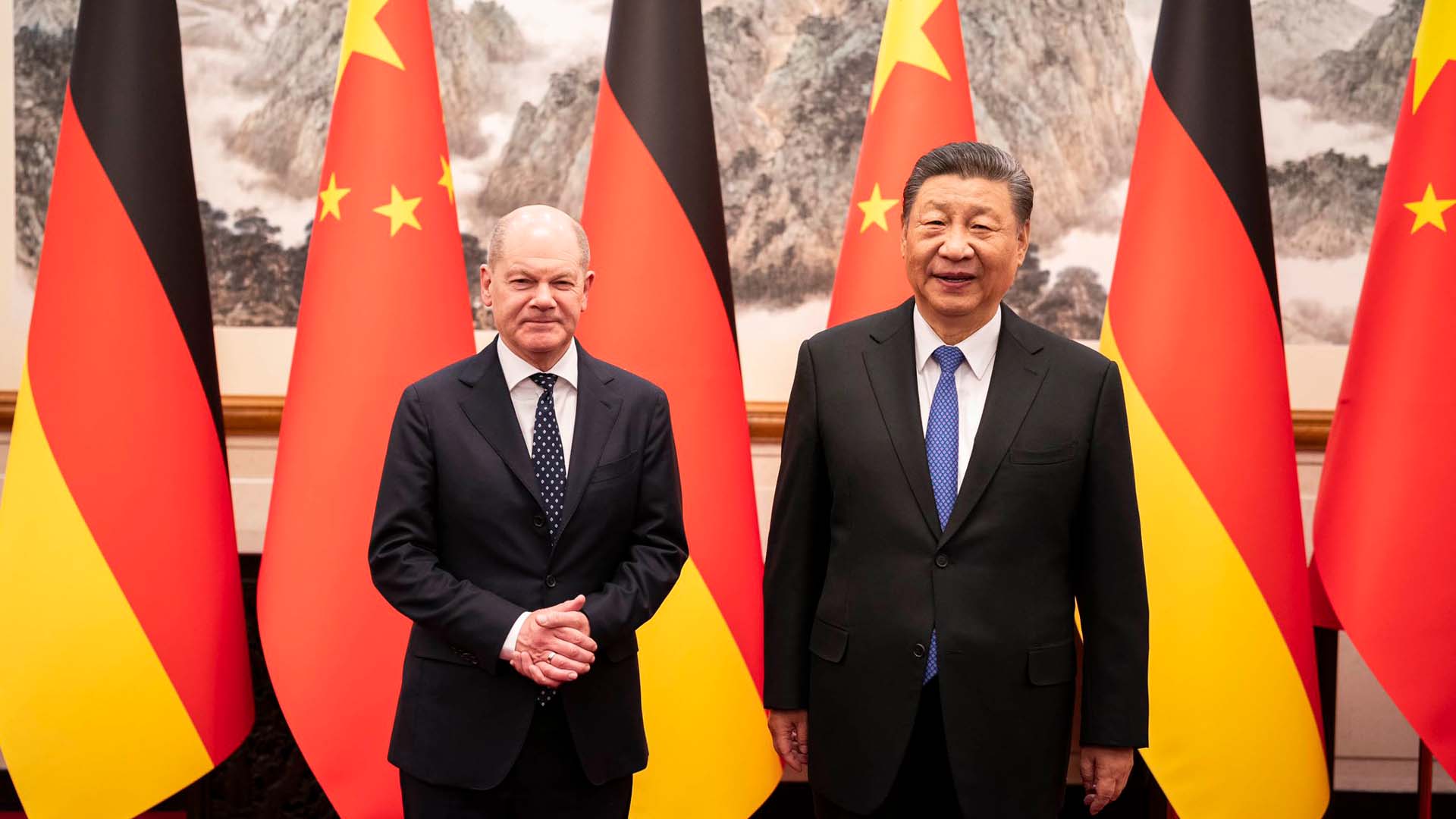

Why is Germany maintaining economic ties with China? – Al Jazeera English

German Chancellor Olaf Scholz has been on a three-day visit to China in a bid to shore economic ties.

Germany is China’s biggest European trade partner.

But, Berlin also sees Beijing as a competitor and a rival.

And – in its first-ever “strategy on China” launched last year – pledged to reduce German dependence on the Chinese market.

But, during his visit last week to China, the German Chancellor signalled his intentions to maintain business ties.

That may have angered some of Olaf Scholz’s closest allies.

The European Union has launched several investigations into exports of Chinese green technology to protect European industry from competition.

Are Nigeria’s reforms working?

We speak to the president of the United Nations General Assembly on sustainability.

Economy

BMO chief says US economy improving, calls California ‘a strategically important market’

|

|

TORONTO (Reuters) – The U.S. economy was showing signs of stronger than expected growth, with California being a strategically important market, said the head of Bank of Montreal, which has rapidly expanded in its southern neighbour.

CEO Darryl White, addressing shareholders at the bank’s annual meeting, said the bank was well positioned to cater to clients between American and Canadian economies in a shifting global landscape.

BMO, Canada’s third largest bank by market capitalization, makes about a third of its income from the United States after its $16.3 billion Bank of the West acquisition last year, the biggest ever deal in Canadian banking history.

He said that trade and investment between Canada and the U.S. is key to economic competitiveness noting that it is one of the largest bilateral trade relationships in the world.

“The relationship is significant. Put into context, just counting the Great Lakes region… (it) would be the world’s third largest economy, nearly equal to that of Japan and Germany combined, and the region employs about a third of the U.S.-Canadian combined workforce,” he said.

“Then add in California, an economy almost twice the size of Canada’s, and you can see the global impact this North-South partnership has.”

Canadian banks are increasingly looking to expand south of the border or in other parts of the world as opportunities at home are limited in a saturated market.

White cautioned about a higher-for-longer interest rate environment as borrowing costs remain high and demand weakens. But when rates begin to ease, the market could see a “new normal, an environment with fundamentally different characteristics than that of the past two decades,” he said.

(Reporting by Nivedita Balu in Toronto; Editing by Aurora Ellis)

-

Sports12 hours ago

Sports12 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState20 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech20 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Science23 hours ago

Science23 hours agoSpace exploration: A luxury or a necessity? – Phys.org

-

Politics17 hours ago

Politics17 hours agoPolitical interference in Canada’s pension funds is wrong

-

Sports24 hours ago

Sports24 hours agoRECAP: Red Wings' 5-4 comeback OT victory against Canadiens the result of belief, resiliency | Detroit Red Wings – NHL.com

-

News21 hours ago

Former mayor appealing sexual assault conviction dies of cancer

-

Business11 hours ago

Firefighters battle wildfire near Edson, Alta., after natural gas line rupture – CBC.ca