News

Family of Tyre Nichols pleads for calm as U.S. confronts ‘horrifying’ video evidence

|

|

The grieving family of Tyre Nichols called for calm across the United States on Friday as a country racked by racial and cultural divisions witnessed for itself visceral new video evidence of another young Black man enduring brutal, deadly violence at the hands of police.

Authorities in Memphis, Tenn., released a series of video clips — an hour-long compilation of footage and audio from body-worn police cameras as well as a static mounted security camera — depicting the traffic stop, foot chase and street-corner takedown that ultimately led to the 29-year-old man’s death.

The video, widely vilified by officials before its public release and likened to the explosive 1991 police beating of Rodney King in Los Angeles, shows Nichols fleeing the scene of the initial stop, then later enduring a savage series of punches, kicks and blows from a retractable police baton.

Anticipation surrounding the video evoked the national mood after the death of George Floyd during a violent takedown in Minneapolis in 2020 that sparked a months-long reckoning with racial tension and police brutality, as well as persistent and sometimes violent protests in cities across the country.

Nichols’ mother RowVaughn Wells and his stepfather Rodney Wells urged people in Memphis and across the country to show their support for the family by protesting peacefully, but it was unclear whether it would make any difference.

“We do not want any type of uproar. We do not want any type of disturbance. We want peaceful protests,” Rodney Wells told a news conference earlier Friday in Memphis.

“That’s what the family wants. That’s what the community wants. I got a text today from one of my supervisors about an alert telling her, ‘Don’t be in crowds tonight.’ We shouldn’t have that. We need to do this peacefully.”

Five former officers, all of them Black, face murder charges following the Jan. 7 confrontation with Nichols, a FedEx employee and father of a four-year-old boy. Each is charged with second-degree murder, aggravated assault, aggravated kidnapping, official misconduct and official oppression.

The video shows officers, winded from chasing Nichols on foot, struggling to deal with the residual impact of pepper spray. On the audio track, they speculate about Nichols being “on something.” At one point, Nichols is heard crying out several times for his mother, who lives just blocks away.

Eventually, Nichols is dragged over and propped up against a police vehicle, only to slump over in a stupor multiple times. It appears to take at least 20 minutes before medical personnel appear to attend to him.

“I still haven’t had time to grieve yet. I’m still dealing with the death of my son,” RowVaughn told the news conference.

“I want to say to the five police officers that murdered my son: you also disgraced your own families when you did this. But you know what, I’m gonna pray for you and your families. Because at the end of the day, this shouldn’t have happened.”

Protesters were gathering in the streets of Memphis after the video was released, as well as in other U.S. cities including Philadelphia and Washington, D.C., but they appeared to be well-organized and peaceful.

Ben Crump, the family’s lawyer, cheered how promptly the charges were laid, calling it the “blueprint” for similar cases of police brutality in the future, regardless of ethnicity.

“It was the police culture in America that killed Tyre Nichols,” Crump said.

“We want to proclaim that this is the blueprint going forward for any time any officers, whether they be Black or white, will be held accountable … We won’t accept less going forward in the future.”

All five officers — Tadarrius Bean, Demetrius Haley, Desmond Mills Jr., Emmitt Martin III and Justin Smith — were taken into custody, but at least four of them had posted bond and been released Friday.

Antonio Romanucci, another member of the family’s legal team, singled out the kidnapping charges as especially remarkable in a case involving a police takedown.

“Think about the weight of a kidnapping charge being brought against officers who are wearing a badge, a shield, carrying weapons on their duty belt, acting under the cover of law,” Romanucci said.

He likened the actions of the officers, describing them as a “pack of wolves,” to an act of terrorism.

“It was designed to terrorize the victim,” Romanucci said. “Once those officers were there, they knew their actions were going to cause death. And indeed it did.”

The contents of the video were said to be so explosive, police officials decided it would be best to release it later Friday after schools have let out and businesses are closed.

In an interview with The Associated Press, Memphis Police Director Cerelyn Davis described the actions of the officers as “heinous, reckless and inhumane,” noting the department has been unable to substantiate the reckless driving allegation that prompted the traffic stop.

During the initial stop, the video shows the officers were “already ramped up, at about a 10,” she said. The officers were “aggressive, loud, using profane language and probably scared Mr. Nichols from the very beginning.”

Christopher Wray, director of the FBI, told an unrelated news conference Friday that he had seen the video and was “appalled” by its contents. He said field officers are standing ready to work with state and local law enforcement agencies if necessary.

U.S. President Joe Biden spoke with the Wells family earlier Friday to express his condolences, the White House said in a statement.

“During the conversation, the president commended the family’s courage and strength.”

The New York Times reported that law enforcement officials in other cities, including Philadelphia, New York and Washington, D.C., were bracing for the possibility of civil unrest.

Philip Sellinger, the U.S. district attorney for the District of New Jersey, said in a statement that the Justice Department had already opened a criminal civil rights investigation into the death. He echoed the calls for peaceful protest.

“We want to make clear that the U.S. Attorney’s Office respects the right of all people to assemble and protest peacefully,” said Sellinger, who last year set up a new division in New Jersey designed exclusively to enforce and protect civil rights.

“Where law enforcement officers abuse their authority by violating the constitutional rights of our citizens, it undermines all other law enforcement officers who lawfully perform their duties with dignity and respect.”

The Rodney King assault in 1991, which was captured by an amateur videographer, proved a flashpoint for tensions between police and the Black community in the U.S., one that erupted into protracted riots in Los Angeles after the officers were acquitted the following year on charges of excessive force.

It also offered a glimpse of a future in which everyone would be equipped to readily record encounters between police and the public, officers would be fitted with body-worn cameras and surveillance equipment would be mounted high above city streets, as is the case in Memphis.

It was cellphone video recorded by a group of bystanders that showed the world a group of four Minneapolis police officers restraining Floyd in May 2020, among them George Chauvin, who could be seen kneeling on the Black man’s neck for more than nine minutes.

Chauvin was convicted of murder and manslaughter charges in 2021 and sentenced to more than 22 years in prison.

This report by The Canadian Press was first published Jan. 27, 2023.

— With files from The Associated Press

News

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

More money will land in the pockets of Canadian families on Friday for the latest Canada Child Benefit (CCB) installment.

The federal government program helps low and middle-income families struggling with the soaring cost of raising a child.

Canadian citizens, permanent residents, or refugees who are the primary caregivers for children under 18 years old are eligible for the program, introduced in 2016.

The non-taxable monthly payments are based on a family’s net income and how many children they have. Families that have an adjusted net income under $34,863 will receive the maximum amount per child.

For a child under six years old, an applicant can annually receive up to $7,437 per child, and up to $6,275 per child for kids between the ages of six through 17.

That translates to up to $619.75 per month for the younger cohort and $522.91 per month for the older group.

The benefit is recalculated every July and most recently increased 6.3 per cent in order to adjust to the rate of inflation, and cost of living.

To apply, an applicant can submit through a child’s birth registration, complete an online form or mail in an application to a tax centre.

The next payment date will take place on May 17.

News

Capital gains tax change draws ire from some Canadian entrepreneurs worried it will worsen brain drain – CBC.ca

A chorus of Canadian entrepreneurs and investors is blasting the federal government’s budget for expanding a tax on the rich. They say it will lead to brain drain and further degrade Canada’s already poor productivity.

In the 2024 budget unveiled Tuesday, Finance Minister Chrystia Freeland said the government would increase the inclusion rate of the capital gains tax from 50 per cent to 67 per cent for businesses and trusts, generating an estimated $19 billion in new revenue.

Capital gains are the profits that individuals or businesses make from selling an asset — like a stock or a second home. Individuals are subject to the new changes on any profits over $250,000.

The government estimates that the changes would impact 40,000 individuals (or 0.13 per cent of Canadians in any given year) and 307,000 companies in Canada.

However, some members of the business community say that expanding the taxable amount will devastate productivity, investment and entrepreneurship in Canada, and might even compel some of the country’s talent and startups to take their business elsewhere.

Finance Minister Chrystia Freeland unveiled the government’s 2024 federal budget, with spending targeted at young voters and a plan to raise capital gains taxes for some of the wealthiest Canadians.

Benjamin Bergen, president of the Council of Canadian Innovators (CCI), said the capital gains tax has overshadowed parts of the federal budget that the business community would otherwise be excited about.

“There were definitely some other stars in the budget that were interesting,” he said. “However, the … capital gains piece really is the sun, and it’s daylight. So this is really the only thing that innovators can see.”

The CCI has written and is circulating an open letter signed by more than 1,000 people in the Canadian business community to Trudeau’s government asking it to scrap the tax change.

Shopify CEO Tobi Lütke and president Harley Finkelstein also weighed in on the proposed hike on X, formerly known as Twitter.

We need to be doing everything we can to turn Canada into the best place for entrepreneurs to build 🇨🇦<br><br>What’s proposed in the federal budget will do the complete opposite. Innovators and entrepreneurs will suffer and their success will be penalized — this is not a wealth tax,…

—@harleyf

Former finance minister Bill Morneau said his successor’s budget disincentivizes businesses from investing in the country’s innovation sector: “It’s probably very troubling for many investors.”

Canada’s productivity — a measure that compares economic output to hours worked — has been relatively poor for decades. It underperforms against the OECD average and against several other G7 countries, including the U.S., Germany, U.K. and Japan, on the measure.

Bank of Canada senior deputy governor Carolyn Rogers sounded the alarm on Canada’s lagging productivity in a speech last month, saying the country’s need to increase the rate had reached emergency levels, following one of the weakest years for the economy in recent memory.

The government said it was proposing the tax change to make life more affordable for younger generations and fund efforts to boost housing supply — and that it would support productivity growth.

A challenge for investors, founders and workers

The change could have a chilling effect for several reasons, with companies already struggling to access funding in a high interest rate environment, said Bergen.

He questioned whether investors will want to fund Canadian companies if the government’s taxation policies make it difficult for those firms to grow — and whether founders might just pack up.

The expanded inclusion rate “is just one of the other potential concerns that firms are going to have as they’re looking to grow their companies.”

He said the rejigged tax is also an affront to high-skilled workers from low-innovation sectors who might have taken the risk of joining a startup for the opportunity, even taking a lower wage on the chance that a firm’s stock options grow in value.

But Lindsay Tedds, an associate economics professor at the University of Calgary, said the tax change is one of the most misunderstood parts of the federal budget — and that its impact on the country’s talent has been overstated.

“This is not a major innovation-biting tax change treatment,” Tedds said. “In fact, when you talk to real grassroots entrepreneurs that are setting up businesses, tax rates do not come into their decision.”

As for productivity, Tedds said Canadians might see improvements in the long run “to the degree that some of our productivity problems are driven by stresses like housing affordability, access to child care, things like that.”

‘One foot on the gas, one foot on the brake’

Some say the government is sending mixed messages to entrepreneurs by touting tailored tax breaks — like the Canada Entrepreneurs’ Incentive, which reduces the capital gains inclusion rate to 33 per cent on a lifetime maximum of $2 million — while introducing measures they say would dampen investment and innovation.

“They seem to have one foot on the gas, one foot on the brake on the very same file,” said Dan Kelly, president of the Canadian Federation of Independent Business.

Some business groups are worried that new capital gains tax changes could hurt economic growth. But according to Small Business Minister Rechie Valdez, most Canadians won’t be impacted by that change — and it’s a move to create fairness.

A founder may be able to sell their successful company with a lower capital gains treatment than otherwise possible, he said.

“At the same time, though, big chunks of it may be subject to a higher rate of capital gains inclusion.”

Selling a company can fund an individual’s retirement, he said, which is why it’s one of the first things founders consider when they think about capital gains.

Mainstreet NS7:03Ottawa is proposing a hike to capital gains tax. What does that mean?

Tuesday’s federal budget includes nearly $53 billion in new spending over the next five years with a clear focus on affordability and housing. To help pay for some of that new spending, Ottawa is proposing a hike to the capital gains tax. Moshe Lander, an economics lecturer at Concordia University, joins host Jeff Douglas to explain.

Dennis Darby, president and CEO of Canadian Manufacturers & Exporters, says he was disappointed by the change — and that it sends the wrong message to Canadian industries like his own.

He wants to see the government commit to more tax credit proposals like the Canada Carbon Rebate for Small Businesses, which he said would incentivize business owners to stay and help make Canada competitive with the U.S.

“We’ve had a lot of difficulties attracting investment over the years. I don’t think this will make it any better.”

Tech titan says change will only impact richest of the rich

Toronto tech entrepreneur Ali Asaria will be one of those subject to the expanded capital gains inclusion rate — but he says it’s only fair.

“It’s going to really affect the richest of the rich people,” Asaria, CEO of open source platform Transformer Lab and founder of well.ca, told CBC News.

“The capital gains exemption is probably the largest tax break that I’ve ever received in my life,” he said. “So I know a lot about what that benefit can look like, but I’ve also always felt like it was probably one of the most unfair parts of the tax code today.”

While Asaria said Canada needs to continue encouraging talent to take risks and build companies in the country, taxation policies aren’t the most major problem.

“I think that the biggest central issue to the reason why people will leave Canada is bigger issues, like housing,” he said.

“How do we make it easier to live in Canada so that we can all invest in ourselves and invest in our companies? That’s a more important question than, ‘How do we help the top 0.13 per cent of Canadians make more money?'”

News

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

More money will land in the pockets of Canadian families on Friday for the latest Canada Child Benefit (CCB) installment.

The federal government program helps low and middle-income families struggling with the soaring cost of raising a child.

Canadian citizens, permanent residents, or refugees who are the primary caregivers for children under 18 years old are eligible for the program, introduced in 2016.

The non-taxable monthly payments are based on a family’s net income and how many children they have. Families that have an adjusted net income under $34,863 will receive the maximum amount per child.

For a child under six years old, an applicant can annually receive up to $7,437 per child, and up to $6,275 per child for kids between the ages of six through 17.

That translates to up to $619.75 per month for the younger cohort and $522.91 per month for the older group.

The benefit is recalculated every July and most recently increased 6.3 per cent in order to adjust to the rate of inflation, and cost of living.

To apply, an applicant can submit through a child’s birth registration, complete an online form or mail in an application to a tax centre.

The next payment date will take place on May 17.

-

Media18 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media20 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment19 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Real eState11 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

News17 hours ago

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

-

Sports23 hours ago

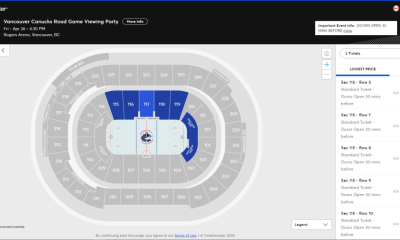

Sports23 hours ago2024 Stanley Cup Playoffs 1st-round schedule – NHL.com

-

Business19 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Art22 hours ago

Enter the uncanny valley: New exhibition mixes AI and art photography – Euronews