Politics

Senate passes Democrats' sweeping health care and climate bill – CNN

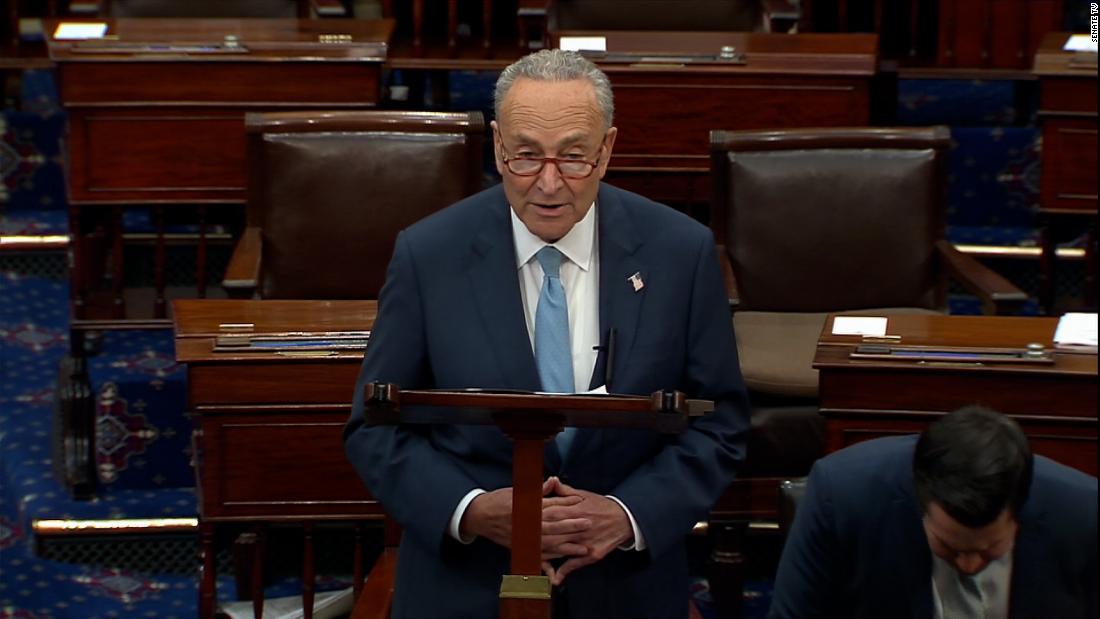

(CNN)The Senate on Sunday afternoon passed Democrats’ $750 billion health care, tax and climate bill, in a significant victory for President Joe Biden and his party.

How Senate Democrats passed the bill on a party-line vote

How the bill addresses the climate crisis

Key health care and tax policy in the bill

Politics

With capital gains change, the Liberals grasp the tax reform nettle again – CBC News

In the fall of 2021, the editors of the Canadian Tax Journal devoted several dozen pages to the “hotly debated” topic of capital gains.

On balance, the editors wrote, their selected contributors were in favour of raising the inclusion rate for capital gains — the share of an individual’s capital gains that are subject to income tax rates. But they acknowledged that putting such a change into practice would not be easy.

“Opposition to capital gains tax increases among affected taxpayers is apt to be vociferous,” Michael Smart and Sobia Hasan Jafry wrote in one of the featured papers, “precisely because such a reform would act like a lump sum tax that would be difficult or impossible for taxpayers to avoid in the long run by changing their behaviour.”

Whatever its exact causes or motivations, “vociferous” opposition to tax hikes may be as old as taxation itself. But the Liberals already have firsthand experience of how loud that opposition can get, having watched one set of reforms struggle to survive an onslaught of confusion and controversy in the summer of 2017.

Now they’re taking another swing at it — and one big question is whether they’re better prepared for the blowback this time.

The federal government unveiled billions in spending in its 2024 budget, and to help pay for it all, it’s proposing changes to how capital gains are taxed. CBC’s Nisha Patel breaks down how it works and who will be affected.

If the Liberals are hoping to look reasonable and measured, they can at least point to the fact that they haven’t gone nearly as far as some wanted them to go.

In their 2001 paper, Smart and Hasan Jafry proposed increasing the inclusion rate from 50 per cent to 80 per cent for all capital gains. In her third budget, tabled last week, Finance Minister Chrystia Freeland proposed an inclusion rate of 67 per cent for capital gains of $250,000 or more.

In their 2021 analysis, Smart and Hasan Jafry pointed out that the wealthiest families benefited disproportionately from the preferential tax treatment afforded to capital gains (though there is some debate over exactly how disproportionately the benefits are distributed). That’s now a key aspect of the government’s argument.

“The government is asking the wealthiest Canadians to pay their fair share,” last week’s budget document said, adding that only about 0.13 per cent of Canadians would be affected by the change.

As Freeland noted, her changes also aren’t unprecedented. From 1990 to 2000, the inclusion rate was 75 per cent for all capital gains. Freeland is also promising a special carve-out aimed at entrepreneurs.

“There are a lot of reasons why the inclusion rate should go up for capital gains,” Smart said in an interview this week.

For one thing, Smart argues, “it’s fairer for all Canadians if taxpayers with capital gains pay the same rates of tax as the rest of us do right now.” Also, he says, “it’s better for the economy if every investor is paying the same tax rate on everything she or he invests in,” pointing to differences in the way dividends and capital gains are taxed.

The fight over what these changes will mean

While condemning the budget, Pierre Poilievre’s Conservatives have been noticeably quiet on the issue of capital gains. That might be because they sense — correctly — that the Liberals would be happy to accuse them of supporting tax breaks for the rich.

For the time being, other voices are filling the void — including doctors, who came forward with their own concerns this week. The technology sector has been the loudest in its objections. The Council of Canadian Investors has sponsored an open letter that has now been signed by hundreds of tech executives.

Canadian Medical Association president Dr. Kathleen Ross tells Power & Politics that she fears changes to the capital gains tax will make recruitment and retention of physicians more difficult at ‘a time where the health force is beleaguered, mothballed and really struggling to deliver on services to Canadians.’

In an op-ed for the National Post, the council’s president, Benjamin Bergen, warned that the changes would hurt Canada’s economic “vibes.” Specifically, he argued that a higher inclusion rate would discourage business investment.

“Capital gains are taxed at a different rate because they are taxes on investment,” he wrote. “Every investment comes with risk … [t]he tax code takes this into account.”

But other figures in the investment community have come forward to say the backlash is confused and unwarranted.

There does not seem to be a clear consensus on the economic impact of changes to the capital gains tax. In a paper published last year, the economist Jonathan Rhys Kesselman wrote that “the overall impact of existing and increased capital gains taxes on the economy’s efficiency and growth are mixed and not easily quantified.”

“When the gains inclusion rate was raised to 75 per cent in 1990 for nearly a decade, adverse economic impacts were not observed, though this is at best weak evidence,” Kesselman wrote. “Contrary to common claims about higher taxes on gains, some impacts would be economically favourable, and others that might be adverse could be mitigated through appropriate concomitant reforms.”

All in a Day13:14Three tech entrepreneurs break down impact of federal budget on their sector

Ottawa tech pros want the federal government to reconsider capital gains changes that, they say, can scare investors and jeopardise business.

It might be fair to assume the change will have some downside. But every policy choice involves a trade-off.

In an email this week, University of Calgary economist Trevor Tombe — who argues it makes sense to hike taxes on capital gains — wrote that while it would not be controversial to suggest the capital gains changes will have some kind of negative effect, “all policy choices come with costs and benefits, so we also have to then compare the costs to the benefits of the government’s spending choices.”

What the Liberals might have learned from 2017

Compared to the tax fight of 2017 — when the Liberals sought to change the rules on private incorporation — the government has been far more explicit and purposeful this time about connecting the tax changes to new spending proposals, particularly those related to ensuring that younger Canadians can find affordable places to live.

“I understand for some people this might cost more if they sell a cottage or a secondary residence, but young people can’t buy their primary residences yet,” Prime Minister Justin Trudeau said Tuesday.

In total, the changes are projected to produce $19.4 billion in additional revenue for the federal government over five years. In her budget speech, Freeland connected asking wealthy Canadians to pay more with federal programs to provide dental care, school lunches and free contraception.

The goal of reducing income inequality might be worthy in and of itself, but it’s more abstract than the tangible things the Liberals are pointing to now.

An internal review conducted by the Finance Department after the tax storm of 2017 concluded that the government had been slow to respond to concerns and criticism and that there was a “need to more rapidly adjust communications strategies and messaging to effectively address misconceptions.” Scott Clark, a former senior finance official, observed at the time that there were no “winners” — people who would benefit from the changes — to whom the federal government could point.

The early returns might suggest the government learned some things from the 2017 experience. For one thing, Freeland openly acknowledged from the outset that some people were likely going to be upset.

But if 2017 is any guide, the opposition is unlikely to pass quickly or quietly.

Politics

Meet Shannon Waters, The Narwhal’s B.C. politics and environment reporter – The Narwhal

When Shannon Waters first joined the press gallery at the B.C. legislature, the decision on whether or not to continue the Site C dam project was looming large. Shannon was there as a reporter for BC Today, a daily political newsletter, and she remembers being blown away by long-time Narwhal reporter Sarah Cox’s work.

“Her ability to look at these huge complex reports, which, at the time, I mostly just felt like I was drowning in, and cut through that to tell stories about what was really going on was impressive,” Shannon says. “That was my initial intro and I have been following The Narwhal ever since!”

Fast forward more than six years later, Shannon joins The Narwhal as our first-ever B.C. politics and environment reporter. And get this, Sarah will be her editor in the new gig.

“After years of admiring their work, I’m excited to work with Sarah and the whole Narwhal team,” Shannon says.

I sat down with Shannon to get to know her better and hear more about what brought her The Narwhal’s growing pod.

What’s your favourite animal?

That’s easy, it’s an octopus. I have one tattooed on my arm. I just think it’s really neat that we have a creature on this planet as intelligent as an octopus. It’s the closest thing to alien life that we’ve ever come across but it’s right here on the planet with us. And I think that’s very cool.

What is the thing about journalism that gets you excited to start your work day?

I get excited about working as a journalist because every day is a bit different. I like having the opportunity to learn new things on a regular basis, partly because I get bored really easily.

My favorite thing about being a reporter is you never really know exactly how your day is gonna go and you’re always getting to talk to interesting people. As a bonus, I also really like to write, and I always have.

Your first job was at a radio station in Prince George, B.C. How did this early experience shape you?

I think it really honed my sense of journalism being part of the community and a community service. We covered all kinds of things. I was on the school board beat when I first got there and then I was covering city hall a little later on. I did a weekend shift. I covered crime stories.

Sometimes you’d start out the day covering one story and then by the end of the day, you’d be doing something else. I was also in Prince George in 2017, for the wildfires, and the city became a hub for people who were displaced from all across B.C. That was a really intense, eye-opening experience about what communities can do for people when they are put to the test. So again, learning things, and that variety and getting to write about them for a living.

You’re a self-described political nerd. Where does that come from?

I’m fascinated by politics because it touches every aspect of our lives, and there’s not really any way to get away from it. I consider myself a bit cynical about our political systems but even if you don’t like them, or don’t believe in them, or don’t want anything to do with them, you can’t really get away from politics. I find it fascinating to look at what is going on in the political sphere, what kind of policies are popular at the moment? Which ones are being rejected? How is that conversation going? How did it get started? Where might it go? And politics is also about people.

I like being someone who can hopefully try and help people understand why politics matters, what they can do to try and affect the change that they might want to see and how the politics in their area or the policies being enacted by politicians affects them and the people around them. It’s not something that everybody finds fascinating. A lot of people’s eyes glaze over when you tell them you’re a political or a legislative reporter. But I really enjoy the work. And it’s one of those things that feels like, well, somebody should be doing it. And so for now, at least, that somebody can be me.

It’s an election year in B.C. What are you most excited about?

I’m looking forward to seeing what happens. We’re really in a very interesting space in B.C. right now. If you were talking to me a year ago about the election, I would probably have sounded a bit more bored, because it seemed like much more of a foregone conclusion — you know, the NDP were going to likely win a majority and we’d have sort of more of the same. But now you have this really interesting churn in the political landscape with the emergence of the B.C. Conservatives as a real contender of a party according to the polling that we’ve been seeing. Meanwhile B.C. United, which is the very well-established B.C. Liberal party renamed, has sort of had the wheels come off.

So, I’m really interested to see what happens on the campaign trail as you have these parties trying to court voters, what sort of ideas they’re going to put forward. I’m also really curious what it means for the Green Party. B.C. hasn’t had a lot of elections where we’ve had so many parties competing for seats in the legislature and I think that’s going to make for a very interesting and probably quite dramatic campaign.

What kind of stories do you hope to tell more of?

I am excited about getting more in depth. I’ve been doing daily news for about seven years now, including covering elections. I have really enjoyed doing that and I feel like when you’re a daily news reporter you also have all these thoughts about potential stories that need a closer look or more time to percolate. So I’m really looking forward to looking at the news landscape and seeing what’s missing. With the election, I’m also excited to look back and think: what was the government saying about this particular policy in the last election? What have they done on it during the interim? And what are they saying now?

I think one of the biggest things I learned as BC Today’s reporter and later Politics Today’s editor-in-chief is finding the stories in the minutia and the nuts and bolts of what goes on in the legislature. There’s a list that has been building in my head for a long time of all of these stories that I’ve wanted to take a closer look at over the years and I’m excited to get started.

What are three things people might not know about you?

I could eat peanut butter toast and drink coffee every day of my life and die happy. Growing up I wanted to be a marine biologist and study either sharks or cephalopods. I am the biggest word nerd, which can be a good thing for someone who writes for a living, but is sometimes a struggle. I am still striving to use the word “absquatulate” in a story someday!

Politics

Trudeau questions Poilievre's judgment, says the Conservative Leader 'will do anything to win' – The Globe and Mail

Prime Minister Justin Trudeau is flanked by Minister of Housing Sean Fraser, right, and Treasury Board President Anita Anand, left, during a press conference in Oakville, Ont., on April 24.Cole Burston/The Canadian Press

Prime Minister Justin Trudeau criticized Pierre Poilievre over his judgment, a day after the Conservative Leader visited a protest against carbon pricing that featured a “Make Canada Great Again” slogan and a symbol that appeared to be tied to a far-right, anti-government group.

Mr. Trudeau accused Mr. Poilievre of exacerbating divisions and welcoming the “support of conspiracy theorists and extremists.”

“Every politician has to make choices about what kind of leader they want to be,” the Prime Minister said at a press conference Wednesday in Oakville, Ont.

“He will do anything to win, anything to torque up negativity and fear and it only emphasizes that he has nothing to say to actually solve the problems that he’s busy amplifying.”

On Tuesday, Mr. Poilievre stopped at a protest against carbon pricing near the New Brunswick-Nova Scotia border while on his way from PEI to Nova Scotia. Video of the protest shows an expletive-laden flag directed at Mr. Trudeau that was a symbol of the anti-vaccine-mandate protests that gripped Ottawa two years ago, as well as an anti-carbon-tax sign and a van with the slogan “Make Canada Great Again” written on it.

“We saw you so I told the team to pull over and say ‘hello,’” Mr. Poilievre said to the protesters in one of the videos posted online. He thanked them for “all you’re doing.”

“We’re going to axe the tax and its going to be in part because you guys fought back,” Mr. Poilievre said in the videos. “Everyone hates the tax because everyone’s been screwed over. People believed his lies. Everything he said was bullshit, from top to bottom.”

When asked to take a picture in front of the flag with the expletive, Mr. Poilievre responded: “Let’s do it in front of something else.”

One of the vans at the protests has what appeared to be a symbol of the anti-government, far-right group called Diagolon. Mr. Trudeau tried on Wednesday to tie that to Mr. Poilievre. The Conservative Leader has previously disavowed the group.

In a statement Wednesday through his lawyer, the group’s leader, Jeremy MacKenzie, said he was Mr. Poilievre’s biggest detractor in Canada. He also criticized Mr. Trudeau, saying “both of these weak men are completely out of touch with reality and incapable of telling the truth.”

Mr. Poilievre’s office defended the Conservative Leader’s visit to the protest in a statement on Wednesday.

“As a vocal opponent of Justin Trudeau’s punishing carbon tax which has driven up the cost of groceries, gas and heating, he made a brief, impromptu stop,” spokesperson Sebastian Skamski said.

“If Justin Trudeau is concerned about extremism, he should look at parades on Canadian streets openly celebrating Hamas’ slaughter of Jews on October 7th.”

During his press conference, Mr. Trudeau also pointed out that Mr. Poilievre has done nothing to reject the endorsement of right-wing commentator Alex Jones earlier this month. Mr. Jones, on X, called Mr. Poilievre “the real deal” and said “Canada desperately needs a lot more leaders like him and so does the rest of the world.”

Mr. Jones was ordered to pay nearly $1-billion in damages to the families of the victims of the deadly 2012 Sandy Hook school shooting, which he portrayed as a hoax.

“This is the kind of man who’s saying Pierre Poilievre has the right ideas to bring the country toward the right, towards conspiracy theories, towards extremism, towards polarization,” Mr. Trudeau said.

In response to the Prime Minister’s remarks, Mr. Skamski said “we do not follow” Mr. Jones “or listen to what he has to say.”

“Common-sense Conservatives are listening to the priorities of the millions of Canadians that want to axe the tax, build the homes, fix the budget and stop the crime,” he added.

“It is the endorsement of hard-working, everyday Canadians that Conservatives are working to earn. Unlike Justin Trudeau, we’re not paying attention to what some American is saying.”

With a report from The Canadian Press.

-

Politics20 hours ago

Politics20 hours agoOpinion: Fear the politicization of pensions, no matter the politician

-

Politics19 hours ago

Politics19 hours agoPecker’s Trump Trial Testimony Is a Lesson in Power Politics

-

Science20 hours ago

Science20 hours agoNASA Celebrates As 1977’s Voyager 1 Phones Home At Last

-

Media19 hours ago

B.C. puts online harms bill on hold after agreement with social media companies

-

Media13 hours ago

B.C. online harms bill on hold after deal with social media firms

-

Business19 hours ago

Oil Firms Doubtful Trans Mountain Pipeline Will Start Full Service by May 1st

-

Investment21 hours ago

FLAGSHIP COMMUNITIES REAL ESTATE INVESTMENT TRUST ANNOUNCES CLOSING OF APPROXIMATELY US

-

Media18 hours ago

Trump poised to clinch US$1.3-billion social media company stock award