Economy

We face a global economic crisis. And no one knows what to do about it – The Guardian

[unable to retrieve full-text content]

We face a global economic crisis. And no one knows what to do about it The Guardian

Source link

Economy

Poland has EU's second highest emissions in relation to size of economy – Notes From Poland

[unable to retrieve full-text content]

Poland has EU’s second highest emissions in relation to size of economy Notes From Poland

Source link

Economy

IMF's Georgieva warns "there's plenty to worry about'' in world economy — including inflation, debt – Yahoo Canada Finance

WASHINGTON (AP) — The head of the International Monetary Fund said Thursday that the world economy has proven surprisingly resilient in the face of higher interest rates and the shock of war in Ukraine and Gaza, but “there is plenty to worry about,” including stubborn inflation and rising levels of government debt.

“ Inflation is down but not gone,” Kristalina Georgieva told reporters at the spring meeting of the IMF and its sister organization, the World Bank. In the United States, she said, “the flipside” of unexpectedly strong economic growth is that it ”taking longer than expected” to bring inflation down.

Georgieva also warned that government debts are growing around the world. Last year, they ticked up to 93% of global economic output — up from 84% in 2019 before the response to the COVID-19 pandemic pushed governments to spend more to provide healthcare and economic assistance. She urged countries to more efficiently collect taxes and spend public money. “In a world where the crises keep coming, countries must urgently build fiscal resilience to be prepared for the next shock,” she said.

On Tuesday, the IMF said it expects to the global economy to grow 3.2% this year, a modest upgrade from the forecast it made in January and unchanged from 2023. It also expects a third straight year of 3.2% growth in 2025.

ADVERTISEMENT

The world economy has proven unexpectedly sturdy, but it remains weak by historical standards: Global growth averaged 3.8% from 2000 to 2019.

One reason for sluggish global growth, Georgieva said, is disappointing improvement in productivity. She said that countries had not found ways to most efficiently match workers and technology and that years of low interest rates — that only ended after inflation picked up in 2021 — had allowed “firms that were not competitive to stay afloat.”

She also cited in many countries an aging “labor force that doesn’t bring the dynamism” needed for faster economic growth.

The United States has been an exception to the weak productivity gains over the past year. Compared to Europe, Georgieva said, America makes it easier for businesses to bring innovations to the marketplace and has lower energy costs.

She said countries could help their economies by slashing bureaucratic red tape and getting more women into the job market.

Paul Wiseman, The Associated Press

Economy

Nigeria’s Economy, Once Africa’s Biggest, Slips to Fourth Place – BNN Bloomberg

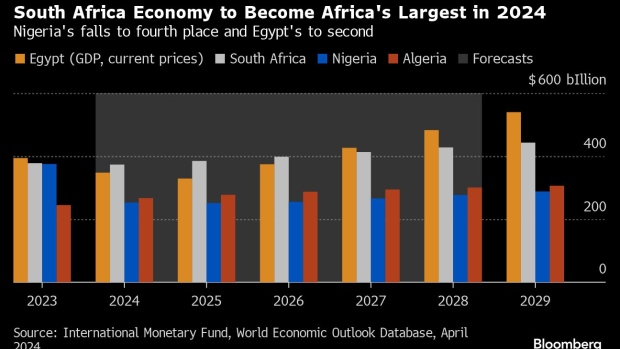

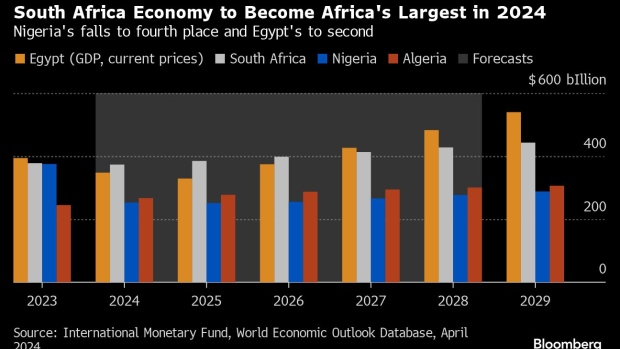

(Bloomberg) — Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Africa’s most industrialized nation will remain the continent’s largest economy until Egypt reclaims the mantle in 2027, while Nigeria is expected to remain in fourth place for years to come, the data released this week shows.

Nigeria and Egypt’s fortunes have dimmed as they deal with high inflation and a plunge in their currencies.

Bola Tinubu has announced significant policy reforms since he became Nigeria’s president at the end of May 2023, including allowing the currency to float more freely, scrapping costly energy and gasoline subsidies and taking steps to address dollar shortages. Despite a recent rebound, the naira is still 50% weaker against the greenback than what it was prior to him taking office after two currency devaluations.

Read More: Why Nigeria’s Currency Rebounded and What It Means: QuickTake

Egypt, one of the emerging world’s most-indebted countries and the IMF’s second-biggest borrower after Argentina, has also allowed its currency to float, triggering an almost 40% plunge in the pound’s value against the dollar last month to attract investment.

The IMF had been calling for a flexible currency regime for many months and the multilateral lender rewarded Egypt’s government by almost tripling the size of a loan program first approved in 2022 to $8 billion. This was a catalyst for a further influx of around $14 billion in financial support from the European Union and the World Bank.

Read More: Egypt Avoided an Economic Meltdown. What Next?: QuickTake

Unlike Nigeria’s naira and Egypt’s pound, the value of South Africa’s rand has long been set in the financial markets and it has lost about 4% of its value against the dollar this year. Its economy is expected to benefit from improvements to its energy supply and plans to tackle logistic bottlenecks.

Algeria, an OPEC+ member has been benefiting from high oil and gas prices caused first by Russia’s invasion of Ukraine and now tensions in the Middle East. It stepped in to ease some of Europe’s gas woes after Russia curtailed supplies amid its war in Ukraine.

©2024 Bloomberg L.P.

-

Tech21 hours ago

Tech21 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

News23 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Health17 hours ago

Health17 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech23 hours ago

Tech23 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca

-

Politics24 hours ago

Politics24 hours agoTrump faces political risks as trial begins – NBC News

-

News16 hours ago

2024 federal budget's key takeaways: Housing and carbon rebates, students and sin taxes – CBC News

-

Tech22 hours ago

Nintendo Indie World Showcase April 2024 – Every Announcement, Game Reveal & Trailer – Nintendo Life

-

News17 hours ago

Canada's 2024 budget announces 'halal mortgages'. Here's what to know – National Post