Economy

Here's how B.C. will spend $1.5 billion to help the economy recover amid the pandemic – CTV News Vancouver

VANCOUVER —

With B.C. facing a multi-billion-dollar deficit because of the COVID-19 pandemic, the premier and finance minister announced Thursday how the provincial government will spend $1.5 billion to help the economy recover.

In a news conference, John Horgan and Carole James explained the government’s plan to divide the recovery funding that was set aside in the province’s $8.25 billion pandemic response.

CTVNewsVancouver.ca is streaming the news conference LIVE NOW.

“Lives have been saved because of the sacrifices of British Columbians,” Horgan said Thursday.

“The pandemic continues to challenge us in unprecedented ways, but fundamental priorities remain the same. We need to protect people’s health, we need to keep the economy open safely and we need to support communities.”

Horgan said the economic recovery plan was built based on consultation with individuals, groups and communities.

“There was no government that had a playbook for how to deal with a global pandemic,” he said. “And when you’re building a plan for people, you have to talk to them.”

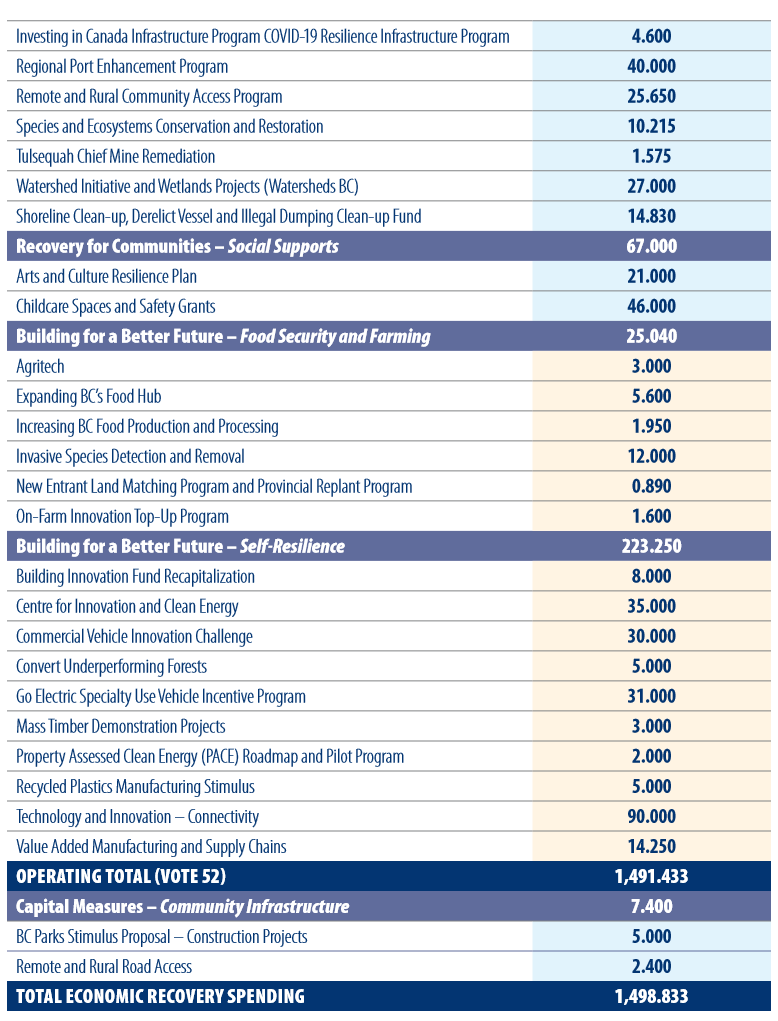

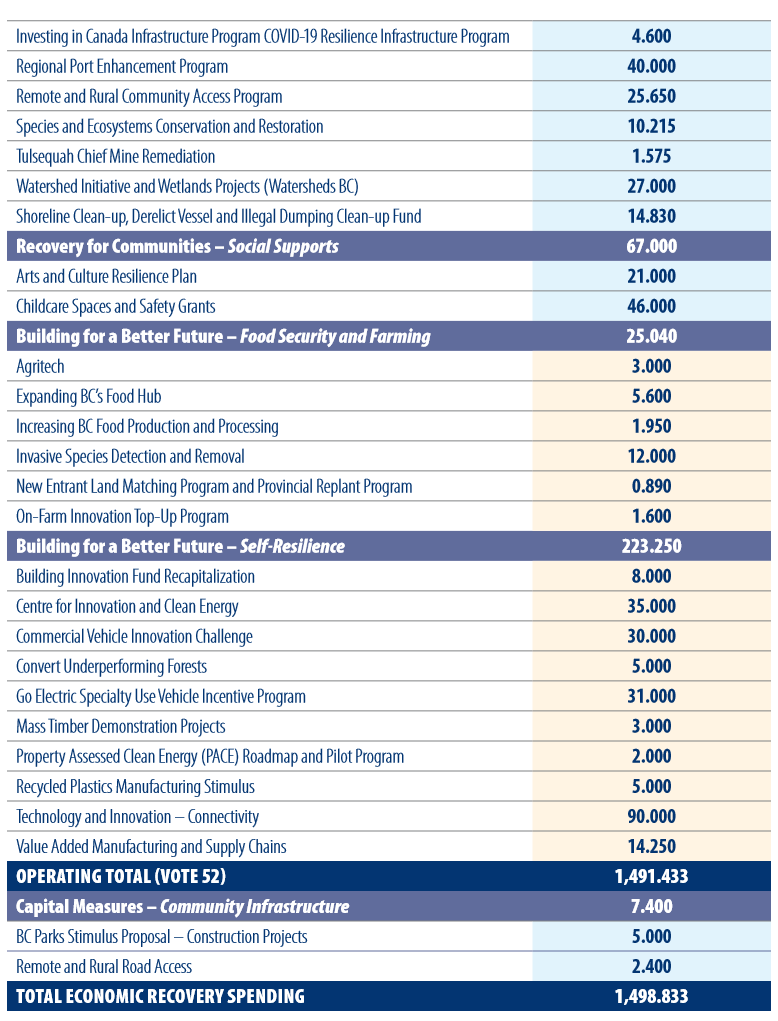

Some of the funds – about $400 million of it – is earmarked to help businesses recover with initiatives that include recovery grants for small and medium-sized businesses and a tourism task force. That task force will come up with recommendations on how tourism in B.C. can prepare for the 2021 season.

About $375 million will be distributed to communities to help local governments provide services and complete some infrastructure, like projects that are shovel-ready and initiatives to improve active transportation.

“The safe restart funds will help us address local challenges that have been made worse by COVID-19,” Horgan said.

More than $460 million is set aside for “recovery for people,” the finance ministry says, which includes previously announced funding for more health-care jobs and skills training.

The remaining $250 million is set aside for “building a better future,” which includes funding for clean energy innovation, recycled plastics manufacturing and some supports for the forestry industry.

The finance ministry also announced new tax recovery measures, totalling $660 million outside the $1.5 billion. More than a third of that covers a PST rebate for some businesses looking to invest in machinery, while the remainder is an employment incentive to encourage businesses to increase their payrolls.

Last week, James revealed that, because of COVID-19, B.C. is on track to see a $12.8-billion deficit this fiscal year.

“Our recovery, of course, will not happen overnight,” Horgan said.

“There’s a long road ahead of us and it will require a constant opportunity for us to adapt and innovate to changing circumstances.”

This is a developing story. Check back for updates.

Graphics from the Government of British Columbia

Economy

Biden's Hot Economy Stokes Currency Fears for the Rest of World – Bloomberg

As Joe Biden this week hailed America’s booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: cool it.

The push-back from central bank governors and finance ministers gathering for the International Monetary Fund-World Bank spring meetings highlight how the sting from a surging US economy — manifested through high interest rates and a strong dollar — is ricocheting around the world by forcing other currencies lower and complicating plans to bring down borrowing costs.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

-

Media14 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media16 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment15 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Sports19 hours ago

Sports19 hours ago2024 Stanley Cup Playoffs 1st-round schedule – NHL.com

-

Real eState7 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

Health24 hours ago

Health24 hours agoToronto reports 2 more measles cases. Use our tool to check the spread in Canada – Toronto Star

-

Business15 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Art18 hours ago

Enter the uncanny valley: New exhibition mixes AI and art photography – Euronews